Web accessibility and the event of economic service apps have been taking part in an important position in enhancing person expertise with monetary companies. For instance, you might entry all of the companies of a financial institution with just a few clicks in your smartphone. As of 2023, there are nearly 30,000 fintech startups worldwide with progressive service choices. Moreover, curiosity in fintech funding has been rising considerably.

The worth-based benefits of fintech have spurred curiosity in studying A to Z of fintech amongst many individuals worldwide. Fintech is an progressive idea that has every little thing to maintain the take a look at of time and transfer towards the way forward for finance. Nonetheless, novices are more likely to expertise difficulties in understanding fintech with out consciousness relating to necessary phrases in fintech. The next glossary of fintech phrases and phrases might function a helpful reference for novices to know fintech.

Curious to know in regards to the potential dangers and predictions for the way forward for fintech? Test the detailed information Now on Fintech And The Future Of Finance

Essential Phrases within the World of Fintech

Have you ever felt like an outsider when your pals and colleagues are discussing fintech? You should have come throughout fintech phrases corresponding to blockchain know-how, decentralized finance and plenty of different phrases in discussions on fintech. Allow us to check out a few of the most necessary additions in fintech terminology you should study proper now.

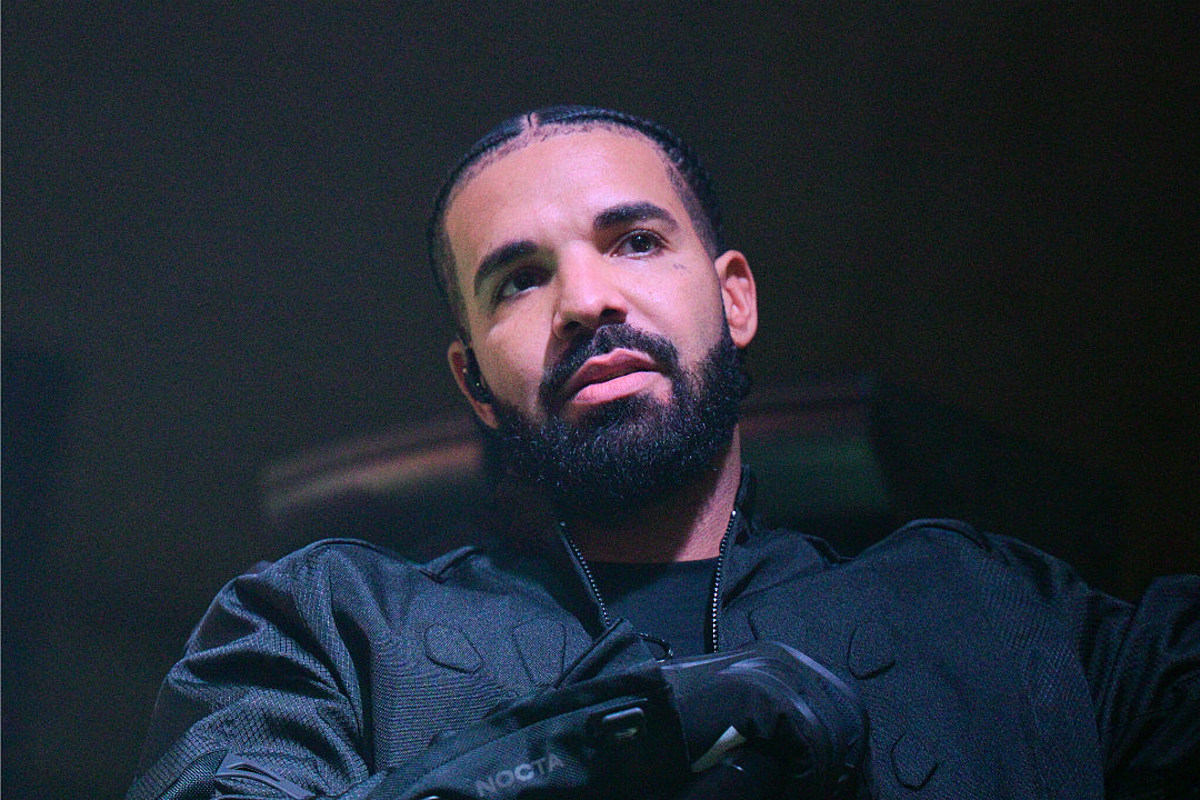

Please embody attribution to 101blockchains.com with this graphic. <a href="https://101blockchains.com/blockchain-infographics/"> <img src="https://101blockchains.com/wp-content/uploads/2023/02/FinTech-Glossary-For-Learners.png" alt="FinTech Glossary For Learners="0' /> </a>

