The worth locked in decentralized finance (defi) protocols has misplaced 17.77% over the past 30 days, falling from $221.67 billion to at present’s $182.27 billion. Furthermore, statistics present the entire worth locked (TVL) throughout a broad vary of defi protocols shed vital worth over the last seven days.

Defi Protocols Shed Appreciable Worth

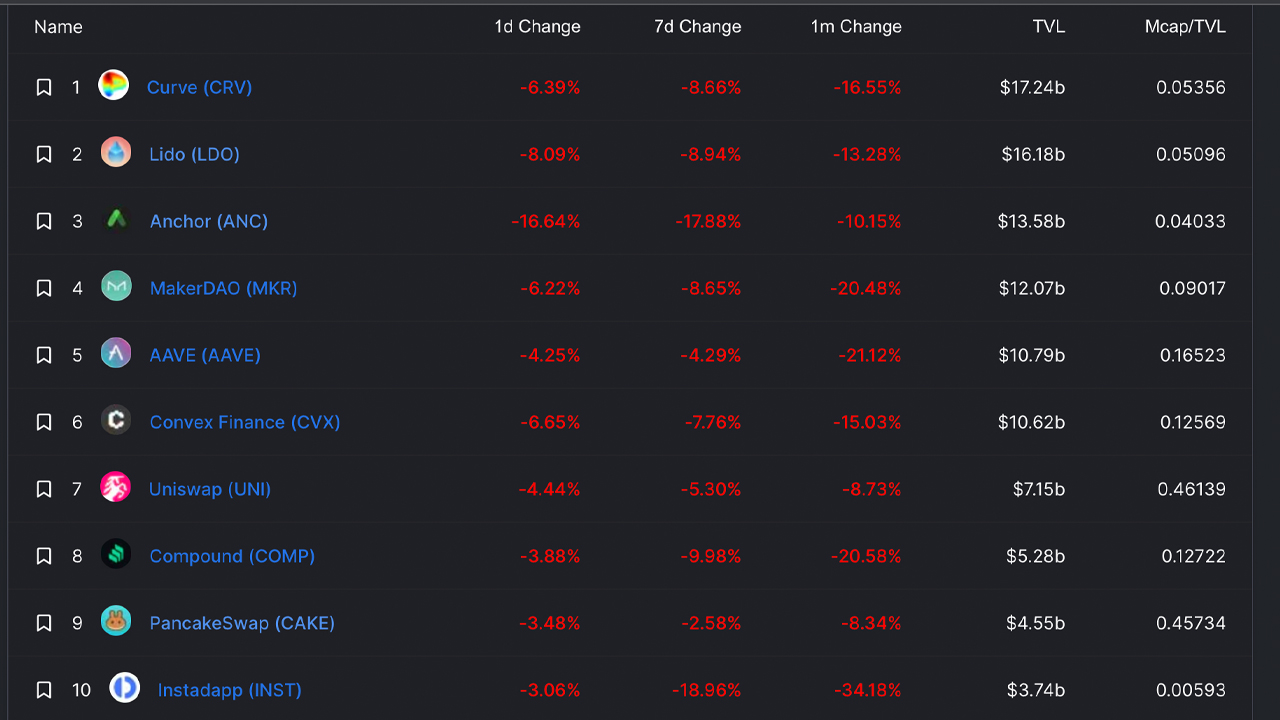

Decentralized finance (defi) protocols have misplaced numerous worth over the last month, as 17.77% has been shaved off the TVL in defi since April 8, 2022. The biggest defi protocol, by way of TVL measurement, Curve Finance, misplaced 16.55% this previous month, whereas Lido shed 13.28% in worth over the 30 day vary. Anchor’s TVL is down 10.15%, Makerdao has dipped by 20.48%, and Aave’s TVL has misplaced 21.12% this previous month.

