2022 was a yr of nice market volatility, bringing sturdy value fluctuations that attracted many merchants. As financial and political instability appear to proceed within the new yr, 2023 would possibly deliver new alternatives to merchants and traders alike. Could this be an appropriate time for novice merchants to enter the market? The reply relies on your private monetary objectives.

To resolve whether or not to begin buying and selling in 2023, you could think about your short-term and long-term monetary goals. Firstly, you must perceive the distinction between buying and selling and investing. By enhancing your information concerning the execs and cons of every strategy, you could give attention to the appropriate choice for you and select one of the best instruments and strategies.

As soon as you determine the distinction between buying and selling and investing it might be time to assemble extra details about belongings for buying and selling and select the suitable instruments in line with your buying and selling preferences and magnificence.

What to Commerce in 2023?

Selecting the best buying and selling instrument for you is among the most essential issues. What do you favor: shares, foreign exchange, cryptocurrency? Perhaps you might be particularly keen on buying and selling commodities? Or maybe you don’t thoughts attempting all of them?

All forms of belongings for buying and selling have their very own traits and will require totally different buying and selling strategies. For instance, shares and foreign exchange are among the many hottest belongings for buying and selling. Whereas having a diversified portfolio with various kinds of belongings to handle dangers is essential, buying and selling too many belongings without delay could also be complicated for novice merchants.

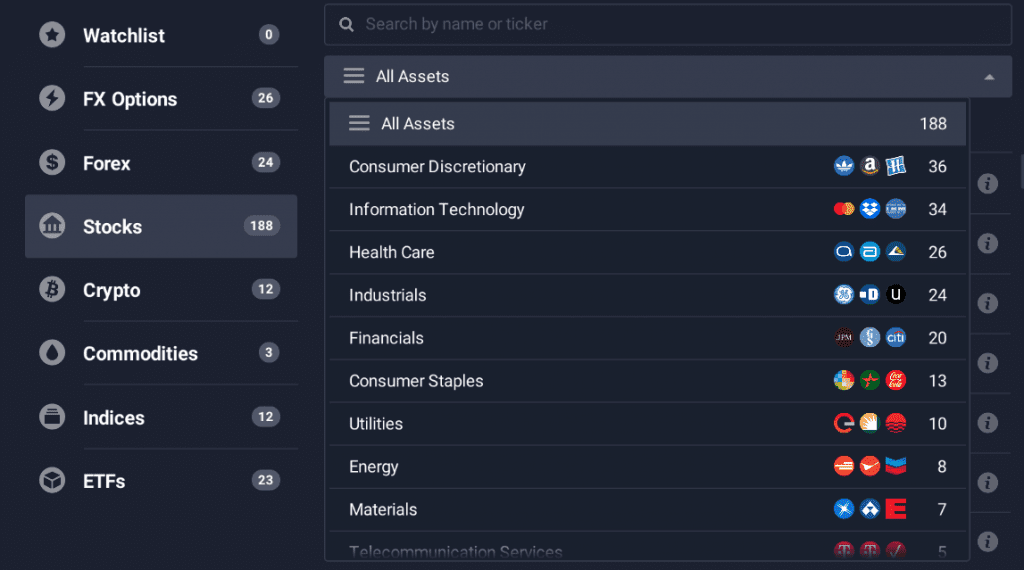

Under is a listing of the most well-liked belongings for buying and selling and their traits.

Buying and selling CFDs on Shares

A inventory, also referred to as a share, represents fractional possession of an organization. While you purchase a share of an organization, you might be primarily shopping for a small piece of possession of that enterprise.

Nonetheless, you don’t at all times want to truly buy shares for buying and selling. You might select to commerce shares as CFDs (Contract for distinction). On this case, as a substitute of shopping for a share, you’d merely attempt to predict the course of the long run value fluctuations of the chosen asset. Relying on whether or not the end result confirms your predictions, you could obtain a revenue or lose the preliminary funding.

On high of that, when buying and selling CFDs, it might be doable to realize constructive outcomes not solely when the inventory value will increase, but additionally in case of a decline. This technique is known as short-selling, and it might provide a wide range of buying and selling alternatives in a downward market.

There are practically 190 shares for buying and selling by way of CFDs on the IQ Choice platform that embrace essentially the most traded shares from high international corporations. You might select shares from totally different sectors which may carry out higher throughout sure enterprise cycles. Take a look at this text to study extra about the best way to analyze shares for buying and selling and perceive how CFDs on shares are traded.

Buying and selling CFDs on Foreign exchange

The time period “Foreign exchange” refers back to the international alternate market, or just FX. The foreign exchange market is the largest and most liquid market on this planet. This implies bigger commerce volumes resulting from excessive demand and dangers linked to market volatility. Listed here are 2 fundamental steps that will make it easier to perceive foreign currency trading higher.

