US authorities are working to return $8.2 million in crypto frozen and seized from three rip-off addresses to victims of a con involving fraudulent messages and a faux funding scheme.

The rip-off concerned sending messages to random telephone numbers pretending to have the mistaken quantity. From there, the scammers would befriend the recipient, acquire their belief and ultimately persuade them to spend money on a crypto rip-off.

The FBI has recognized 33 folks snared by the rip-off; one other 5 are nonetheless to be recognized, with whole losses at $6 million, in accordance with a Feb. 28 assertion from the Ohio District Legal professional’s workplace.

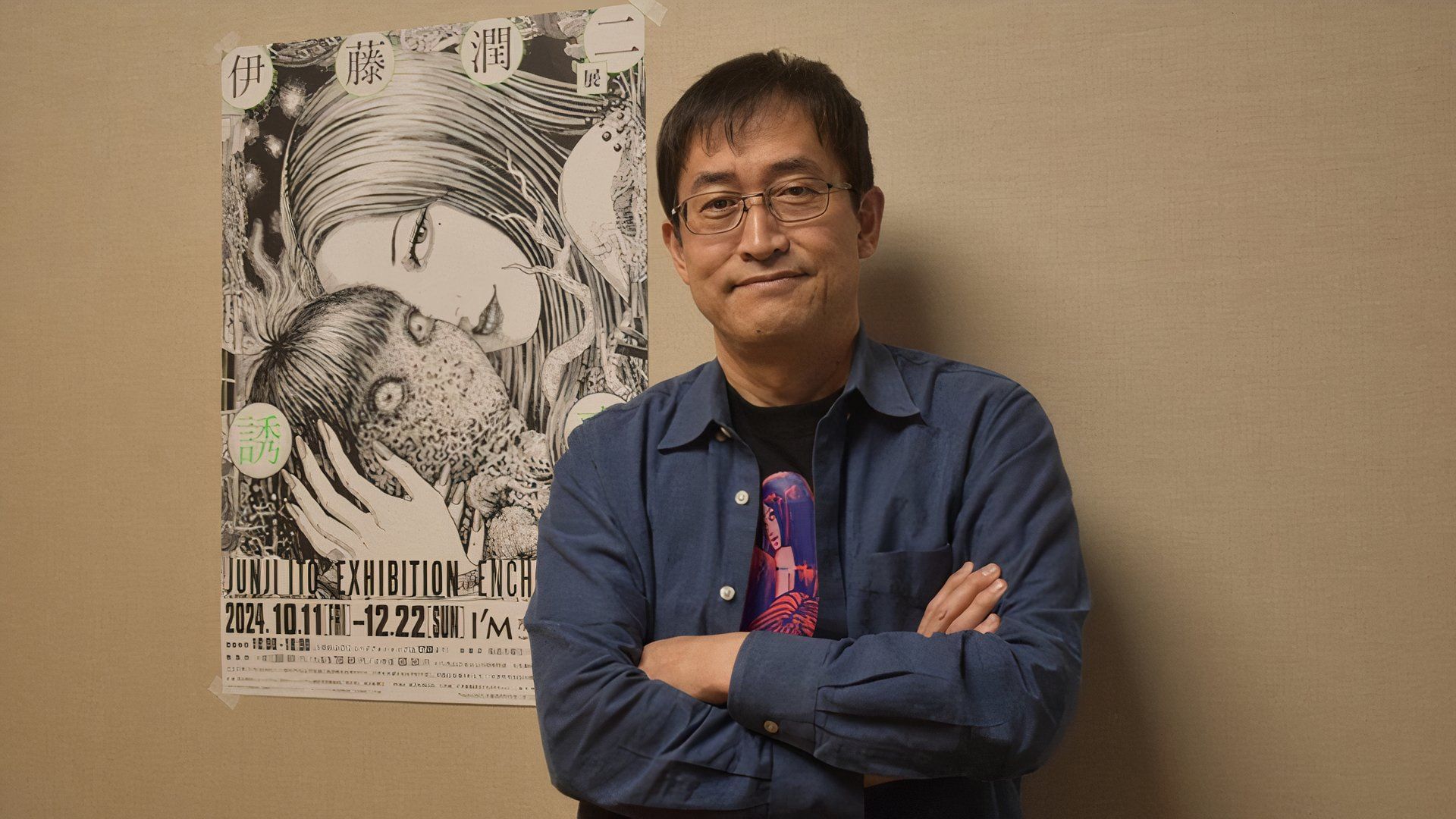

The FBI has recognized 33 folks snared by the rip-off, with one other 5 nonetheless to be recognized. Supply: US Division of Justice

Investigators carried out a blockchain evaluation after a sufferer filed a criticism to the FBI’s web Crime Grievance Middle in June and located a portion of the stolen funds had been transformed into Tether (USDT) and transferred to the three cryptocurrency addresses.

After authorities executed a federal seizure warrant, Tether froze the funds and transferred them to a law-enforcement-controlled pockets, the place they’ve sat ever since.

In a Feb. 27 forfeiture criticism filed in an Ohio District Court docket, appearing US Legal professional for Ohio Carol Skutnik and assistant US Legal professional James Morford are asking the court docket to have all of the funds within the three addresses forfeited to allow them to return them to the victims.

The pair stated the accounts “contained extra funds above the victims’ traceable losses,” which had been utilized in cash laundering and wire fraud, totaling $8.2 million.

How the rip-off labored

Skutnik and Morford stated within the criticism that the scammers contacted victims by way of seemingly innocent, misdirected, or “mistaken quantity” messages despatched by way of textual content messages, relationship purposes {and professional} meet-up teams.

“The fraudster then gained the sufferer’s belief and affection utilizing varied manipulative techniques. As soon as belief was established with the sufferer, the fraudster would share how a lot success they, or somebody they knew, had with investing in cryptocurrency,” Skutnik and Morford stated.

“This private testimonial lessened any uncertainties the victims could have had about digital currencies and ultimately had the meant impact to steer the sufferer to proceed with the funding.”

Associated: Bybit hackers resume laundering actions, transferring one other 62,200 ETH

The fraudsters allegedly guided victims by way of opening legit crypto trade accounts and transferring funds to a faux web site managed by the scammers. The positioning promised profitable returns and inspired additional investments.

In a single occasion, authorities allege an Ohio girl was duped into sending the scammers more cash, claiming she wanted to make extra funds to launch her preliminary funds.

After dropping her life financial savings, $663,000, she was unable to ship any extra funds, and the fraudsters allegedly threatened hurt to her family and friends except she despatched more cash.

Blockchain analytics agency Chainalysis says in its Feb. 13 Crypto Rip-off Income 2024 report that generative AI is making scams extra scalable and reasonably priced for unhealthy actors, which may end in document losses all through 2025.

In the meantime, onchain safety agency Cyvers says that pig butchering scams are one of the crucial important threats to crypto buyers, with losses within the billions throughout 200,000 recognized circumstances in 2024.

Journal: Elon Musk’s plan to run authorities on blockchain faces uphill battle