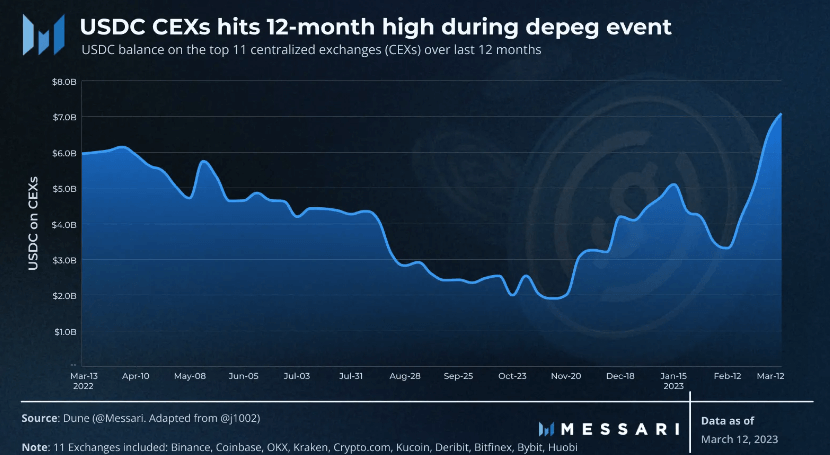

USDC obtainable on centralized exchanges has hit a 12-month excessive regardless of the current calamity surrounding the depeg occasion.

Coinbase was pressured to quickly halt USDC to USD conversions because of the deviation of USDC’s worth from its pegged value of $1.00.

As USDC demand plummeted, its worth dropped by a major 13% on March 11, hitting a low of $0.87 earlier than rebounding to $0.95-0.97 after Circle supplied assurances that redemption operations would normalize by March 13.

Nevertheless, it was not till the U.S. authorities made a public assertion confirming that each one SVB depositors could be reimbursed that the worth of USDC lastly skilled a full restoration, climbing as much as $0.99. This growth has alleviated issues amongst traders who had been beforehand apprehensive concerning the stability of USDC’s peg and supplied renewed confidence within the digital asset’s prospects.

Volatility within the Curve 3pool

DeFi exacerbated the volatility attributable to the depeg occasion, which was triggered by issues concerning the backing of USDC. The Curve 3pool, one of many largest USDC DEX swimming pools, assumes that each one three stablecoins inside it must be value $1.00 when one deviates from this peg. The concentrated liquidity mechanism and incentives result in additional value declines.

DAI additionally depegs

Elsewhere in DeFi, USDC was so trusted that protocols hardcoded $1.00 assumptions, akin to Maker’s peg stability module (PSM), which helps the DAI peg. Nevertheless, this led to Maker and DAI absorbing vital threat and volatility as arbitrageurs took benefit of value discrepancies, leading to over $2 billion of USDC being offloaded to the PSM and greater than doubling the USDC held by Maker.

Stablecoin provide

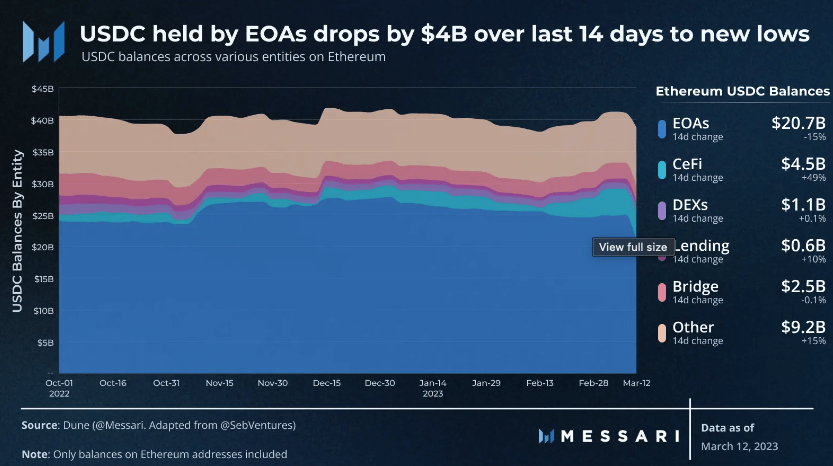

Ethereum, the main ecosystem for USDC, has a commanding maintain on the stablecoin with a $38 billion share of its $40 billion provide. Nevertheless, following the current USDC depeg occasion, Ethereum’s externally owned addresses (EOAs) have been divesting in droves, shedding over $4 billion of USDC and inflicting a brand new 12-month low stability held by EOAs.