Lengthy-term Bitcoin (BTC) holder conduct is taken into account some of the determinate components to evaluate BTC efficiency, the market’s high, and the market’s backside. Lengthy-term holders are outlined as addresses that haven’t moved any of their BTC holdings within the final six to 12 months.

The Brief-to-Lengthy-term Realized Worth (SLRV) Ratio reveals the proportion of BTC in existence, the quantity moved inside the final 24 hours, and divides the proportion final moved inside the final six to 12 months.

Excessive values seen on the SLRV Ratio indicator present that short-term BTC holders have gotten extra energetic and engaged on the BTC community. That is indicative of a looming market high and suggests market hype is in full swing. A low SLRV Ratio signifies the absence of short-term holder exercise and/or an growing base of longer-term holders.

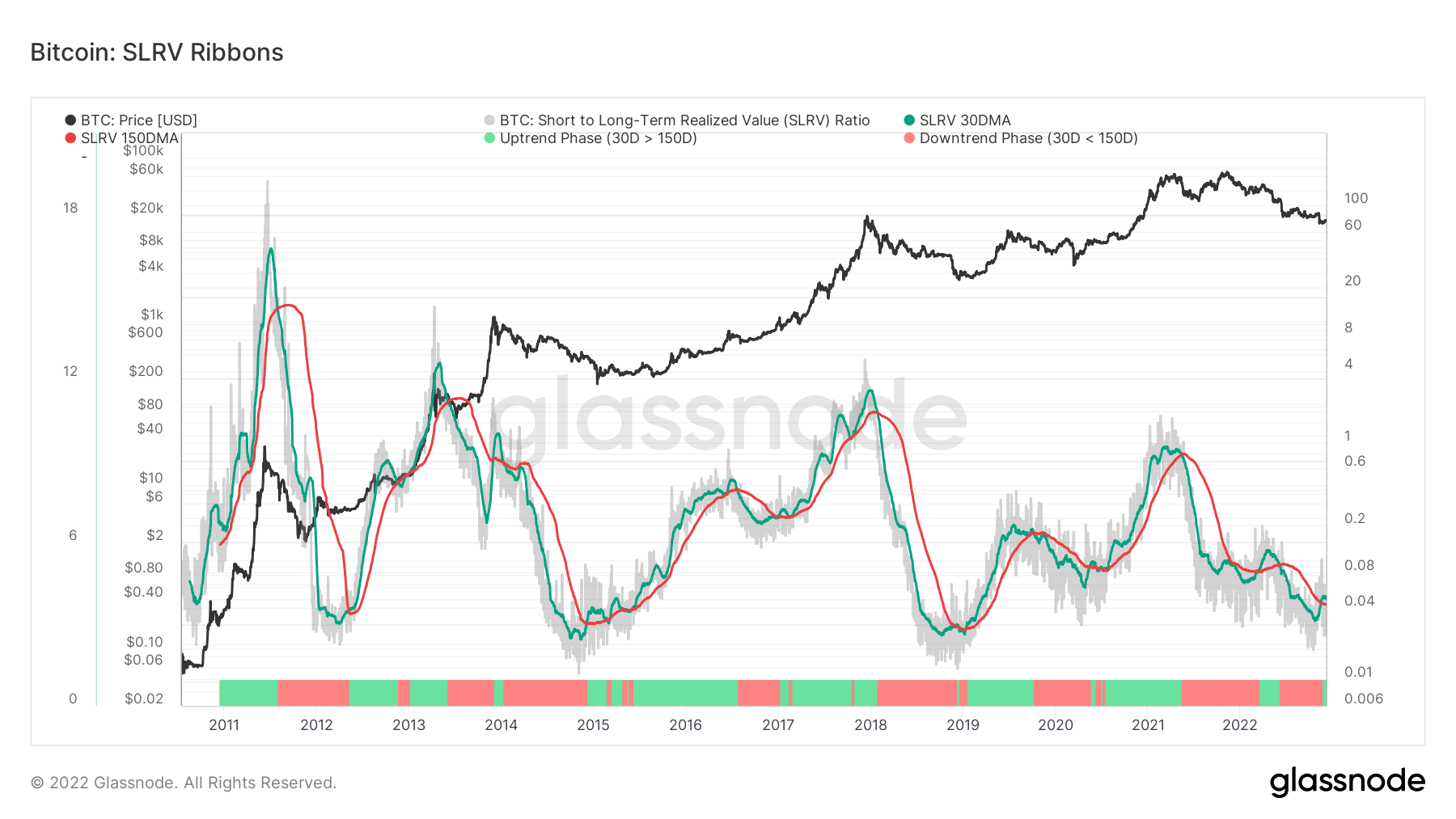

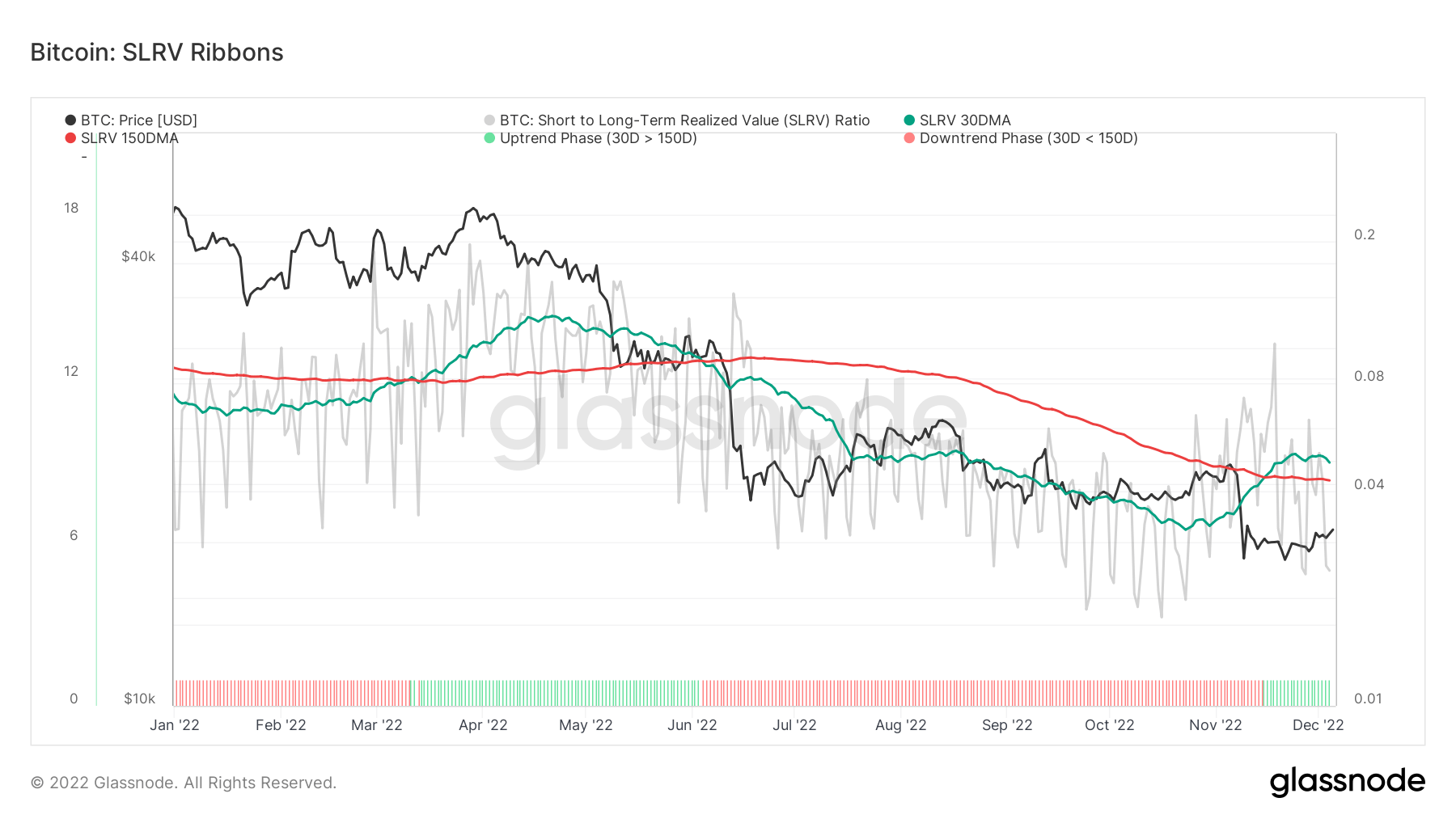

By making use of SLRV Ribbons to the SLRV Ratio, it’s doable to establish optimistic and adverse tendencies out there, and traditionally establish the transitions between risk-on and risk-off allocations to BTC. The SLRV Ribbons in each chart photographs observe the 30-day and 150-day shifting common of the SLRV Ratio.

In accordance with the historic SLRV Ratio chart beneath, the uptrend section usually stays beneath the ratio worth of the downtrend 30- and 150-day section throughout a bear market. The shift in energy might be seen in 2012, 2015, and 2019 — every signaling a definite change in market sentiment and calling in varied bull markets.

In accordance with the SLRV Ratio by means of the 12 months, BTC final noticed a transfer in direction of the uptrend section in March — shortly adopted by a downtrend section in June. This downtrend held an SLRV Ratio of above .08 into Sept however has slowly tapered off in mid-Nov.

As might be seen within the chart above, the SLRV uptrend section ribbon has simply risen above its counterpart as of Dec. Following historic information, this uptrend is predicted to proceed — following the identical sample displayed within the 2015 and 2019 BTC SLRV Ratio ribbons.

An uptrend in direction of bullish sentiment was confirmed when BTC was buying and selling at round $16,800 on Nov 15 and solely as soon as earlier than that round March — previous to the Luna collapse.

In the course of the FTX collapse, the SLRV Ratio fell as little as 0.019. Reaching this low of a price on the SLRV Ratio is traditionally related to the long-term bottoming section of a bear market and change in circulation in direction of a bull market.