Macro Overview

Financial institution of Japan makes an attempt to rescue the Yen

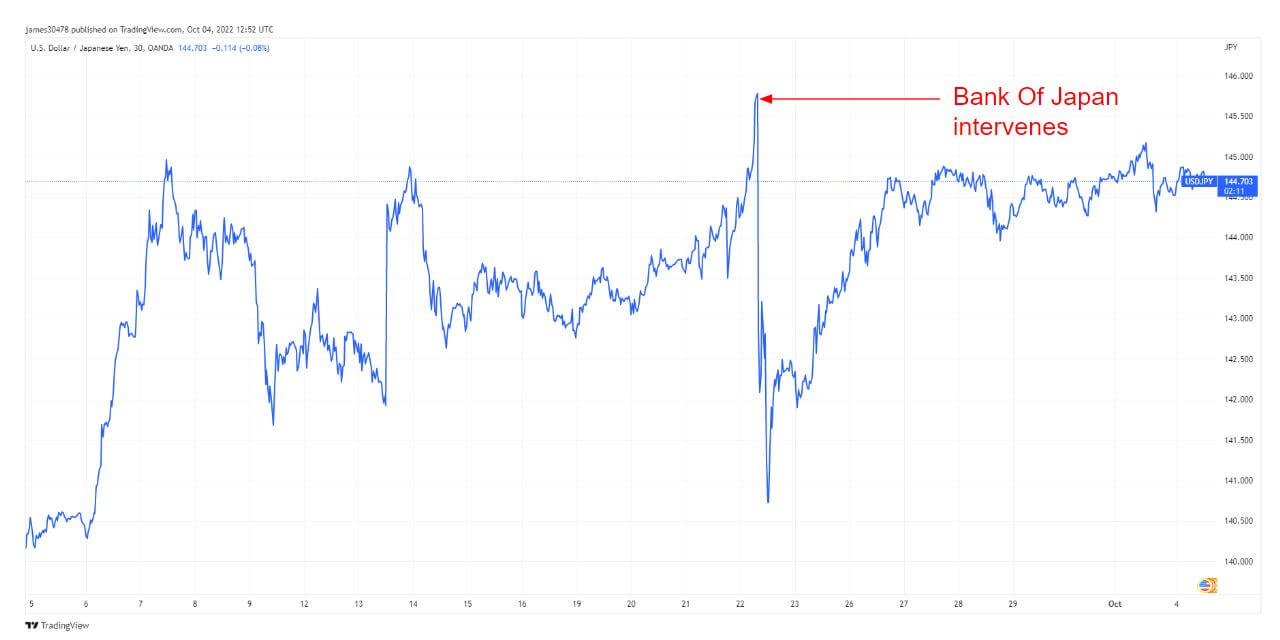

On Sept. 22, the Financial institution of Japan (BOJ) turned the primary central financial institution to intervene with their foreign money to stop a foreign money collapse by means of FX intervention. A couple of days later, the Financial institution of England turned the second financial institution to intervene.

Reuters reported that the BOJ spent as much as $20 billion to prop up the Japanese Yen, which was the primary fx intervention in nearly 25 years.

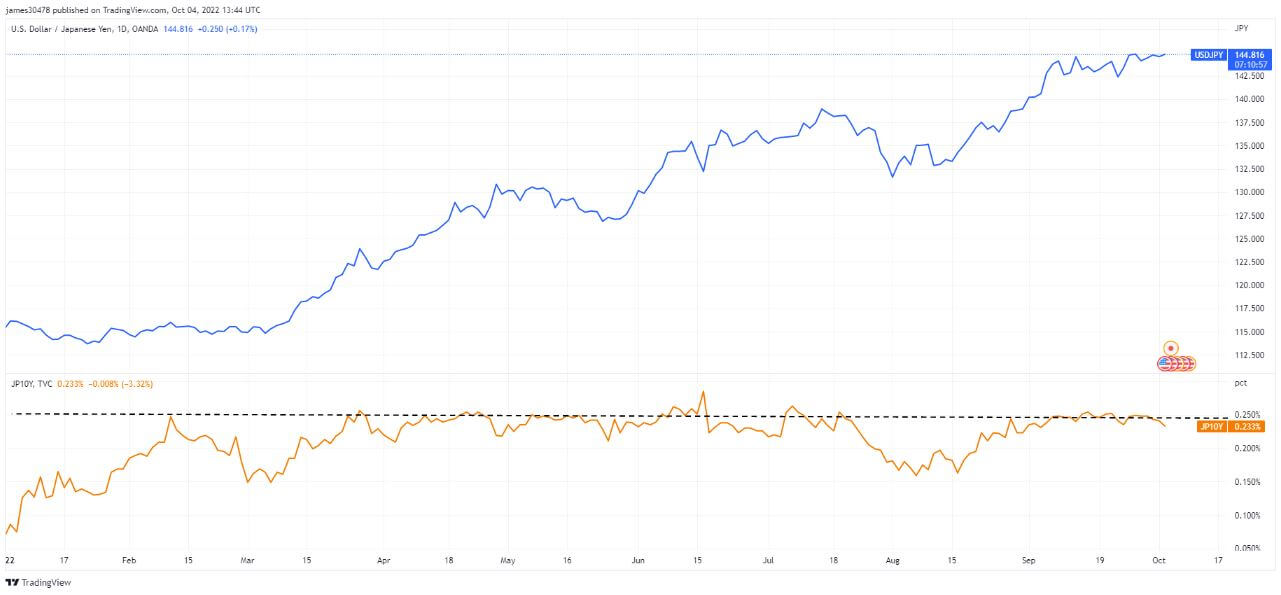

The yen was crashing in opposition to the U.S. greenback and briefly hit 146 to the greenback; after the intervention, the yen went all the way down to 140, a 4% drop. The $20 billion intervention price nearly 15% of the funds that the BOJ has accessible. Since Sept. 22, the yen has been creeping upwards and again at 145. What occurs if the yen breaches 146? Will the BOJ intervene as soon as once more?

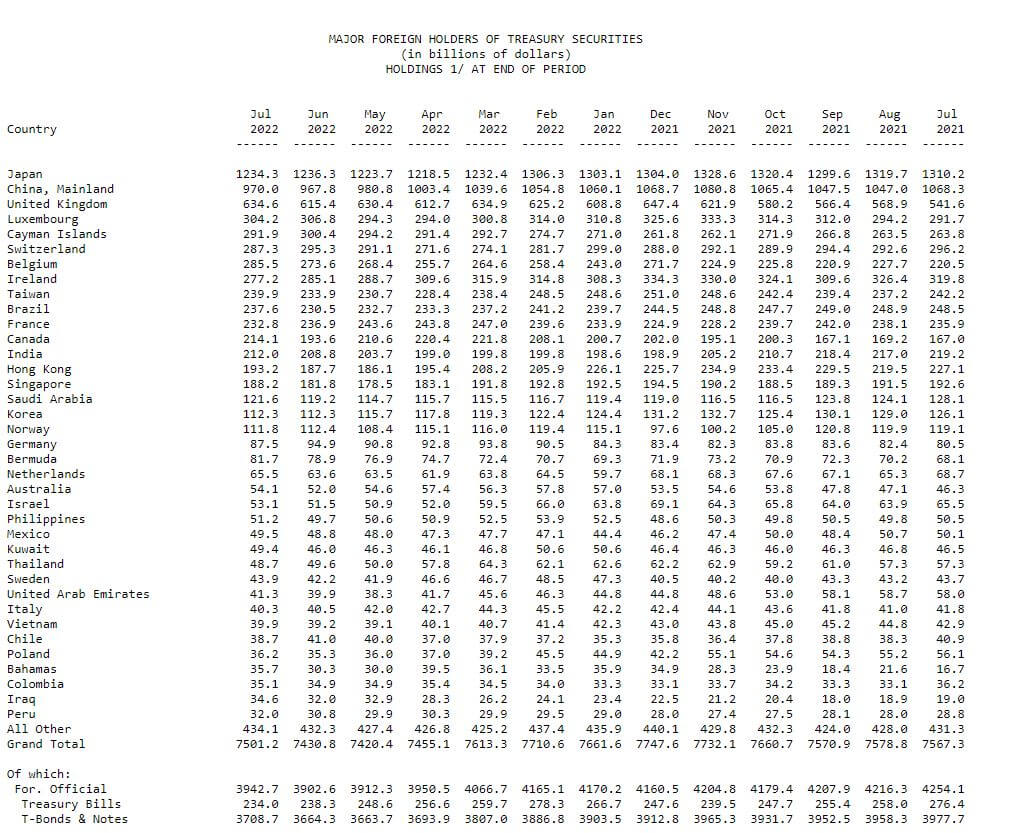

Japan holds roughly $1.2 billion in reserves and is the primary international holder of US debt; China is the second greatest holder, in keeping with the chief economist at Totan Analysis.

“Even when it have been to intervene once more, Japan seemingly wouldn’t should promote U.S. Treasury payments and as an alternative faucet this residue in the interim,” – Izuru Kato.

As soon as the deposits have been used, BOJ might be pressured to promote U.S. treasuries, immediately correlating with U.S treasury yields going greater (which is dangerous for U.S bonds). The most important international holders of treasury securities are Japan (17%) and China (12%), who personal 29% of all foreign-held US Treasuries and are accountable for 99% of 2022’s promote strain.

US treasury yields will quickly rise sharply as international governments promote USTs to get extra U.S. {dollars} to pay for greater power prices over the approaching months. As well as, to quantitative tightening from the federal reserve, which can be promoting treasuries, placing additional strain on yields.