Two protocols noticed substantial 30-day TVL features which embody Aave’s model three (v3) and Tron’s Sunswap protocol. Over the last 24 hours alone, the TVL in defi has slipped by 6.25% in worth, and the biggest protocol by TVL at present is Curve Finance. As of Sunday afternoon (ET), Curve’s $17.24 billion TVL at the moment dominates the combination by 9.46%.

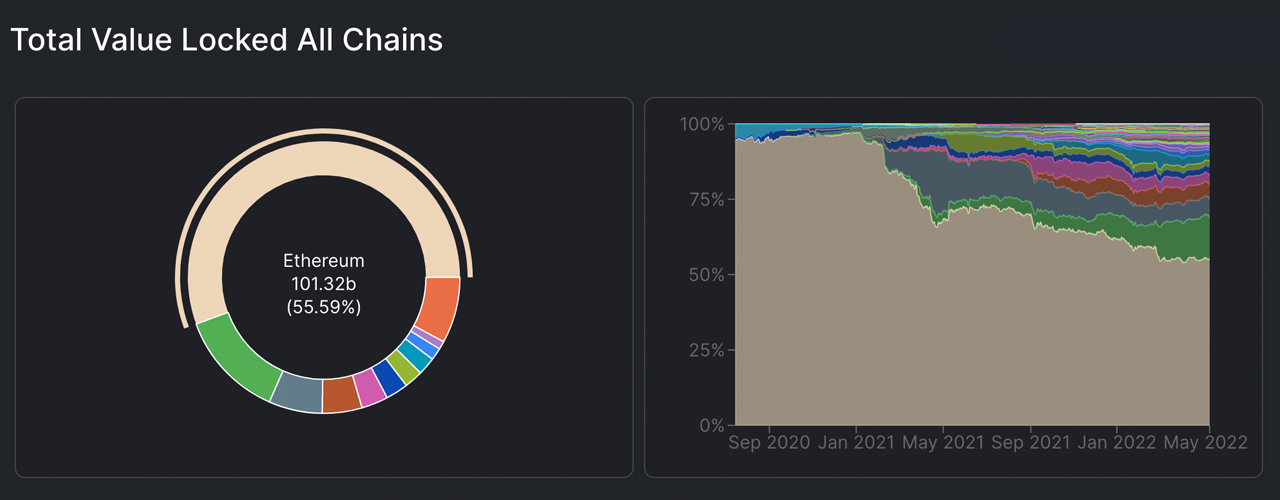

Ethereum nonetheless dominates the defi TVL by 55.59%, as $101.32 billion of the $182.27 billion TVL is held on the ETH chain. Terra is the second largest, by way of defi TVL, as Terra’s $23.44 billion represents 12.86% of the defi TVL mixture. Lastly, Binance Sensible Chain (BSC) is the third-largest blockchain in defi with 6.37% of the entire, which is roughly $11.6 billion at present.

By way of the highest good contract platforms with tokens by market capitalization at present, the complete lot is valued at $546 billion. Nonetheless, the highest good contract tokens have misplaced 6.1% in collective worth through the previous 24 hours. Though, tron (TRX) has managed to leap 5.3% larger over the last day.

One of many greatest losers at present, by way of good contract platform tokens, was counterparty (XCP), because the coin misplaced 19.4%. Terra (LUNA) was additionally an enormous proportion loser, shedding double digits over the last 24 hours, as LUNA misplaced 11.1% in USD worth at present. 30 day statistics additionally present that cross-chain bridge TVLs are additionally down 21.1%. There’s at the moment $16.78 billion TVL throughout a myriad of blockchain bridges.

The highest three rating cross-chain bridge TVLs at present embody Polygon, Avalanche, and Arbitrum respectively. The highest three crypto property leveraged on cross-chain bridges at present embody USDC, wrapped ethereum (WETH), and tether (USDT). Whereas the complete crypto economic system has misplaced 5.1% in worth over the past 24 hours all the way down to $1.65 trillion, it’s doubtless the worth locked in defi will comply with.

What do you concentrate on the most recent decentralized finance market motion? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.