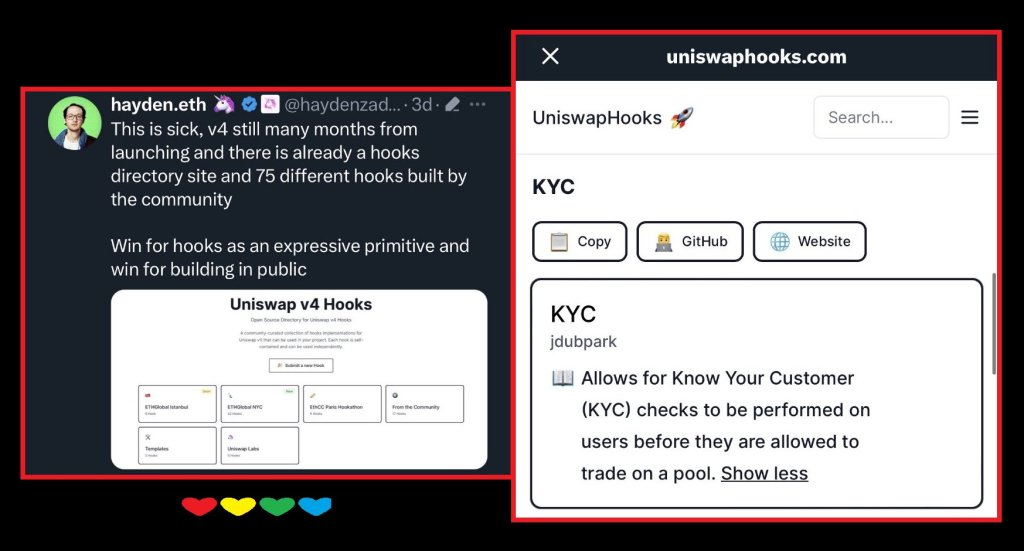

As a consequence of its innovation, Uniswap Labs plans to introduce Hooks within the upcoming Uniswap v4, placing the world’s main decentralized change within the highlight. Based on a critic on social media platform X, the DEX is on the know-your-customer (KYC)-verification route as soon as Hooks on Uniswap v4 are launched.

Uniswap v4 Hooks Is The Starting Of Censorship?

Sharing screenshots, the person shared insights and stated the change brings KYC verifications on the most recent iteration. On the identical time, the platform plans to make use of the “permission required” off-chain server on UniswapX for efficiency enhancements.

UniswapX is an open-source resolution permitting permissionless and open buying and selling throughout Automated Market Makers (AMMs) and different liquidity sources. It’s at the moment being examined on the Ethereum mainnet.

Although the neighborhood has embraced these developments, the critic stated these necessities, particularly the id verification requirement on Hooks, might be out there as an choice earlier than being regularly made obligatory down the road.

Uniswap v4 is being developed, and Hooks might be one of many key updates. Hooks are programmable extensions for customizing pool and commerce habits, tightly built-in with Uniswap’s core protocol.

With Hooks, it turns into simpler for builders to implement different options corresponding to dynamic charges, on-chain restrict orders, and overly improved customization. On this method, it can even be potential to combine Uniswap v4 into different protocols.

Uniswap Evolution: Constructing “Actual” DeFi?

The DEX has consistently developed and launched new options because the first model went dwell in late 2018. Uniswap v1 launched AMM, opening up decentralized finance (DeFi). This allowed liquidity suppliers (LPs) to be essential to market making.

In Uniswap v3, the change launched concentrated liquidity (CL). This function permits LPs to specify a worth vary inside which they’re prepared to offer liquidity. In Uniswap v2, LPs offered liquidity throughout your entire worth vary of the token pair. In v3, liquidity depth will increase whereas merchants get higher pricing.

Regardless of the criticism, Hooks has been supported in some quarters. For example, the person acknowledged that the function would amplify the worth proposition of some protocols, making them actual “DeFi” platforms. On the identical time, whereas responding to the critic, one other commentator said the function will do greater than what anyone else has achieved for “actual DeFi.”

Characteristic picture from Canva, chart from TradingView