TrueUSD (TUSD) has regained parity with the U.S. greenback.

The stablecoin misplaced true parity with the US Greenback on June 10 amid mounting neighborhood issues over its minting and redemption actions.

On June 10, TUSD depegged from the $1 mark after its crew paused minting actions by way of Prime Belief, a Nevada-based crypto custodial agency. Following the information, the stablecoin dropped to as little as $0.9957 on June 11. At press time it had simply reclaimed $1.

There have been speculations on the time that Prime Belief may need been bancrupt as its father or mother firm, Prime Core Applied sciences, had entered right into a non-binding time period sheet with BitGo to accumulate 100% of its fairness on June 8.

Whereas TUSD maintained that its minting and redemption companies stay unaffected, as its partnerships with different banking establishments stay intact, a number of customers on its official Telegram deal with have raised points about their redemptions request as of June 13.

In response, a consultant of TUSD stated:

“Prime Belief will proceed to course of lower-volume redemptions. if you’re in search of a dependable and cost-effective to redeem and wire these currencies, Flowbank could also be a good selection.”

Earlier immediately, the TUSD crew tweeted that it was “diligently working in the direction of resuming TUSD minting on Prime Belief.”

As of press time, TUSD has but to answer CryptoSlate’s request for extra commentary on its minting and redemption points.

TUSD’s market cap declines by $30M

Amid these points, TUSD’s market cap declined by practically $40 million since June 10 however reclaimed $10 million upon assembly parity once more immediately. Its market cap presently stands at $2.03 billion.

As of June 9, TUSD had a market cap of $2.07 billion however dropped as little as $2.02 billion early June 13.

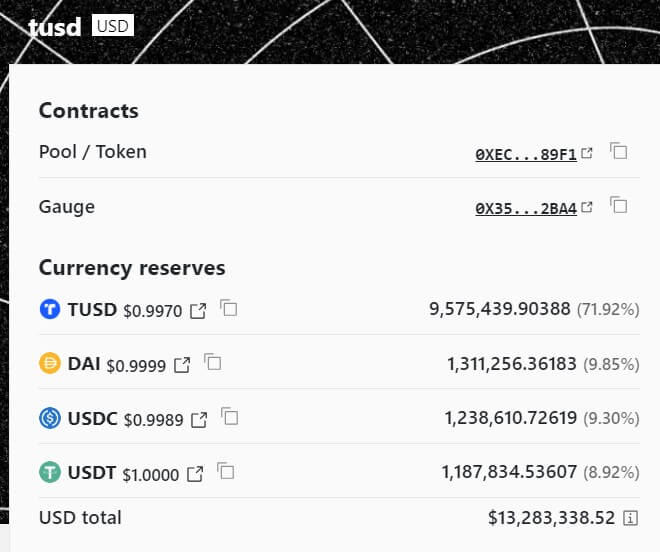

TUSD’s Curve pool additional corroborates the information as it’s closely imbalanced as of press time, with crypto merchants exhibiting preferences for Tether’s USDT, Circle’s USD Coin (USDC), and DAI.

The TUSD dashboard exhibits that the embattled stablecoin account for practically 72% of the pool’s $13.28 million reserve, whereas USDT made up roughly 9%. The opposite stablecoins within the pool make up the 20% stability.

Regardless of these points, Kaiko information said that the BTC-TUSD pair on Binance has overtaken BTC-USDT as essentially the most traded BTC market in crypto and presently accounts for 61% of all BTC quantity on the trade.

The publish TUSD regains $1 parity after three-day depeg appeared first on CryptoSlate.