Welcome to The Interchange! When you acquired this in your inbox, thanks for signing up and your vote of confidence. When you’re studying this as a put up on our website, join right here so you’ll be able to obtain it instantly sooner or later. Each week, I’ll check out the most well liked fintech information of the earlier week. This may embrace every part from funding rounds to developments to an evaluation of a specific house to sizzling takes on a specific firm or phenomenon. There’s quite a lot of fintech information on the market and it’s my job to remain on high of it — and make sense of it — so you’ll be able to keep within the know. — Mary Ann

Regardless of the financial turbulence of the previous 12 months, I believe it’s secure to say that many people didn’t see the sudden full-on implosion of Silicon Valley Financial institution coming. Whereas we may have guessed the storied monetary establishment was struggling, we didn’t anticipate that it might shut down so quickly after saying mentioned struggles. The impression of this occasion can be extreme, widespread and — for worry of being dramatic — probably catastrophic for a lot of. Already, companies are frightened about making payroll, which may result in unanticipated closures and layoffs. As one VC put it: “It’s unhealthy.” Our hearts exit to all impacted.

Natasha Mascarenhas and I talked to a number of rivals within the house and unsurprisingly, they’re seeing a ton of elevated demand. You possibly can learn all about that right here. We additionally teamed up with different TC employees and talked to a number of founders who financial institution(ed) there to get their views.

Outdoors of TC’s a number of (and fabulously reported, if I could add) tales on the subject, which you’ll find bundled right here, there may be another chatter I’ve heard associated to the information:

- One fintech investor advised me that he’s conscious of a single firm that moved over $80 million out of Silicon Valley Financial institution on Thursday.

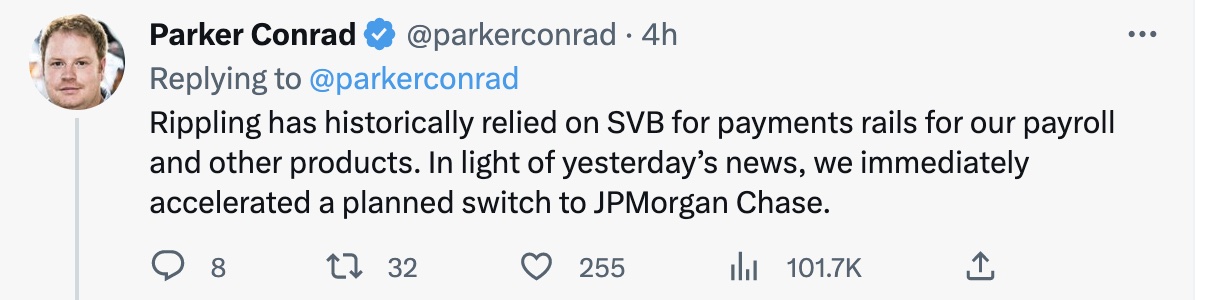

- Rippling co-founder and CEO Parker Conrad on March 10 tweeted that his firm had traditionally relied on SVB for funds rails for its payroll and different merchandise however in gentle of the information, “instantly accelerated a deliberate change to JPMorgan Chase.” Later that day, he added that his firm was not in a position to course of payroll for some firm’s staff and issued an apology, noting that whereas future payroll runs can be processed with JPMorgan Chase, any payroll funds processed for the day’s verify date “have been debited from shoppers earlier within the week,” and that the corporate was “at present caught with SVB, which is now in FDIC receivership.”

- In contrast to many different VCs encouraging corporations to maneuver their cash out of SVB, fintech-focused Restive Ventures’ Ryan Falvey urged individuals to “stay calm.”

- Some have speculated {that a} “bank run” in the end led to SVB’s demise.

- Brazilian fintech Hint Finance launched a brand new checking account for startups within the wake of the information. By way of e-mail, a spokesperson advised me on Friday that stability withdrawals totaling $200 million had been initiated from SVB by Hint Finance for the reason that information broke on Thursday, and that $100 million had already been moved from SVB and deposited in new checking accounts with Hint Finance. Prospects for the brand new checking account embrace Rocket.chat, Mercado Bitcoin, Rentbrella, The Espresso, and Gringo.

Observe: I had a very completely different intro deliberate in the present day based mostly on an excellent attention-grabbing dialog I had with a neobank founder however I’m going to avoid wasting that for one more day, as we’ve needed to bounce on the impression of Silicon Valley Financial institution’s shuttering on the startup and enterprise world.

Picture Credit: Twitter

Weekly Information

I carried out a survey of seven fintech traders: Charles Birnbaum, companion, Bessemer Enterprise Companions; Aunkur Arya, companion, Menlo Ventures; Ansaf Kareem, enterprise companion, Lightspeed Enterprise Companions; Emmalyn Shaw, managing companion, Flourish Ventures; Michael Sidgmore, companion and co-founder, Broadhaven Ventures; Ruth Foxe Blader, companion, Anthemis; Miguel Armaza, co-founder and normal companion, Gilgamesh Ventures. Not simply saying this as a result of I carried out the survey, however I used to be actually impressed with how detailed and considerate their solutions have been. Spoiler alert: B2B funds and infrastructure stay on fireplace and most traders anticipate to see extra flat and down rounds this 12 months. Plus, they have been gracious sufficient to share among the recommendation they’re giving to their portfolio corporations.