3D Safe

The phrase ‘3D Safe’ implies an idea for safeguarding the area of fintech. It’s a safety protocol that leverages three distinct domains for addressing the considerations of safety vulnerabilities and fraud in on-line card transactions. 3D safe is a vital addition to a fintech terminology listing for novices. The time period 3D refers to 3 domains, together with the cardboard issuer, shops that take funds and a 3DS infrastructure platform.

Asset-based Mortgage

The asset-based mortgage, or ABL, is a variant of enterprise finance or a mortgage backed with the assistance of a company asset. Asset-based loans assist in growing short-term money move, and collateral might embody property, accounts receivables, and tools.

Account Info Service Supplier

One other necessary reply to ‘What are Fintech abbreviations?’ would draw consideration towards AISP or Account Info Service Supplier. An AISP is a licensed firm in an open banking mannequin for serving to third-party establishments in accessing monetary info of shoppers with their approval.

Different Finance

You can not discover a fintech glossary listing with out the point out of other finance or Alt-fi. Different finance denotes the various vary of economic options that are totally different from typical monetary devices corresponding to money, shares and bonds. Some examples of other finance level to crowdfunding and peer-to-peer lending.

Construct your id as an authorized blockchain knowledgeable with 101 Blockchains’ Blockchain Certifications designed to supply enhanced profession prospects.

AML

The gathering of necessary phrases for fintech novices additionally contains AML or anti-money laundering. AML denotes the gathering of finest practices adopted by monetary establishments for combating the considerations of cash laundering. AML features a set of clearly outlined guidelines, laws and processes which adjust to authorized standards.

Software Programming Interface

The Software Programming Interface or API is a vital technical software for facilitating improvement of fintech functions. It incorporates a assortment of instruments, procedures and protocols for creating functions that may assist totally different fintech functions and techniques work together with one another. APIs play an important position in facilitating customization of fintech options in line with person necessities alongside streamlining day by day actions.

API Banking

The listing of notable fintech phrases additionally sheds mild on API Banking, which serves a group of regulated protocols, procedures and instruments. API banking permits monetary establishments or third-party organizations to entry banking companies by an API. Monetary establishments can use API banking to supply safe and restricted entry to their central techniques for banking transactions to third-party techniques.

Aspiring to make a profitable profession as a Fintech knowledgeable however unsure how? Test the detailed information Now on How To Turn into A Fintech Professional

Automated Clearing Home

The responses to “What are fintech abbreviations?” additionally invite consideration towards Automated Clearing Home or ACH. Automated Clearing Home community is an digital system for transferring funds, established in 1974. The cost system might help efficient administration of direct deposits, payroll, tax funds, client payments and plenty of different cost companies.

Synthetic Intelligence

Synthetic Intelligence refers back to the progressive idea of encouraging robots to behave like human customers by programming. AI might create new benchmarks on the planet of fintech with prospects for coaching machines for problem-solving and studying duties.

Banking License

Banking License is a authorized doc that signifies the permission of a financial institution to function in a selected jurisdiction. The banking license calls for numerous {qualifications}, corresponding to market capitalization and detailing of enterprise technique.

Financial institution Identification Quantity

The A to Z of fintech additionally factors to BIN or Financial institution Identification Quantity. It’s accessible on credit score, pay as you go or debit playing cards of a financial institution and helps in figuring out the cardboard issuer. Retailers might use the BIN for validation of transactions utilizing the cardboard of a selected financial institution.

Need to understand how the private and non-private sectors work to enhance the monetary system? Turn into a member and get free entry to Central Financial institution Digital Foreign money (CBDC) Masterclass Course.