As this is happening, the BOJ maintains its agency stance on its yield curve management, conserving its 10-year rates of interest at 0.25%; the Yen will act as a launch valve going greater and better in opposition to the united statesdollar.

Correlations

Bitcoin is one of the best horse within the race

Since Bitcoin’s inception, it has confronted criticism from all completely different angles. It’s solely utilized by criminals, has no intrinsic worth, makes use of an excessive amount of power, and many others. Nonetheless, whichever manner it’s checked out, Bitcoin has outperformed all conventional belongings, with a 2-year time horizon or longer.

A ratio used to measure threat and volatility is the Sharpe ratio. It’s a method to measure a return of an funding primarily based on threat and volatility over a selected interval. The chart under tracks the Sharpe ratio of BTC vs. conventional belongings throughout a two-year time horizon. It has included the typical of the 30-day U.S treasury invoice, which is benchmarked because the risk-free fee.

Bitcoin has made vital good points over the previous decade vs. USD, Gold, and S&P 500. The Sharpe ratio identifies if the returns are well worth the volatility to endure as an investor. The chart under reveals that holding BTC over an extended interval is well worth the volatility and notably has a a lot greater Sharpe ratio than different belongings.

Equities & Volatility Gauge

The Customary and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 massive firms listed on exchanges in the US. S&P 500 3,639 -0.62% (5D)

The Nasdaq Inventory Market is an American inventory trade primarily based in New York Metropolis. It’s ranked second on the listing of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Trade. NASDAQ 11,039 -1.15% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Traders use the VIX to measure the extent of threat, concern, or stress available in the market when making funding choices. VIX 31 -4.82% (5D)

Bear Market Rally

Oct. 3 and 4 noticed the S&P 500 rip 5.7% greater, one of the best two-day development since April 2020. Nonetheless, because of a powerful U.S. jobs report on Oct. 7, the S&P 500 has retraced greater than .618 of that acquire.

Equities have barely bounced from their year-to-date lows, with some information that the fed could also be nearing the tip of its mountain climbing schedule. Markets are forward-looking, and August noticed essentially the most vital month-to-month drop in U.S. job openings since April 2020, whereas Australia raised rates of interest by a smaller-than-expected 25 bps.

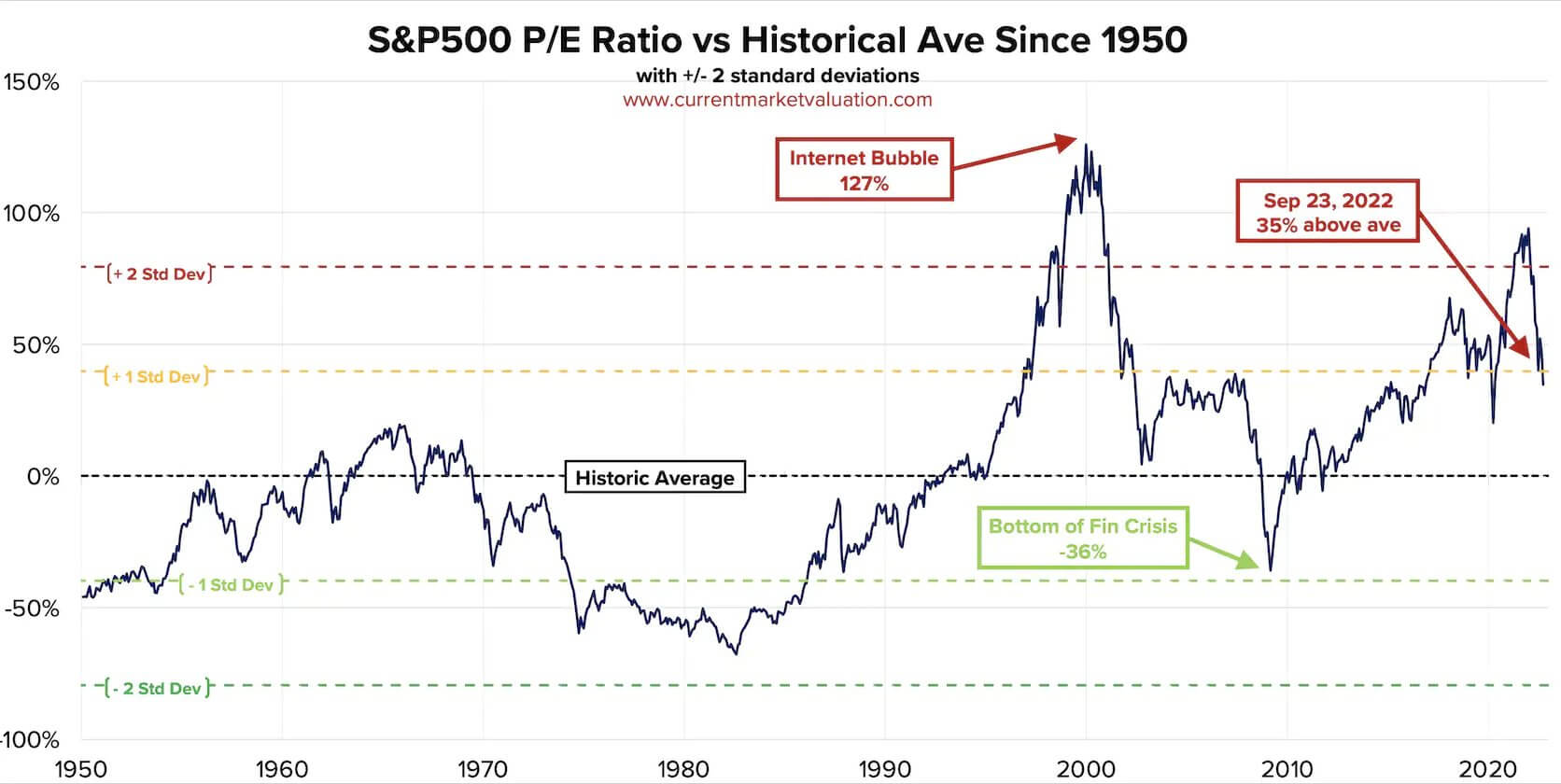

Nonetheless, the fairness market P/E ratio remains to be significantly overvalued when trying again on historical past. Presently, the market remains to be one normal deviation above the historic imply, coupled with essentially the most strong greenback in 20 years and credit score threat seeing new highs in 2022. Inflation remains to be operating riot, so additional ache is anticipated.

Commodities

The demand for gold is set by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the will to carry gold as a hedge in opposition to inflation and foreign money devaluation, all assist drive the value of the valuable metallic. Gold Worth $1,695 1.84% (5D)

Just like most commodities, the silver worth is set by hypothesis and provide and demand. Additionally it is affected by market situations (massive merchants or buyers and brief promoting), industrial, industrial, and client demand, hedge in opposition to monetary stress, and gold costs. Silver Worth $20 5.34% (5D)

The value of oil, or the oil worth, typically refers back to the spot worth of a barrel (159 litres) of benchmark crude oil. Crude Oil Worth $99 12.34% (5D)

Commodities are operating scorching

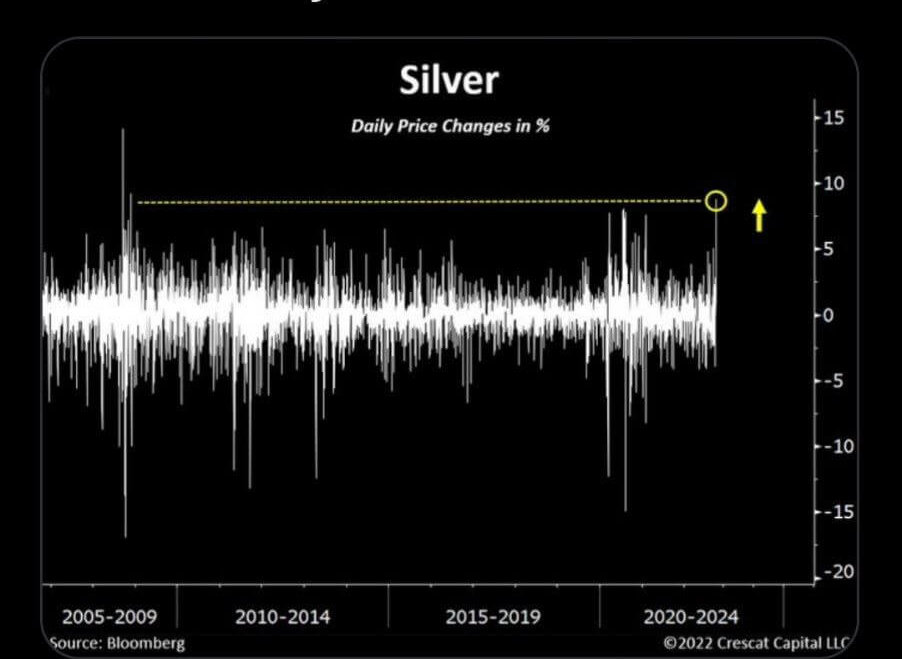

There appears to be an expectation that the fed is nearing the tip of its tightening schedule within the fund’s fee, whereas the U.N. is asking on the fed and different central banks to halt rate of interest will increase. This has seen a large rally in commodities, most notably silver. Silver was up over 7% on Oct. 3, and the final time silver was up as a lot as 7% was November 2008, which was the underside available in the market, and over the subsequent two years, it rallied over 400%.

