The primary presidential debate between Donald Trump and Kamala Harris on Sept. 10 didn’t embrace any dialogue of crypto or Bitcoin, even when the dialogue lined the economic system. The candidates targeted on conventional subjects equivalent to overseas coverage, immigration, and abortion rights.

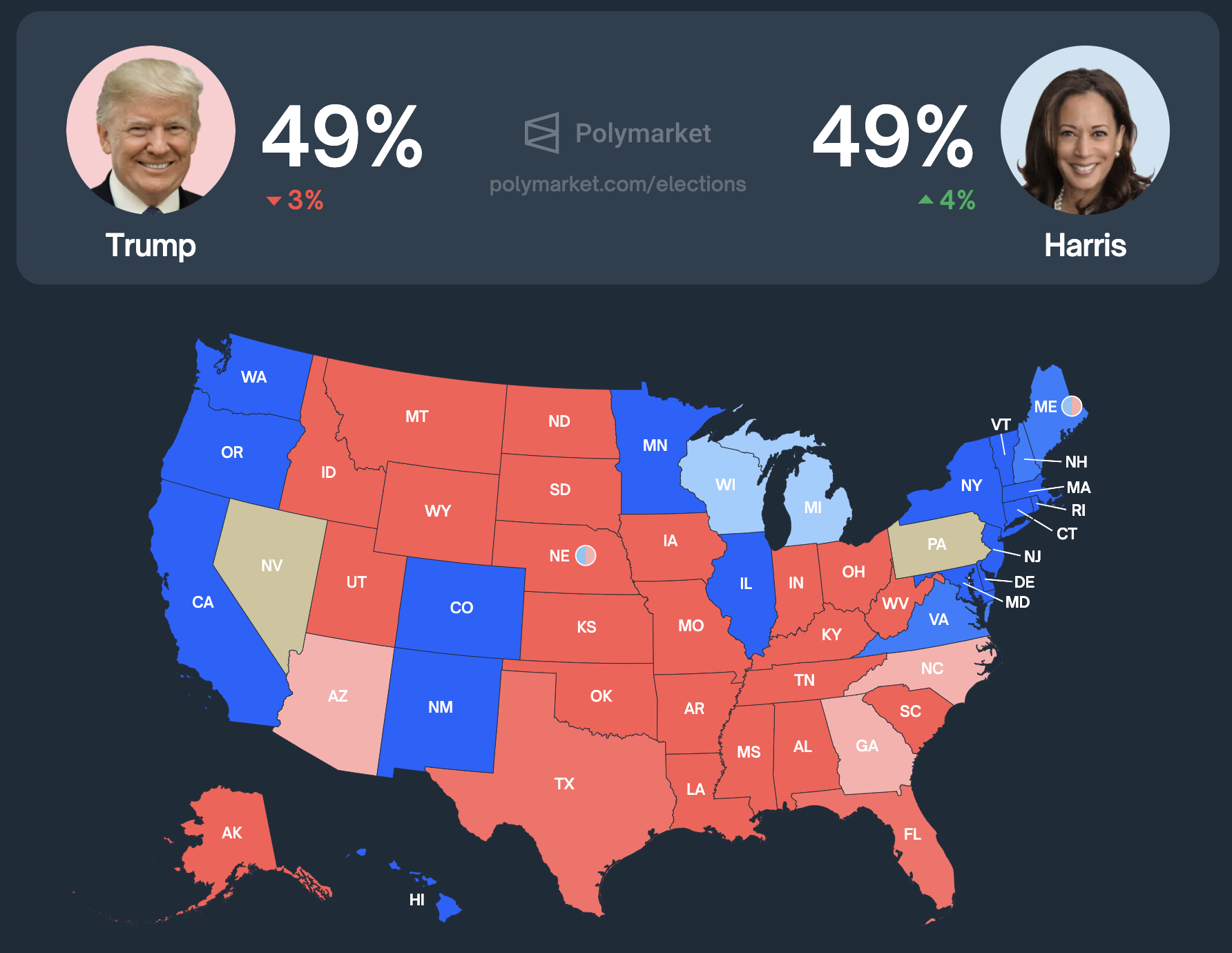

Previous to the talk, Trump held a slight lead in prediction markets. On crypto-based Polymarket, Trump’s odds have been at 53% in comparison with Harris’ 46%. Nevertheless, post-debate, each candidates are tied at 49% every on Polymarket, a seven-point swing. As of press time, $865,183,218 has been wager on the end result of the election. On PredictIt, a non-crypto market accessible within the US, the shift was extra pronounced, with Harris’ odds rising to 56% and Trump’s falling to 47% after the talk. Harris has additionally taken a slight lead on conventional betting websites.

A Polymarket market on the end result of the talk stands at 98% for Harris profitable the talk with just below $1 million wagered.

The talk’s end result appeared to negatively influence Bitcoin’s value. Following the occasion, Bitcoin’s worth dropped by roughly 3%, falling from round $58,000 to $56,600. It has since recovered to over $57,000 as of press time. This decline coincided with Trump’s decreased odds within the prediction markets.

It’s price noting that Bitcoin had already skilled a major 8% drop on Sept. 6, when Trump had his largest lead throughout Polymarket and closest odds on PredictIt. This means that Bitcoin’s value actions will not be solely correlated to Trump’s probabilities of profitable the talk.

Regardless of the dearth of direct dialogue about crypto through the debate, the market’s response signifies that buyers and merchants are intently watching the election’s developments and their potential implications for the crypto trade. Trump has expressed help for the crypto sector, whereas Harris has not but clearly articulated her stance on digital belongings, leaving crypto out of her coverage paperwork.