Massive Knowledge

Massive Knowledge is one other essential time period within the area of fintech, because it denotes the huge quantity of organized and unstructured knowledge associated to monetary companies and functions. Monetary establishments might use predictive knowledge analytics for Massive Knowledge to acquire clear insights relating to the habits of shoppers. The most typical functions of Massive Knowledge embody fraud detection and prevention, personalization of person experiences and sentiment evaluation.

Blockchain

Probably the most important addition to a fintech glossary for 2023 would clearly emphasize blockchain know-how. Blockchain is a distributed ledger of transaction data. Each block contains knowledge about transactions, together with the date, worth, and time of transactions. As soon as a transaction block is verified and deployed on the blockchain, it’s unimaginable to vary the document. Probably the most outstanding functions of blockchain in fintech level at cryptocurrencies and DeFi.

Purchase Now Pay Later

The gathering of fintech acronyms for novices additionally contains Purchase Now Pay Later or BNPL. Purchase Now Pay Later is a brand new variant of retail finance that helps prospects in leveraging the advantages of easy compensation and no-cost EMIs.

Challenger Banks

The first goals of challenger banks distinguish them from conventional banks on the planet of fintech. Challenger banks concentrate on encouraging innovation, client-centric operations, new working fashions and customization of economic companies. The widespread examples of challenger banks embody non-banking monetary establishments, mid-tier banks and specialised banks.

Cloudsourcing

Cloud suppliers provide cloud computing companies to banks and monetary establishments with many promising advantages. Cloudsourcing is a vital addition to fintech terminology listing because it allows fintech service suppliers to outsource IT companies. A selected third-party vendor takes on the accountability of managing all of the IT companies for a fintech firm or platform.

Collaborative Financial system

A collaborative financial system or sharing financial system is the formation of a gaggle by which individuals be part of to share, swap and take loans of services. The group doesn’t need to rely on a big group to entry desired fintech companies and merchandise.

Cryptocurrency

Cryptocurrency refers to a digital forex based mostly on a blockchain community with the facility of decentralization. Cryptocurrencies should not topic to the management of centralized monetary establishments corresponding to banks. Quite the opposite, the pricing of cryptocurrencies depends upon their utility and supply-demand dynamics.

Need to grow to be a Cryptocurrency knowledgeable? Enroll Now in Cryptocurrency Fundamentals Course

Crowdfunding

Crowdfunding is a vital addition to fintech glossary listing as a novel idea in different finance. People or organizations can take part in crowdfunding by in search of financial donations from the general public by web. The contributions in crowdfunding serve useful functions in sponsoring initiatives or ventures.

Knowledge Administration Platform

Knowledge Administration Platform or DMP is likely one of the necessary fintech acronyms which describes the know-how used for accumulating and managing knowledge from totally different sources. Upon compilation, DMPs might distribute the info assortment throughout broader channels. Knowledge Administration Platforms are essential digital advertising and marketing instruments with the benefit of correct viewers focusing on.

Knowledge Mining

Knowledge mining is a crucial idea in fintech because it focuses on investigating knowledge to establish hidden patterns and correlations. The usage of knowledge mining in fintech might assist in drawing exact forecasts relating to future traits. Knowledge mining works by a robust mixture of synthetic intelligence, Massive Knowledge and machine studying.

Decentralized Finance

The A to Z of fintech additionally contains one other outstanding spotlight within the type of decentralized finance or DeFi. Decentralized finance leverages blockchain know-how to allow simpler entry to monetary services. DeFi gives the reassurance of clear transactions by sensible contracts provided by DeFi apps.

Need to study and perceive the scope and objective of DeFi? Enroll Now in Introduction to DeFi- Decentralized Finance Course

Deep Studying

The applied sciences utilized in fintech would additionally embody deep studying, which makes use of machine studying for complete evaluation of unstructured knowledge. Deep studying entails evaluation of various layers of knowledge to acquire high-quality and related insights. Deep knowledge serves as actionable and helpful info obtained by evaluation of enormous datasets.

Neobanks

Neobanks is one other outstanding addition amongst phrases for fintech novices. The time period describes digital banks which supply their companies by cell functions. Clients should not have to go to a financial institution for normal banking transactions like financial savings account evaluations, cash transfers and loans.