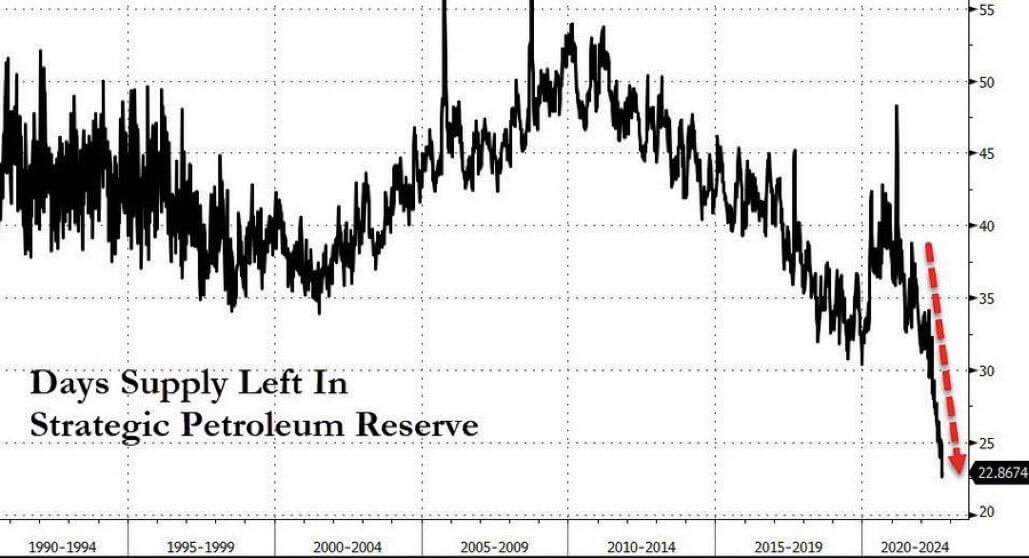

The place’s all of the petroleum reserve gone?

The US Strategic Petroleum Reserve is down -35% for the reason that begin of final 12 months, to ranges not seen since 1984. The 5 most important drawdowns in SPR historical past have occurred within the earlier 5 months, with September’s 34M barrels (-7.5%) being essentially the most important single draw ever.

After the OPEC+ and President Biden choice, the united stateswould have burnt by means of their Strategic Petroleum Reserve, with solely 23 days of provide left, to scale back oil costs forward of the mid-term elections.

Charges & Forex

The ten-year Treasury observe is a debt obligation issued by the US authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury observe pays curiosity at a hard and fast fee as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 3.88% 1.36% (5D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign currency. DXY 112.7 0.53% (5D)

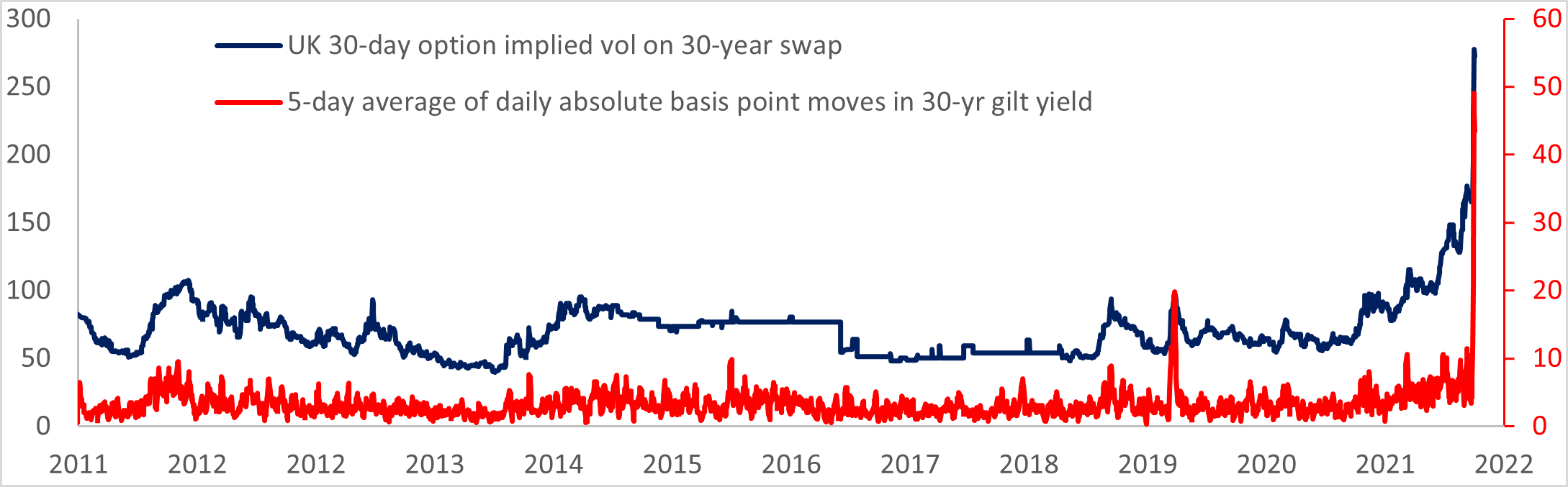

Critical market dislocation

Within the final week of September, lots of chaos occurred within the fixed-income market because the lengthy finish of the gilt curve was not the obvious place to discover a blow-up in extra derivatives publicity. In the UK, pension funds confronted margin calls that noticed the gilt market face pandemonium and a fast sale of gilts.

The BOE stepped in with a bailout (the place have we heard that earlier than?) that noticed the benchmark 30-year worth on the gilt bounce over 25%. The lengthy finish of the yield curve historically strikes round 5 foundation factors every day; the present volatility in charges resembles meme shares blowing up in the course of the mania of 2021.

The basic subject is the UK is experiencing nearly double-digit inflation with a BOE that’s refusing to tighten financial coverage meaningfully. Subsequently long-term inflation will keep elevated. As well as, the BOE was offloading gilts on their steadiness sheet; now, on the first signal of systematic threat, they’re shopping for once more whereas elevating rates of interest. The date to be careful for is Oct. 14, because the gilt gross sales will finish, however this might contribute to a a lot better rate of interest hike than first thought.

Bitcoin Overview

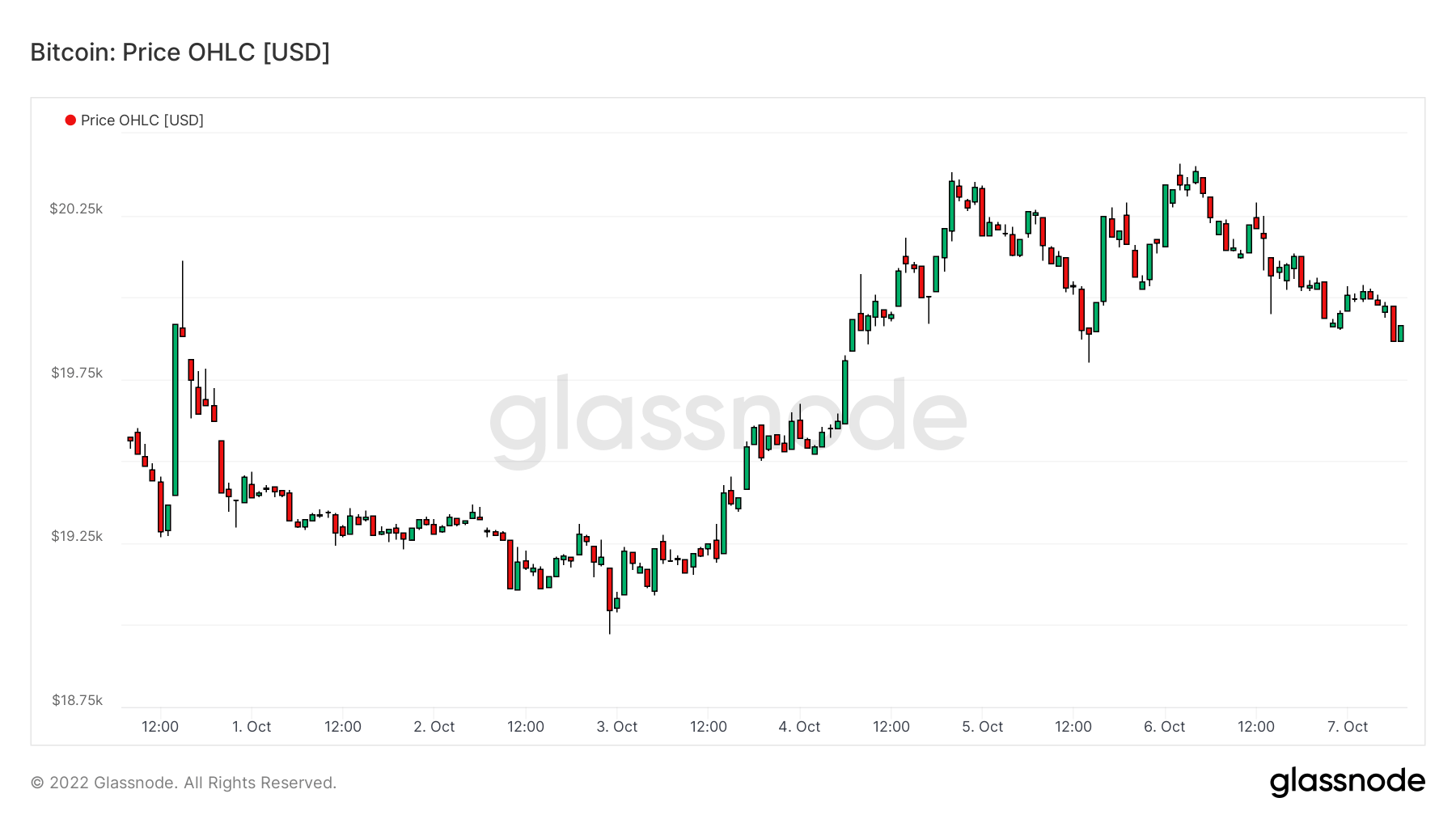

The value of Bitcoin (BTC) in USD. Bitcoin Worth $19,560 1.75% (5D)

The measure of Bitcoin’s whole market cap in opposition to the bigger cryptocurrency market cap. Bitcoin Dominance 41.28% 0.03% (5D)

- Hash fee hits all-time excessive – 248.64 EH/s

- Lightning capability surpasses 5k BTC

- Futures contracts denominated in BTC hit an all-time excessive

- Whales promoting BTC on the third most aggressive fee in historical past

- Shrimps proceed to stack amid macro uncertainty

- Asia commerce premium is at its highest level in 2022

Addresses

Assortment of core tackle metrics for the community.

