Polymarket is a decentralized prediction market platform that operates utilizing Polygon.

Not too long ago, it gained important consideration by enabling customers to wager on the outcomes of US political elections, a follow primarily prohibited throughout the conventional US betting framework.

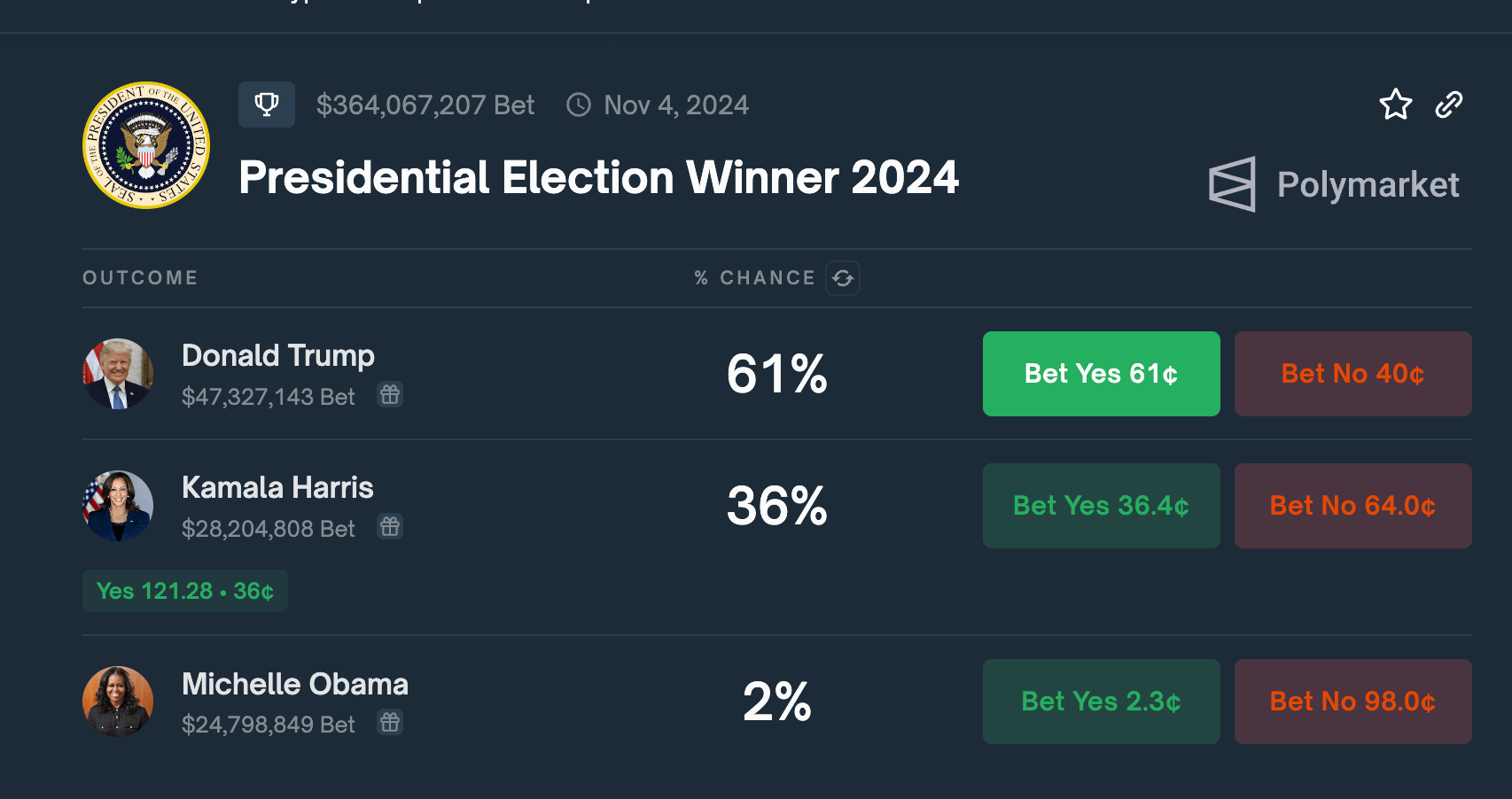

The platform’s marketplace for the 2024 US Presidential Election, as an illustration, has seen substantial engagement, with over $364 million wagered on potential outcomes as of latest knowledge. This surge in exercise highlights a broader development the place prediction markets like Polymarket provide a novel avenue for political engagement and hypothesis, circumventing the restrictions imposed by US regulators on conventional betting platforms.