Digital Identification

Digital id refers back to the on-line model of bodily id of a person, which depends upon their on-line habits. The web habits of a person might embody details about the username, buy habits and search exercise.

Excited to study the idea of decentralized id on current digital ecosystems? Turn into a member and get free entry to Decentralized Identification Fundamentals Course Now!

ESG

ESG is likely one of the tops mentions for questions like “What are fintech abbreviations?” with vital implications for fintech. The abbreviation denotes Environmental, Social and Governance requirements that decide the social and environmental duties of fintech firms.

Fintech Sandboxes

The fundamental terminology in fintech additionally factors in the direction of fintech sandboxes, that are testing packages for brand new enterprise fashions. The fintech sandboxes assist in testing new fintech merchandise in precise enterprise settings earlier than deployment.

Inexperienced Finance

Inexperienced Finance represents the organized monetary actions by fintech firms and platforms for making certain higher outcomes for the setting. It might cowl investments and loans which help inexperienced initiatives or tackle local weather change considerations.

Begin studying Decentralized Finance (DeFi) with World’s first DeFi Talent Path with high quality sources tailor-made by trade consultants Now!

ICO

The gathering of widespread fintech phrases additionally contains ICO or Preliminary Coin Providing. It’s a kind of fundraising for crypto-based initiatives, much like IPOs for typical companies.

Insurance coverage Know-how

Insurance coverage know-how, or InsurTech, is an rising software in fintech centered on bettering productiveness for insurance coverage corporations. It really works by decreasing prices for insurance coverage suppliers in addition to shoppers, alongside bettering person expertise. InsurTech helps in lowering considerations of fraud claims alongside making certain environment friendly claims administration and underwriting.

KYC

KYC or Know Your Buyer is a compulsory addition amongst fintech acronyms and is crucial for fintech functionalities. Know Your Buyer procedures assist fintech firms in confirming the id of customers.

Multi-factor Authentication

Multi-factor authentication or MFA is an efficient safety method for serving to customers in verification of id with a number of affirmation strategies. One of many widespread examples of multi-factor authentication is the two-factor authentication technique.

Non-fungible Token

Non-fungible tokens, or NFTs, are additionally outstanding additions to fintech glossary for novices. It’s a blockchain-based asset that represents possession of an asset on a blockchain community by sensible contracts. Every NFT is exclusive and indivisible.

Peer-to-Peer Transactions

Peer-to-Peer or P2P transactions denote the transaction method by which customers work together straight with one another. For instance, direct lending and borrowing between two individuals or direct person-to-person funds with out involving intermediaries.

RegTech

Regulatory Know-how, or RegTech, is a vital a part of fintech terminology listing for novices. It refers to the usage of info know-how in monetary companies for enchancment of regulatory operations. RegTech focuses on making certain higher compliance, regulatory monitoring and reporting in monetary companies.

Good Contracts

Good contracts are an important element of the rising fintech panorama for facilitating automated transaction processing and verification. Blockchain know-how helps in implementing sensible contracts and monitoring their functions.

Curious to know the entire sensible contract improvement lifecycle? Turn into a member and get free entry to the Good Contracts Growth Course Now!

Conclusion

The listing of necessary phrases for fintech novices presents a chance to acquire a short understanding of the fintech market. You possibly can come throughout necessary banking and monetary companies phrases in addition to applied sciences that drive fintech. Because the area of fintech features recognition and extra fintech startups emerge sooner or later, it can open up new avenues for profession improvement.

Aspiring fintech professionals ought to depend on complete coaching sources and certifications for pursuing careers in fintech. 101 Blockchains can assist you study extra about applied sciences utilized in fintech and validate your expertise with a fintech certification. Study extra about fintech and navigate your profession path within the futuristic area proper now.

*Disclaimer: The article shouldn’t be taken as, and isn’t meant to supply any funding recommendation. Claims made on this article don’t represent funding recommendation and shouldn’t be taken as such. 101 Blockchains shall not be accountable for any loss sustained by any one who depends on this text. Do your personal analysis!