The variety of distinctive addresses that have been lively within the community both as a sender or receiver. Solely addresses that have been lively in profitable transactions are counted. Lively Addresses 889,323 3.09% (5D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 2,856,153 2.94% (5D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 905,374 0.11% (5D)

The variety of distinctive addresses holding at the least 1k BTC. Addresses with Steadiness ≤ 1k BTC 2,117 -0.09% (5D)

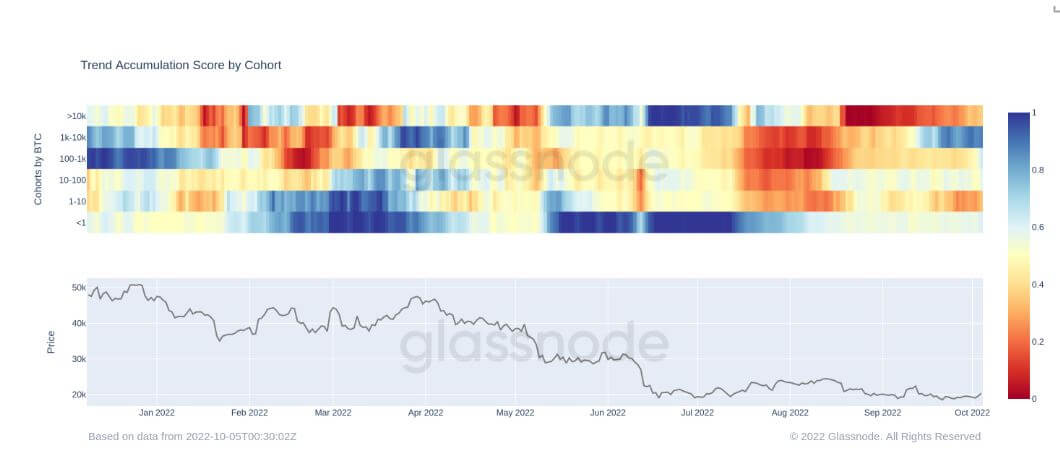

Heavy distribution from a variety of cohorts

This metric breaks down the Accumulation Development Rating into the relative habits of varied entity pockets cohorts.

The relative energy of the buildup for every entity steadiness is measured by each the dimensions of the entities and the quantity of cash they’ve acquired during the last 15 days. For extra particulars on calculation methodology, please see this Academy entry.

- A worth nearer to 1 signifies that members in that cohort are accumulating cash.

- A worth nearer to 0 signifies that members in that cohort are distributing cash.

- A listing of entities, together with exchanges and miners, is excluded from the calculation.

For the previous three months, from July to September, there was a comparatively small quantity of accumulation from many alternative cohorts. In July, shrimps and whales have been accumulating at one of the vital aggressive charges in historical past. Nonetheless, since then, all cohorts have began to be internet distributors.

As we enter a worldwide recession, liquidity dries up, and unemployment begins to spike. Bitcoin turns into essentially the most liquid asset to promote to pay for any debt obligations; on this atmosphere, it will be encouraging to see smaller cohorts at 0.5 to represent no distribution however holding onto their Bitcoin.

Entities

Entity-adjusted metrics use proprietary clustering algorithms to offer a extra exact estimate of the particular variety of customers within the community and measure their exercise.

The variety of distinctive entities that have been lively both as a sender or receiver. Entities are outlined as a cluster of addresses which might be managed by the identical community entity and are estimated by means of superior heuristics and Glassnode’s proprietary clustering algorithms. Lively Entities 275,303 -0.88% (5D)

The variety of BTC within the Goal Bitcoin ETF. Goal ETF Holdings 23,596 0% (5D)

The variety of distinctive entities holding at the least 1k BTC. Variety of Whales 1,686 -0.41% (5D)

The whole quantity of BTC held on OTC desk addresses. OTC Desk Holdings 3,975 BTC 31.62% (5D)