Decide an appropriate buying and selling strategy

There isn’t a one foreign currency trading technique that fits everybody. One factor you must at all times bear in mind is that the foreign exchange market is open 24 hours a day 5 days every week. There are busy durations that are likely to have bigger commerce quantity and vital value fluctuations, so it might be essential to decide on the appropriate time to commerce foreign exchange. For those who can’t commerce through the busy durations, you could want to think about a private foreign currency trading strategy that might fit your schedule.

Select your foreign money pairs

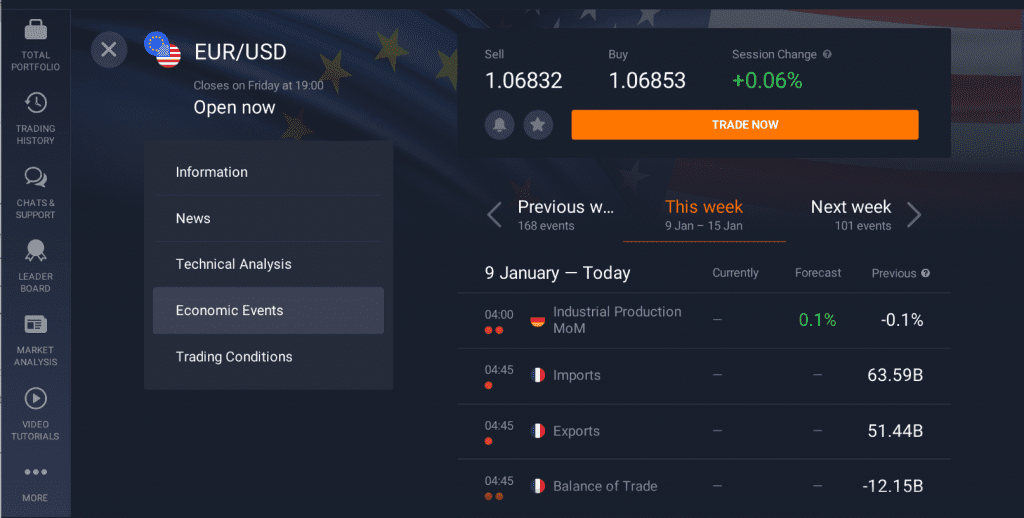

It’s also essential to choose the foreign money pairs for buying and selling, that are usually put into two major classes: main and unique. The previous are represented by the most well-liked foreign exchange pairs reminiscent of EUR/USD, GBP/USD, USD/JPY and USD/CHF. The unique pairs are much less widespread, however they could typically be extra unstable. These embrace currencies just like the Mexican peso and the Swedish krona.

Every foreign money pair could also be affected by totally different exterior components, so that you would possibly need to keep knowledgeable concerning the market information associated to the chosen belongings. As an illustration, you’ll be able to test crucial occasions that will affect particular foreign money pairs proper from the IQ Choice platform. This fashion, you can begin buying and selling foreign exchange whereas staying on high of present information and studying about belongings for buying and selling with out leaving the platform.

FAQ

How a lot do you want for buying and selling?

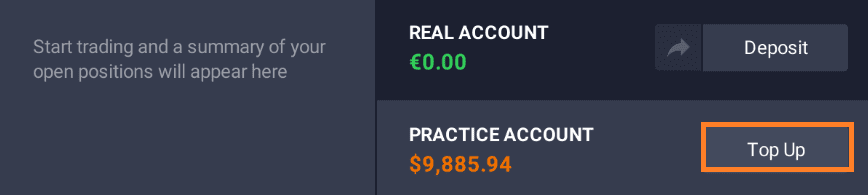

Some folks assume that buying and selling requires investing massive funds. Nonetheless, some merchants start their journey even with small investments. As an illustration, the minimal deposit on IQ Choice is simply $20 or an equal in your native foreign money. With a minimal commerce quantity ranging from $1, merchants could select belongings for buying and selling that go well with their monetary circumstances. Don’t overlook concerning the risk-management guidelines and devices – they could make it easier to determine dangers and handle them.

How one can get buying and selling expertise?

It could be a good suggestion to first take a look at your concepts on the free demo account on IQ Choice. It features a $10 000 stability that may be topped up at no cost at any second, so you should utilize it risk-free so long as you want earlier than making the primary deposit.

In Conclusion

In case you are planning to reinforce your buying and selling strategy in 2023, you will need to be extra versatile and continue learning and testing totally different strategies. Devoting a while to finding out and working towards varied buying and selling strategies could make it easier to determine alternatives and get extra constant outcomes. You may additionally need to remember risk-management devices and actively embrace them in your buying and selling strategy. Take a look at your technique and don’t get discouraged if one thing doesn’t work out immediately — errors are part of the educational course of, they assist us get extra expertise and transfer ahead.