Avalanche (AVAX) has discovered itself ensnared inside a essential value zone, grappling with a lackluster buying and selling quantity that has hindered its value motion. The coin’s journey has been fraught with challenges as market sentiment takes a bearish stance, casting shadows over its potential upward trajectory.

The latest try at a bullish surge, stemming from the $11 assist degree, encountered a formidable impediment on the $15.8 resistance degree. This pivotal juncture proved to be an insurmountable barrier, resulting in an abrupt value rejection.

The consequence of this rejection has been instrumental in preserving AVAX’s bearish market construction, leaving merchants and buyers grappling with uncertainty.

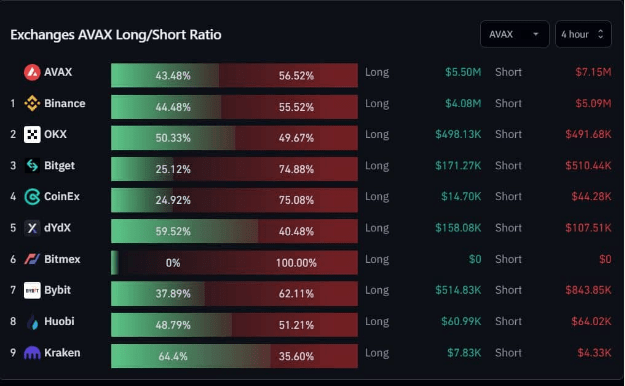

AVAX Lengthy/Quick Ratio Indicators Predominance Of Sellers

On nearer examination of the buying and selling panorama, the lengthy/quick ratio within the four-hour timeframe reveals a putting imbalance in favor of sellers. Knowledge sourced from Coinglass paints a telling image, with a staggering 56.5% of open contracts adopting quick positions.

Supply: Coinglass

This lopsided ratio serves as a transparent indication {that a} important cohort of market individuals anticipates AVAX’s downward trajectory to persist, amplifying the prevailing bearish sentiment.

The end result of those elements has translated into AVAX’s present value of $12.46, as reported by CoinGecko. Over the previous 24 hours, the cryptocurrency has skilled a modest decline of 0.6%, reflective of the prevailing market volatility.

AVAX value immediately. Supply: Coingecko

Moreover, the seven-day development highlights a marginal contraction of 0.2%, additional underscoring the turbulent nature of AVAX’s latest value actions.

Uncertainty Looms As Sellers Keep Grip

As AVAX navigates this difficult section, uncertainty looms massive over its quick future. The shortage of buying and selling quantity has left the cryptocurrency susceptible to sudden and sharp value fluctuations, whereas the prevailing bearish sentiment continues to discourage potential buyers from getting into the market.

On this local weather of uncertainty, all eyes stay fixated on the interaction between assist and resistance ranges., In accordance with a latest value evaluation, the token’s capacity to transcend the $15.8 resistance degree will possible dictate its trajectory transferring ahead.

AVAX market cap at $4.2 billion immediately. Chart: TradingView.com

Ought to this barrier be breached, it may instill newfound confidence amongst merchants, probably mitigating the bearish grip that presently envelopes the market sentiment.

AVAX finds itself at a essential crossroads, grappling with an absence of buying and selling quantity and a prevailing bearish sentiment. The latest value rejection has sustained the cryptocurrency’s bearish market construction, with the lengthy/quick ratio skewing considerably in direction of sellers.

As AVAX treads cautiously by this unsure terrain, the cryptocurrency group watches, desperate to discern whether or not the present challenges will pave the way in which for a resurgence or additional deepen its bearish trajectory.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes threat. While you make investments, your capital is topic to threat).

Featured picture from Token Gamer