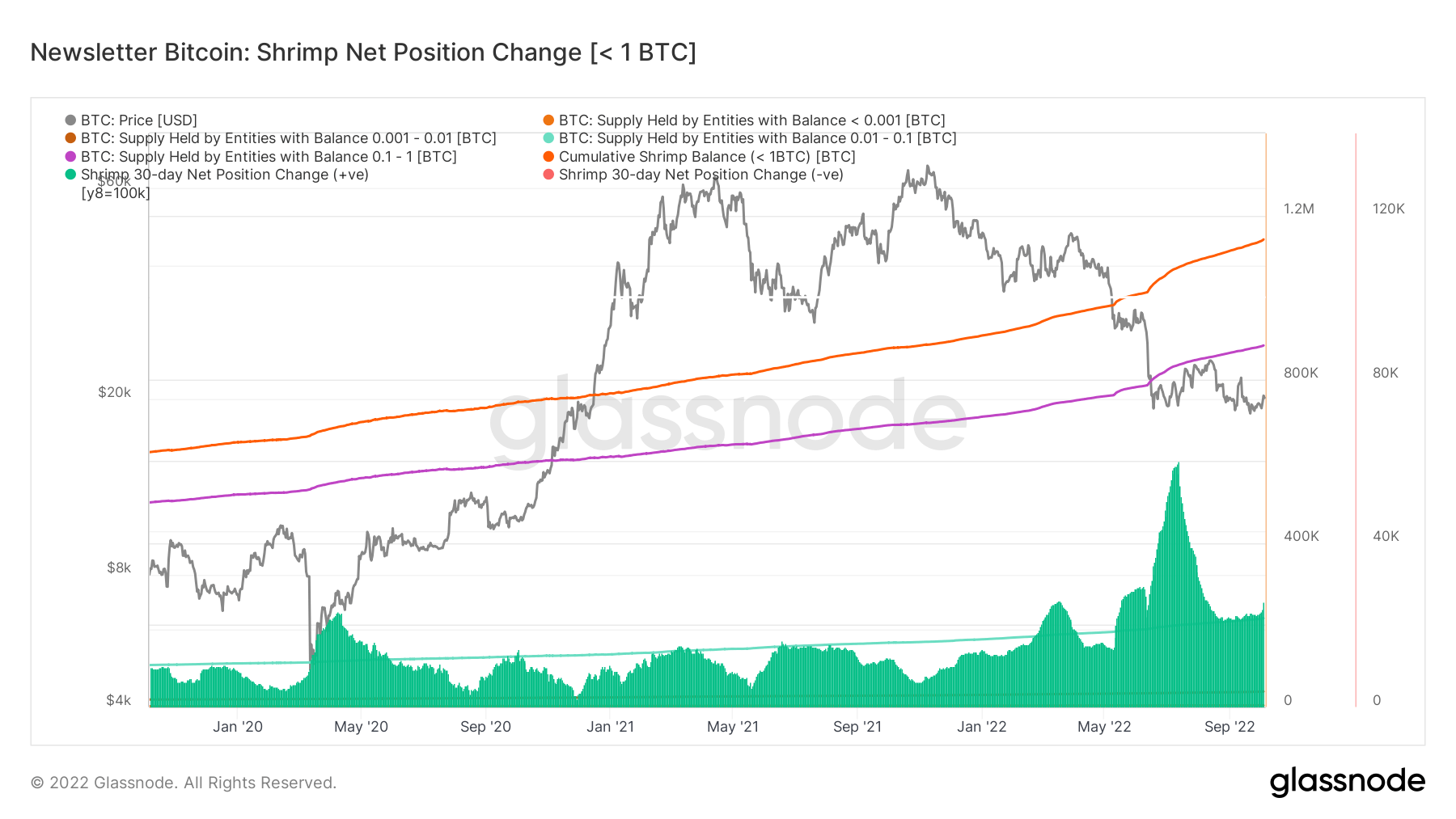

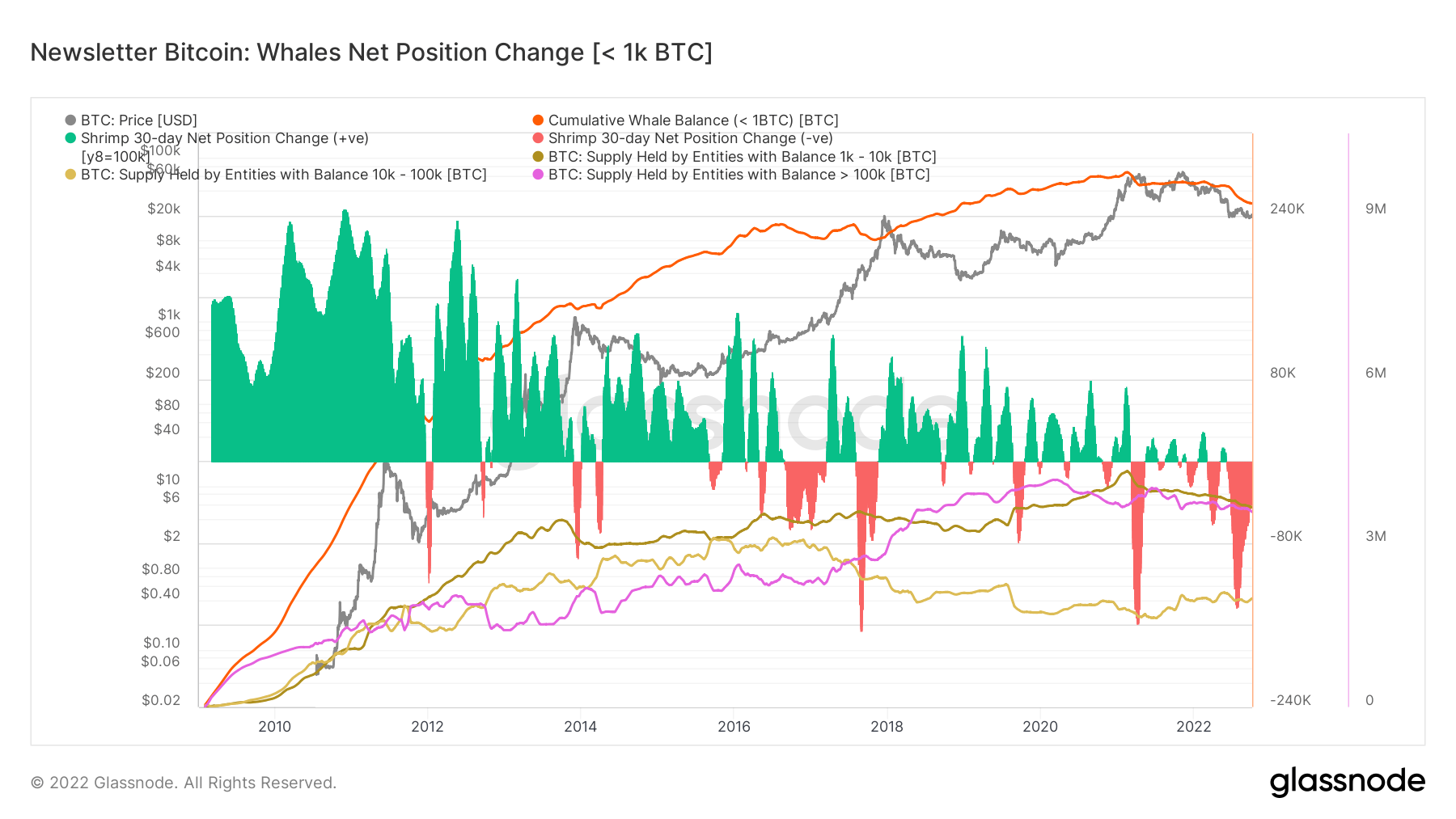

Whales vs. shrimps

An additional deep dive into whale and shrimp holdings might be summarized under. Shrimps are a cohort when you maintain one or much less Bitcoin, and their holdings have risen since covid dramatically. The 30-day internet place change has all the time remained constructive, exhibiting that this cohort accumulates greater than they distribute and has elevated their bullishness as time passes.

Nonetheless, whales holding 1K BTC or extra have been on a distinct journey. They’re thought of the good cash of the ecosystem, and in the course of the 2017 and 2021 bull run, they distributed essentially the most BTC reaping huge quantities of revenue. Presently, they’re in one among their most prolonged promoting durations on the third most aggressive quantity, and contemplating BTC is buying and selling for round $20,000, it doesn’t bode nicely within the brief time period.

Dervatives

A spinoff is a contract between two events which derives its worth/worth from an underlying asset. The commonest kinds of derivatives are futures, choices and swaps. It’s a monetary instrument which derives its worth/worth from the underlying belongings.

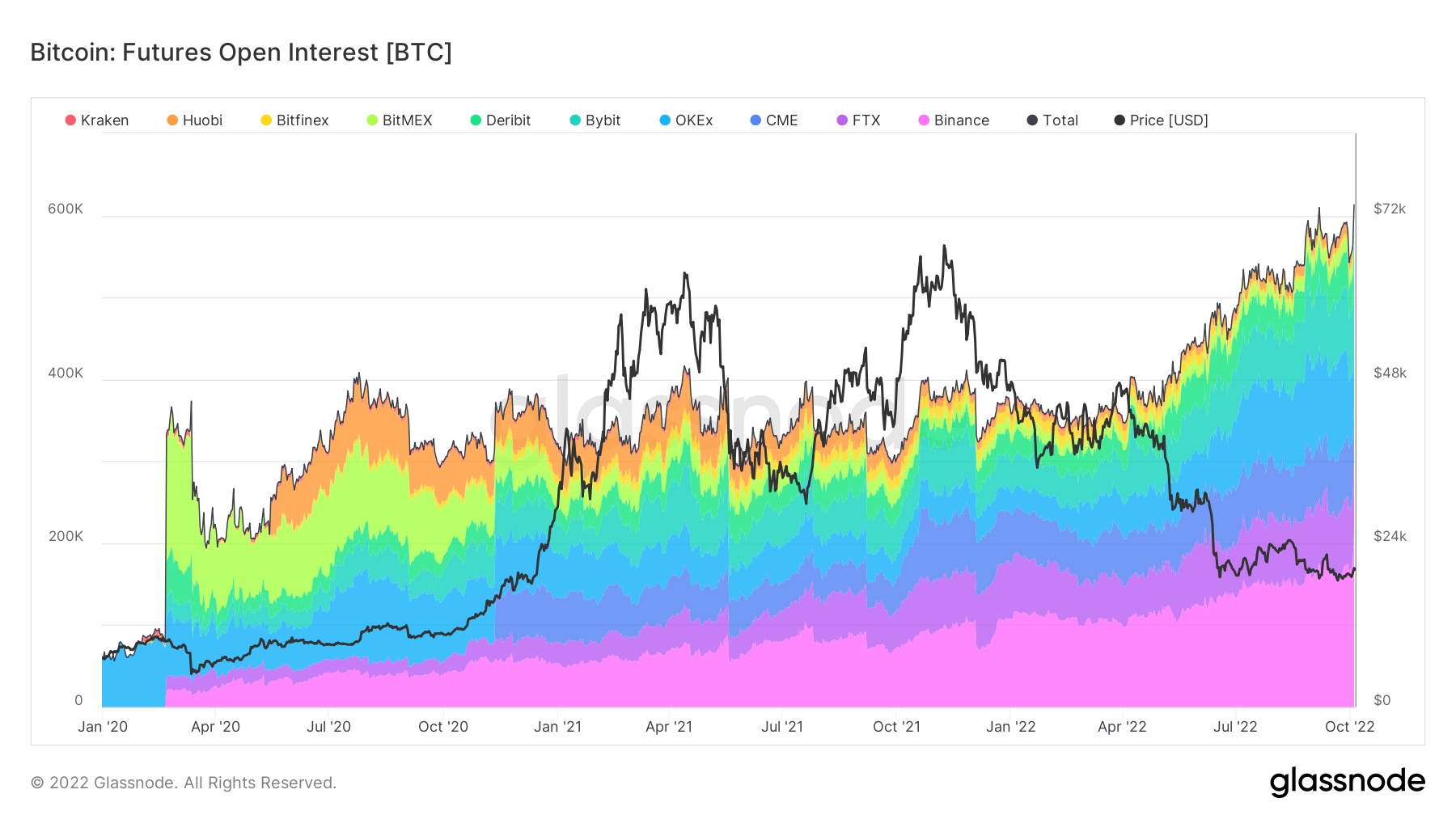

The whole quantity of funds (USD Worth) allotted in open futures contracts. Futures Open Curiosity $12.05B 5.94% (5D)

The whole quantity (USD Worth) traded in futures contracts within the final 24 hours. Futures Quantity $34.38B $-26.09 (5D)

The sum liquidated quantity (USD Worth) from brief positions in futures contracts. Complete Lengthy Liquidations $42.01M $0 (5D)

The sum liquidated quantity (USD Worth) from lengthy positions in futures contracts. Complete Quick Liquidations $42.01M $0 (5D)

Merchants piling into futures

Bitcoin surpassed $20k this week, with an enormous serving to hand in a rally in equities however most grateful to merchants piling into futures.