The Commodity Futures Buying and selling Fee (CFTC) has actively labored to close down or restrict platforms providing election-related contracts, reflecting the contentious regulatory atmosphere wherein these markets function. Regardless of these challenges, Polymarket’s revolutionary method has positioned it as a key participant within the world zeitgeist, significantly throughout high-stakes election cycles.

Whereas Polymarket’s use is formally restricted within the US, entry by way of VPN remains to be potential. Though this violates the location’s phrases of use, many US betters could also be able to interacting as a result of lack of KYC necessities, which might additional restrict accessibility.

Market Construction and Execution

Polymarket options binary end result markets, the place customers can wager on “Sure” or “No” outcomes for numerous occasions. The platform makes use of a steady double public sale mannequin, the place costs symbolize the chance of an occasion occurring. For instance, if “Sure” shares for an occasion are buying and selling at $0.56, it implies a 56% chance of that end result.

For instance, to wager on the result of the 2024 US Presidential Election utilizing Polymarket, customers first join their EVM-compatible pockets, resembling MetaMask, and deposit USDC into their Polymarket account.

As soon as funded, customers navigate to the marketplace for the Presidential Election Winner 2024, the place they will see the present chances for every candidate. For instance, as of July 24, Donald Trump has a 61% probability of profitable, with shares priced at $0.61 every.

Customers can then purchase “Sure” shares in the event that they consider Trump will win or “No” shares in the event that they suppose he’ll lose. If Trump wins, every “Sure” share will likely be value $1, yielding a revenue of $0.39 per share.

Conversely, if Trump loses, the “Sure” shares will change into nugatory. This dynamic permits customers to commerce their positions at any time earlier than the market resolves, enabling them to lock in earnings or reduce losses primarily based on evolving chances.

Technical Infrastructure & Reward Mechanism

Polymarket leverages Polygon to reinforce scalability and cut back transaction prices. This permits the platform to deal with a excessive quantity of trades with out congesting the Ethereum community or incurring prohibitive gasoline charges.

The platform offers builders with REST and WebSocket API endpoints for accessing market knowledge, costs, and order historical past. This permits the creation of third-party instruments and integrations.

Considered one of Polymarket’s novel options is its use of the UMA (Common Market Entry) Optimistic Oracle for market decision. The method works as follows:

- When a market is created, a decision request is distributed to the UMA Optimistic Oracle.

- Customers can suggest a decision to the request.

- A problem interval begins, permitting the proposed decision to be disputed.

- If disputed, the decision is submitted to UMA’s Information Verification Mechanism (DVM).

- UMA token holders vote to find out the right end result.

This decentralized method ensures that market outcomes are resolved pretty and transparently with out counting on a centralized authority.

Reward Mechanisms

Polymarket implements a number of incentive constructions to encourage liquidity and participation:

- Liquidity Supplier Rewards: Customers who place resting restrict orders close to the market midpoint are eligible for weekly rewards. This program goals to create a wholesome, liquid market by incentivizing balanced quoting and discouraging exploitative behaviors.

- Order Scoring Operate: Rewards are calculated utilizing a posh components contemplating components resembling market participation, two-sided depth, and unfold from the midpoint. Every market has a configured max unfold and minimal measurement cutoff for eligible orders.

- Weekly Distribution: Rewards are distributed on to makers’ addresses weekly, usually on Fridays at midnight ET.

- Market-Particular Rewards: The reward quantity is remoted per market, permitting for focused incentivization of particular occasions or classes.

- Extra Incentives: Polymarket often runs one-off public PnL/quantity competitions to stimulate buying and selling exercise additional.

Options and Benefits

Polymarket’s design provides a number of distinctive benefits:

- Actual-time Buying and selling: Customers can enter and exit positions anytime, permitting dynamic market participation.

- No Native Token Requirement: Not like some rivals, Polymarket doesn’t require customers to carry or earn a local platform token to take part.

- Self-Custodial Wallets: Customers keep management of their funds, enhancing safety and decreasing counterparty danger.

- Huge Vary of Markets: The platform helps markets on numerous matters, together with politics, sports activities, leisure, and extra.

- Scalability: By leveraging Polygon, Polymarket can deal with excessive transaction volumes with low charges.

- Clear Value Discovery: The continual double public sale mannequin offers exact, real-time chances for occasion outcomes.

Polymarket combines blockchain, aspect chain scaling, decentralized oracles, and revolutionary reward mechanisms to create a sturdy and environment friendly prediction market platform. Its design permits for real-time buying and selling, clear worth discovery, and honest market decision whereas incentivizing liquidity and participation.