A U.S. congressman has urged the federal authorities to briefly insure each financial institution deposit within the nation. Following the collapses of a number of main banks, he harassed that if the federal government doesn’t do that, there will likely be a run on smaller banks. “This can be a contagion that might be unfold throughout the whole banking system,” he warned.

Lawmaker Warns of Runs on Smaller Banks

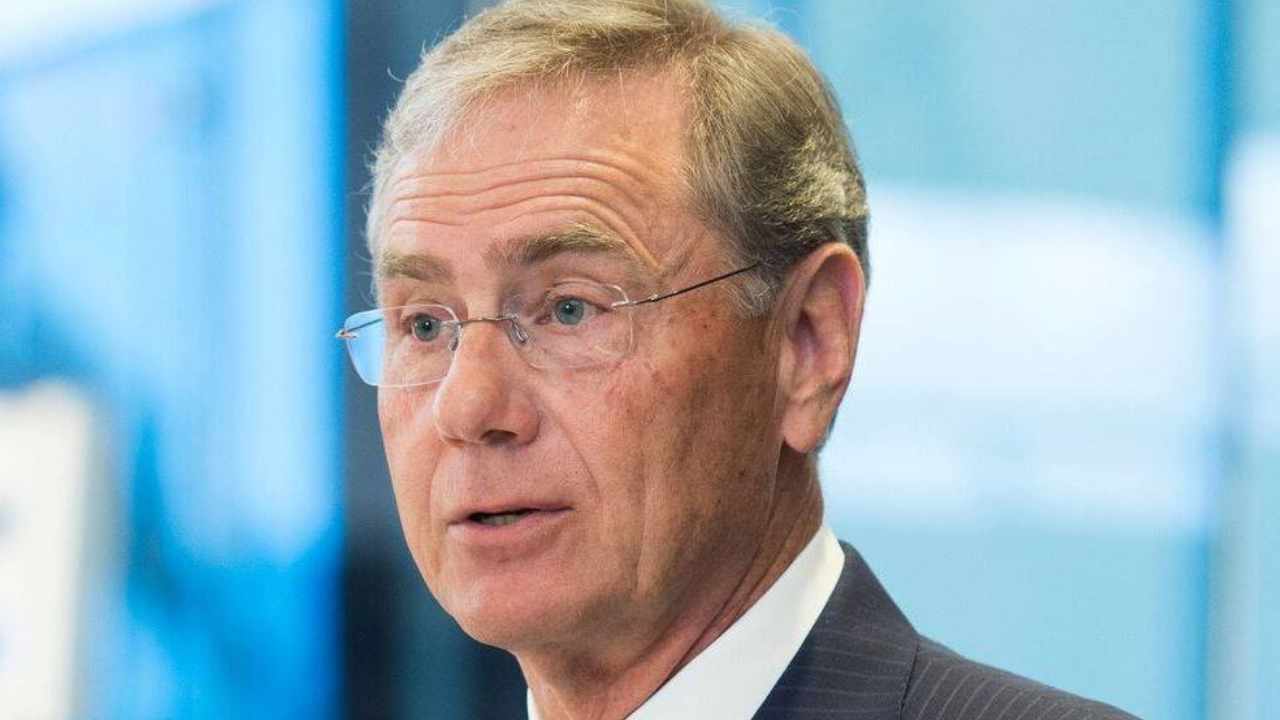

U.S. Congressman Blaine Luetkemeyer (R-MO), a former banker and a member of the Home Monetary Providers Committee, mentioned final week that the federal government ought to briefly insure each financial institution deposit within the nation.

His assertion adopted the collapses of a number of main banks, together with Silicon Valley Financial institution and Signature Financial institution. To stop financial harm, the Biden administration and regulators assured all deposits on the two banks, even these exceeding the $250,000 Federal Deposit Insurance coverage Company (FDIC) deposit insurance coverage restrict.

Noting that increasing the deposit assure would “give the system confidence,” Luetkemeyer was quoted by Politico as saying:

For those who don’t do that, there’s going to be a run in your smaller banks … Everybody’s going to take their cash out and run to the JPMorgan’s and these too-big-to-fail banks, they usually’re going to get larger and all people else goes to get smaller and weaker, and it’s going actually be dangerous for our system.

“The thought course of right here is that this can be a contagion that might be unfold throughout the whole banking system if it’s not contained and if folks don’t cease and be calm about their evaluation of the scenario,” the congressman opined.

He instructed that the federal government may assure “each single deposit on this nation and each financial institution” for six to 12 months till the “rate of interest scenario [is] resolved and these banks get again on strong footing,” the information outlet conveyed. Nevertheless, the publication famous that the congressman later modified his place, and a spokesperson for him acknowledged that the assure might be in place for “maybe 30 to 60 days.”

On Friday, Peter Orszag, the CEO of economic advisory agency Lazard, shared an analogous view in an interview with CNBC. “Regional banks have relied on the enterprise mannequin that relied on uninsured deposits,” he mentioned, including:

Right here’s what must occur at this level: the federal government must make express what lots of people are assuming, which is that for the foreseeable future, uninsured deposits don’t exist. Every thing is insured.

Concerning whether or not doing so will result in an ethical hazard the place banks really feel they’ll “take exceptional dangers with depositors’ cash,” Orszag insisted: “I don’t suppose it would create an ethical hazard.” Whereas emphasizing that “There’s going to be much more regulation,” he famous: “You will see continued circulation of deposit focus.”

Whereas some folks, like Congressman Luetkemeyer and Orszag, have expressed the necessity for the federal authorities to ensure all deposits within the nation, Treasury Secretary Janet Yellen informed the Senate Finance Committee on Thursday that not all deposits will likely be assured. Nonetheless, she insisted that “our banking system stays sound.”

Do you suppose the federal authorities ought to assure all deposits? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

:contrast(5):saturation(1.16)/https%3A%2F%2Fprod.static9.net.au%2Ffs%2Fa521a821-8701-47e1-a6c6-ab251c2e75ff)