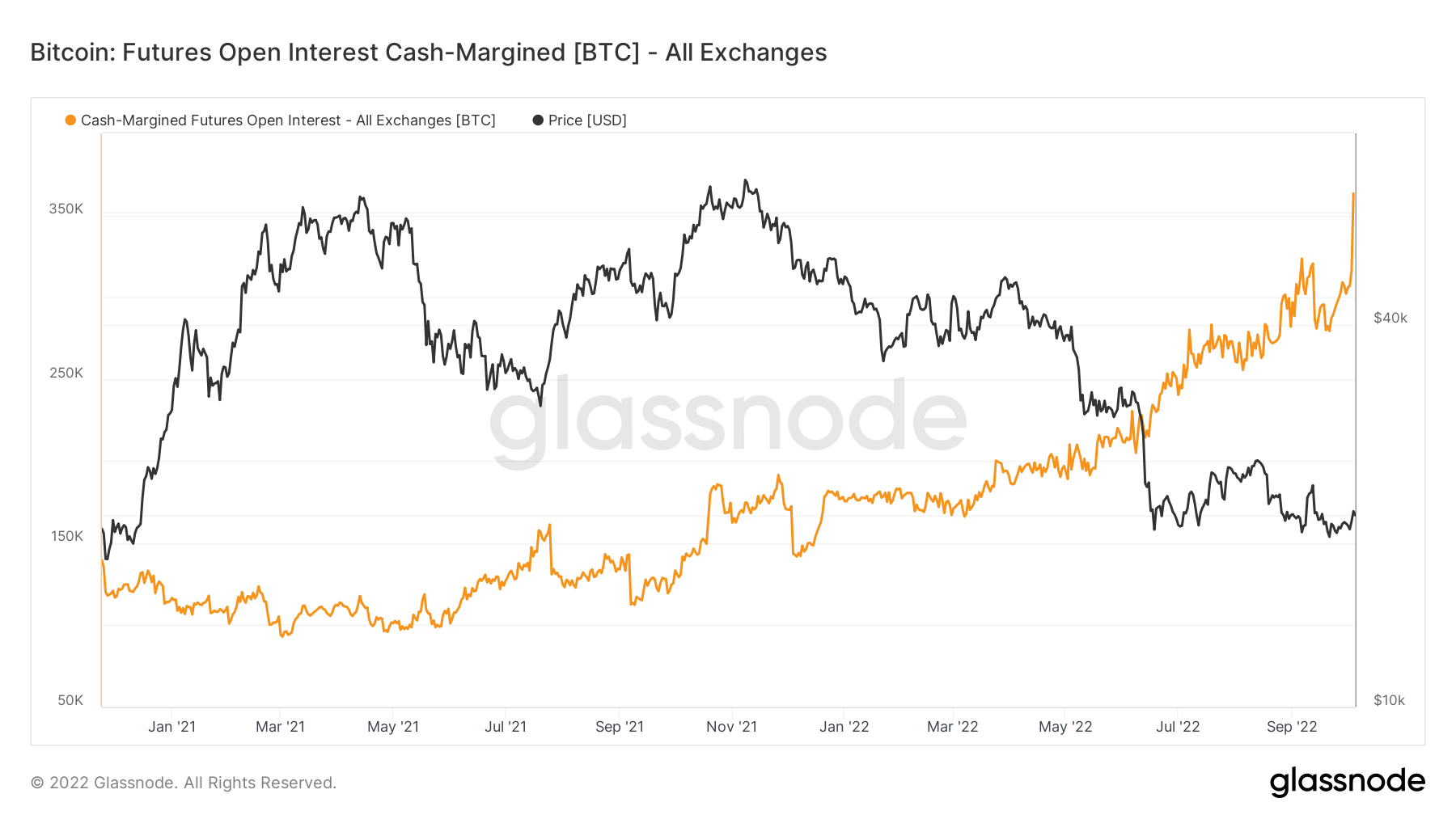

Futures open curiosity money margined is the entire quantity of futures contracts open curiosity that’s margined in USD or USD-pegged stablecoins. Stablecoins embody USDT and BUSD. On Oct. 4, it went to an all-time excessive, surpassing 350k, with little spot shopping for exercise occurring, which isn’t sustainable.

With open Curiosity increase, there’s potential for a liquidation cascade (on both shorts or longs) if the value deviates far sufficient from this vary. Roughly $450 million of Bitcoin open curiosity was opened above $19,500 worth ranges on Oct. 4 — assuming the bulk is aggressive longs are actually underwater.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

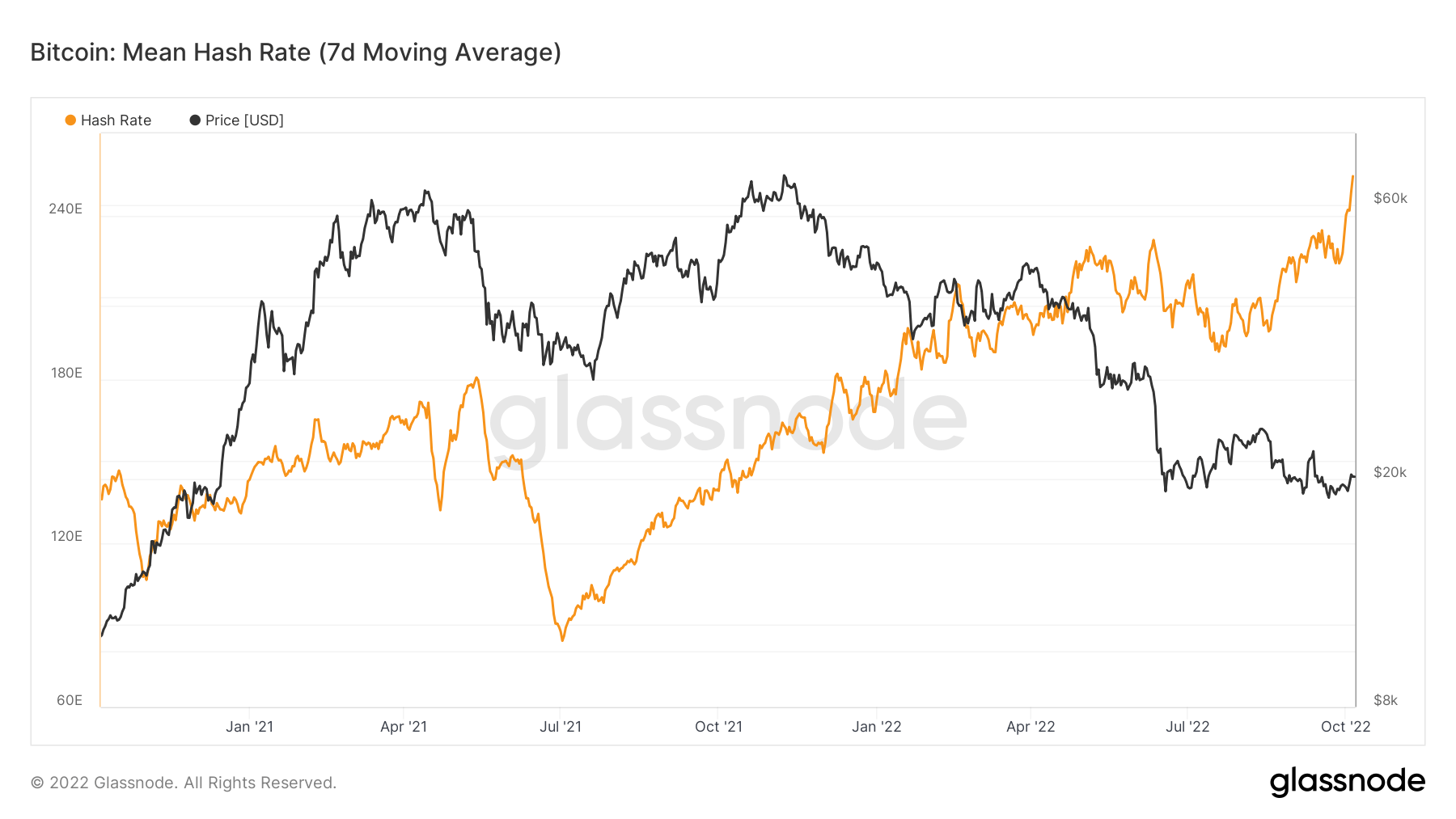

The typical estimated variety of hashes per second produced by the miners within the community. Hash Fee 273 TH/s 23.53% (5D)

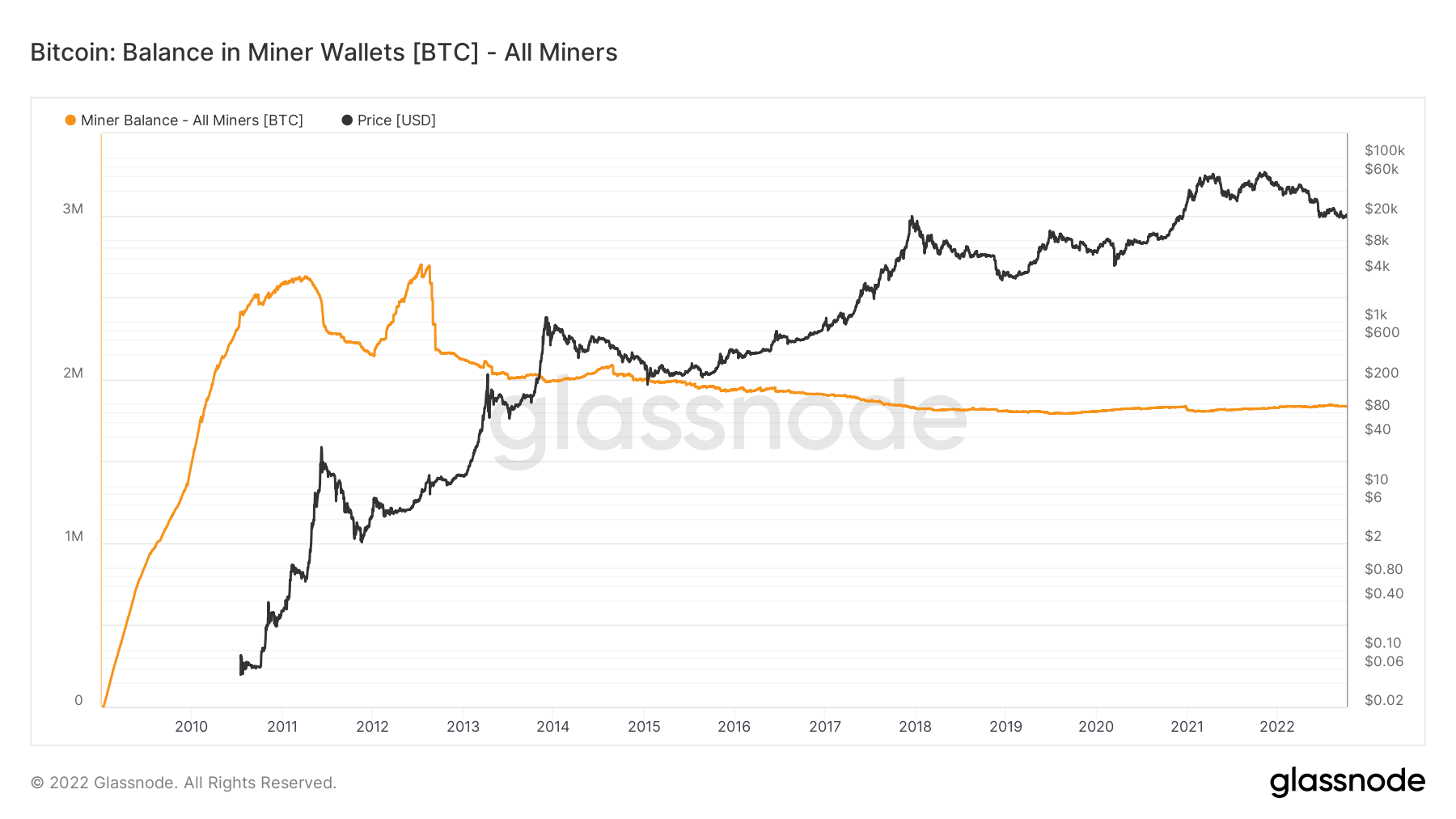

The whole provide held in miner addresses. Miner Steadiness 1,834,077 BTC -0.04% (5D)

The whole quantity of cash transferred from miners to trade wallets. Solely direct transfers are counted. Miner Internet Place Change -14,396 BTC 9,551 BTC (5D)

Proof of labor is the fairest consensus

Miner steadiness is at its lowest level in Bitcoin phrases since 2010. That is the facility that proof of labor offers, steadily creating an equal distribution of the foreign money throughout time.

Miner steadiness has seen massive outflows since costs have been rejected from the native prime of $24,500. This implies miner profitability remains to be below stress, as over 8k BTC have been bought in September to cowl USD-denominated prices.

Hash fee hits all-time excessive

Bitcoin’s hash fee has soared to new all-time highs of 248.64 EH/s, now 3X from the lows reached in the course of the China mining ban. With an anticipated issue adjustment of over 10% on Oct. 10, miners proceed to get squeezed by way of income, however the community is stronger than ever.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized trade exercise.

The whole quantity of cash held on trade addresses. Trade Steadiness 2,382,098 BTC -31,430 BTC (5D)

The 30 day change of the provision held in trade wallets. Trade Internet Place Change 281,432 BTC -325,248 BTC (30D)

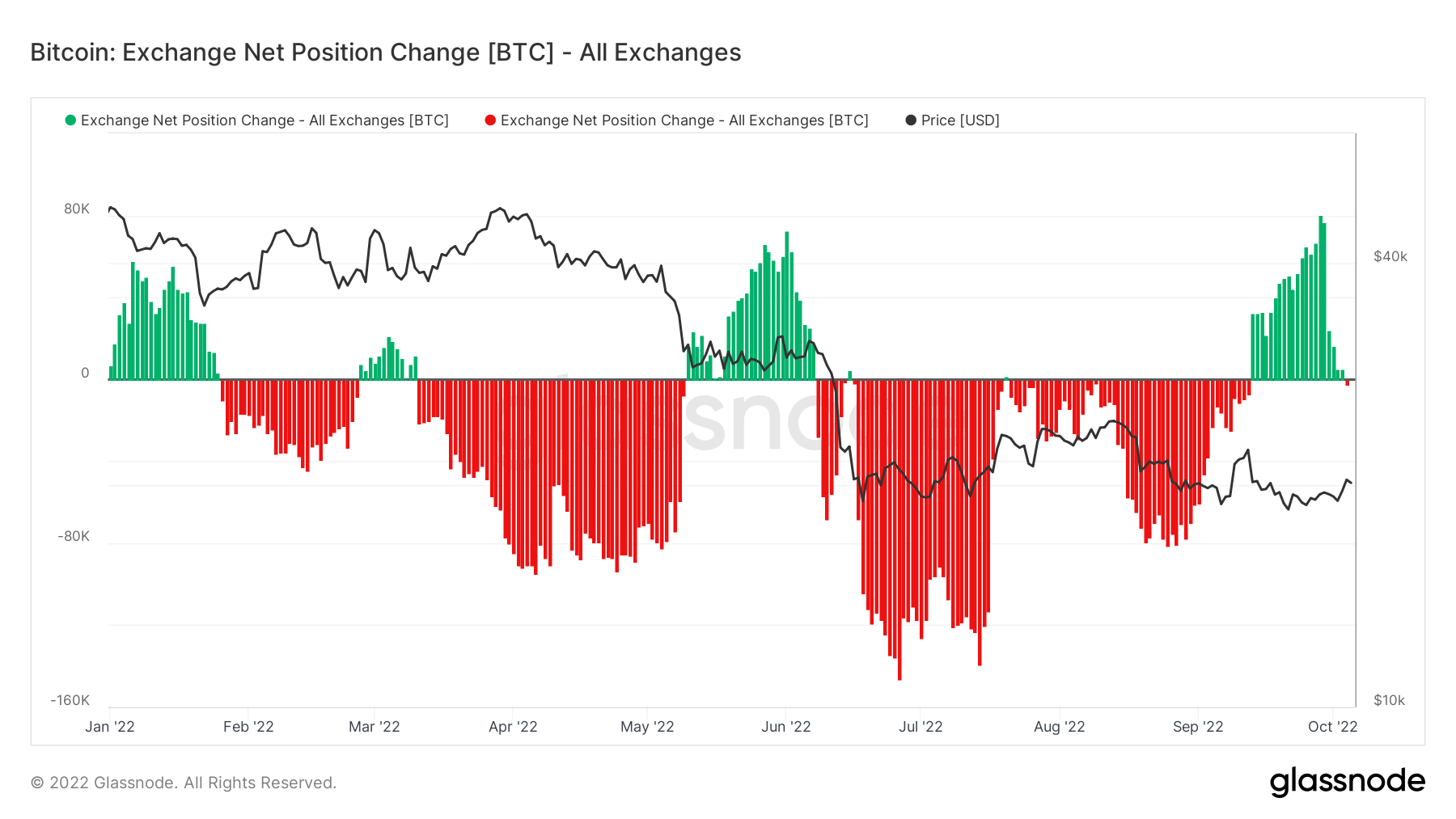

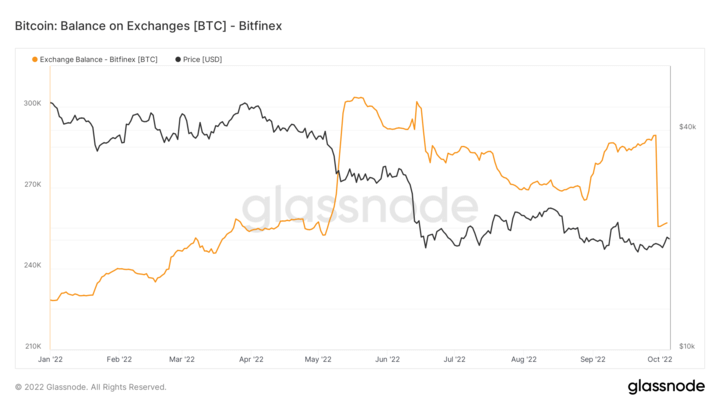

Outflows from exchanges, first time in nearly a month

2022 has seen durations of inflows and outflows from exchanges, and searching on the metric trade internet place change; it’s simple to know buyers’ rationale.

When the Russian invasion came about, the Luna collapse and the macro uncertainty being at excessive ranges in September all noticed durations of inflows to exchanges. Traders have been fearful and bought. Nonetheless, the opposite durations of 2022 have seen aggressive outflows. As many as 100k BTC have been leaving exchanges, which was bullish.

Bitfinex noticed a big quantity of BTC being withdrawn from their exchanges originally of October, over 30k BTC ($6 billion). This has contributed to decreasing inflows to exchanges over 30 days; for a extra constructive narrative, Bitcoin outflows want to stay to indicate investor urge for food remains to be there.

Geo Breakdown

Regional costs are constructed in a two-step course of: First, worth actions are assigned to areas primarily based on working hours within the US, Europe, and Asia. Regional costs are then decided by calculating the cumulative sum of the value modifications over time for every area.

This metric reveals the 30-day change within the regional worth set throughout Asia working hours, i.e. between 8am and 8pm China Customary Time (00:00-12:00 UTC). Asia 11,601 BTC -987 BTC (5D)

This metric reveals the 30-day change within the regional worth set throughout EU working hours, i.e. between 8am and 8pm Central European Time (07:00-19:00 UTC), respectively Central European Summer season Time (06:00-18:00 UTC). Europe -8,172 BTC 4,785 BTC (5D)

This metric reveals the 30-day change within the regional worth set throughout US working hours, i.e. between 8am and 8pm Japanese Time (13:00-01:00 UTC), respectively Japanese Daylight Time (12:00-0:00 UTC). U.S. -5,466 BTC 4,756 BTC (5D)

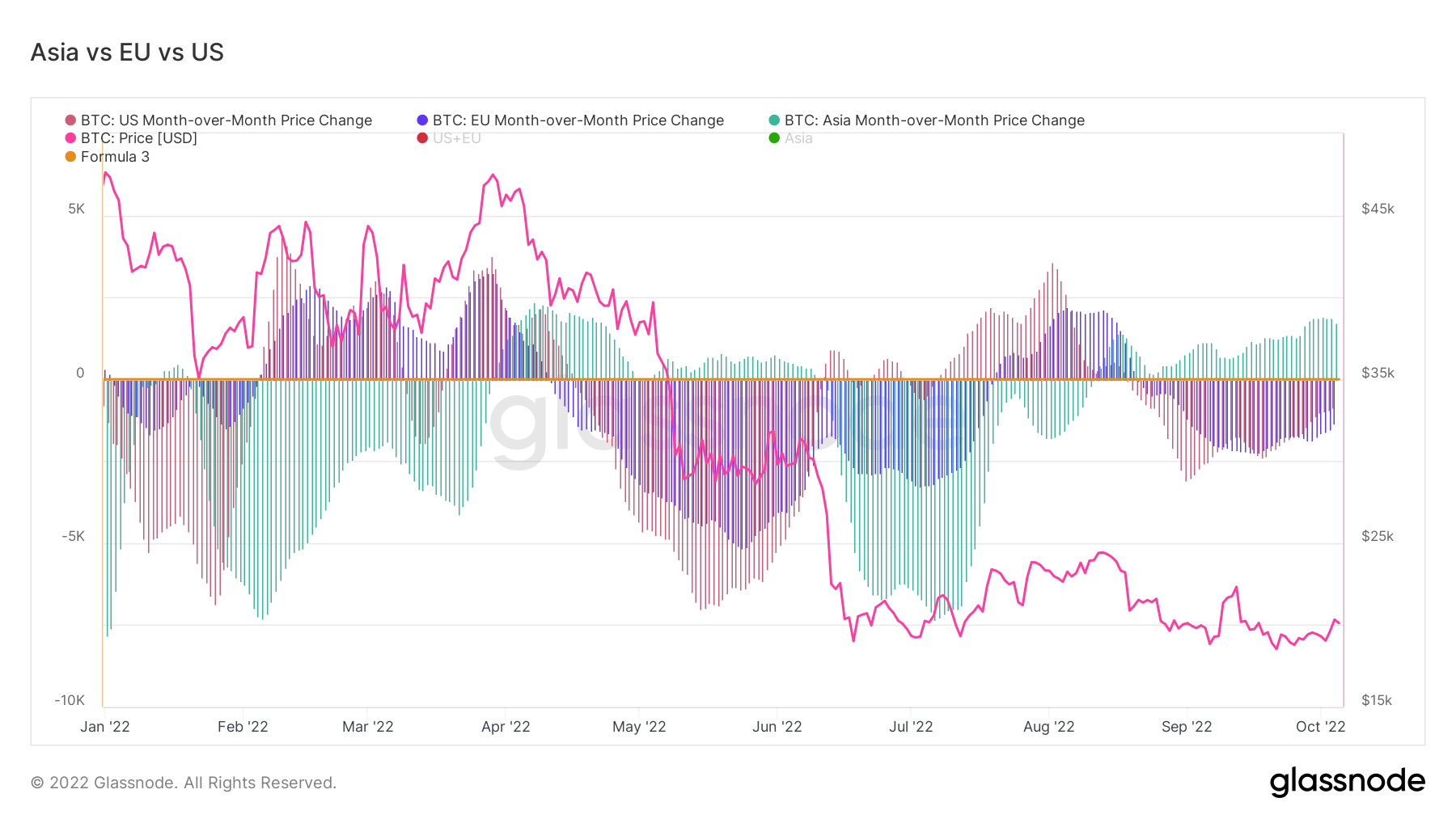

Asia commerce premium approaching 2022 highs

For the previous three months, CryptoSlate has been addressing that Asia is the good cash of the BTC ecosystem over the EU and the US. Asia purchases BTC when the value is low or being suppressed, which is exactly what has been taking place for the final three months; Asia’s bullishness has solely elevated, however the EU and US proceed to be in concern and promote their BTC holdings.

Provide

The whole quantity of circulating provide held by completely different cohorts.

The whole quantity of circulating provide held by long run holders. Lengthy Time period Holder Provide 13.73M BTC 0.27% (5D)

The whole quantity of circulating provide held by brief time period holders. Quick Time period Holder Provide 3.01M BTC 0.04% (5D)

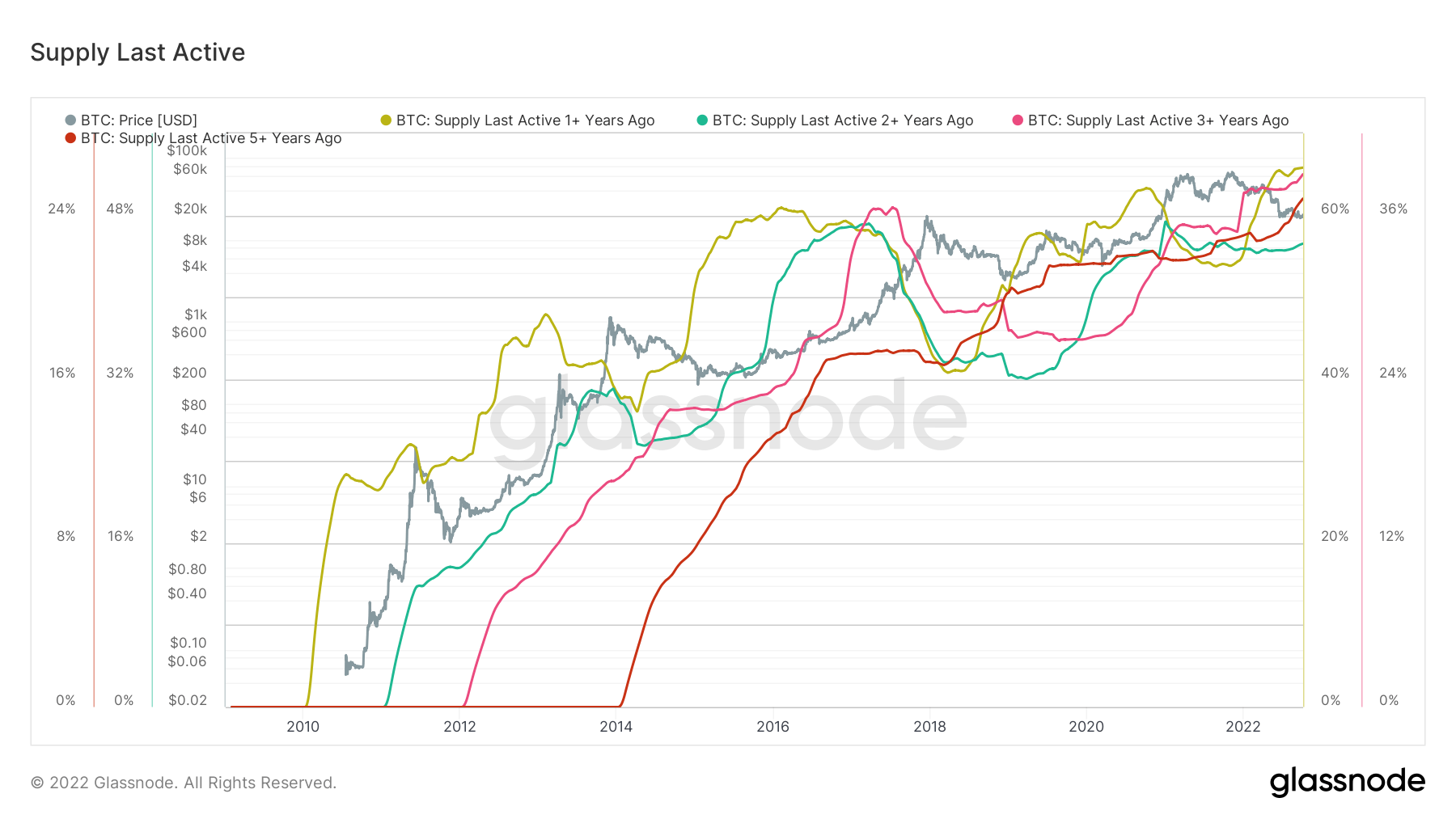

The % of circulating provide that has not moved in at the least 1 12 months. Provide Final Lively 1+ Yr In the past 66% 0% (5D)

The whole provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Provide 14.82M BTC 0.27% (5D)

Diamond arms continue to grow

The % of circulating provide that has not moved in at the least one 12 months is 66%; that is an all-time excessive. Sure, the quantity has plateaued, but it surely’s encouraging to see that it’s holding these excessive ranges. Many of the holdings can be considerably underwater as we method the time Bitcoin hit nearly $69,000 in November 2021.

As well as, provide final lively 2,3 and 5 + years are additionally trending to all-time highs. Holders refuse to promote and maintain onto their belongings throughout essentially the most unstable and unsure occasions.