Whereas the general public market correction has been widespread, tech and fintech shares have seen the biggest declines, in accordance with a current report. Particularly, the Fintech Index — which tracks the efficiency of rising, publicly traded monetary expertise corporations — was down a staggering 72% in 2022, in accordance with F-Prime Capital’s State of Fintech 2022 report. After hitting a peak of $1.3 trillion in late 2021, the F-Prime Fintech Index slid to $397 billion by the tip of 2022. At present, the Fintech Index contains 55 corporations throughout B2B SAAS, funds, banking, wealth and asset administration, lending, insurance coverage and proptech. I dug DEEP on the subject right here.

Experiences Christine Corridor: “From the individuals who introduced you credit score monitoring companies now comes Credit score Karma Web Value, a brand new product to assist individuals know, develop and shield their wealth. The brand new function brings the 16-year-old firm nearer to changing into an end-to-end private finance administration platform, additionally providing debt, credit score constructing and checking and financial savings merchandise, Credit score Karma founder and CEO Kenneth Lin mentioned in an interview. As Credit score Karma members moved by their credit score journey of building credit score and getting their credit score rating in verify, they’re now fascinated by the following stage of their life: “monetary targets and outcomes, he mentioned.”

A follow-up to our Higher.com information from final week (a collaboration with the good Alex Wilhelm): Even when the Higher.com SPAC mixture closes, the transaction has been all however neutered from a money perspective. From the corporate’s pursuant SEC submitting: “About 92.6% of the corporate’s Class A abnormal shares have been redeemed and roughly 7.4% of the Class A abnormal shares stay excellent. After the satisfaction of such redemptions, the stability in Aurora’s belief account can be roughly $20,931,627.” Whereas the drop-dead date to go public through a SPAC is September 30, it can doubtless be obvious by summer season whether or not Higher.com will have the ability to transfer ahead with the transaction. A supply conversant in inner happenings on the firm advised TechCrunch that’s in all probability when the “loss of life spiral will start.” With no incoming fairness financing and sure no religion on the a part of collectors, the supply added, the corporate will almost definitely have to contemplate submitting for chapter by late 2023 or early 2024. CEO Vishal Garg advised The Data that extra layoffs and a down spherical could be within the firm’s future, too. In the meantime, a number of sources conversant in the background on Higher.com’s “settlement” with Amazon advised TechCrunch that the deal didn’t in actual fact signify a partnership between the 2 corporations. Moderately, Higher apparently introduced its new Fairness Unlocker instrument final week, and it rolled it out saying that it was initially solely obtainable to Amazon staff. The information was framed to indicate that there was some form of partnership cast between the 2, presumably to spice up Higher.com’s credibility.

In keeping with KPMG’s newest Pulse of Fintech report, the U.S. continued to drive fintech investments final 12 months, accounting for $61.6 billion throughout 2,222 offers throughout 2022, together with $25.2 billion within the second half of the 12 months. Seed-stage fintech offers noticed file funding as valuations of late-stage VC-backed corporations noticed vital downward stress, attracting a file $4.5 billion, up from 2021’s $3.4 billion. Says KPMG through e-mail: “We’re additionally seeing a continued deal with BNPL, AI choices/instruments, and M&A exercise remaining sluggish by the primary half of 2023.”

In the meantime, in accordance with PitchBook, enterprise fintech startups are capturing extra of the broader fintech VC pool. The corporate’s newest Rising Tech Analysis discovered particularly that international VC funding within the broader fintech house reached $57.6 billion throughout 2,747 offers in 2022, declines of 40.7% and 18.1% year-over-year, respectively. Inside the vertical, enterprise fintech startups raised 60.9% of capital from traders in comparison with their retail counterparts. In 2020, that quantity was 48.2% of capital.

Experiences Ingrid Lunden: “Startups are dealing with a second of reckoning within the present financial local weather, and in the present day one of many extra promising on the planet of fintech has cracked below the stress. Railsr, the U.Ok.-embedded finance startup previously referred to as Railsbank and as soon as value almost $1 billion, has been acquired by a shareholder consortium; and as a part of the deal, it’s going into administration in order that it will possibly proceed [operating] . . . because it restructures. The consortium, which trades below the identify Embedded Finance Ltd, contains earlier Railsr’s traders D Squared Capital, Moneta VC and Enterprise Capital. The corporate is just not disclosing the worth of the deal. It was valued, when nonetheless solvent, at round $250 million again in October 2022, so that’s one place to begin.”

In keeping with TC’s Tage Kene-Okafor: African fintech Moniepoint (previously referred to as TeamApt Inc), has appointed Pawel Swiatek as its chief working officer. Pawel joins the enterprise from Capital One, the place he served as managing vp for over 4 years. At Capital One, he was answerable for the financial institution’s monetary inclusion program. He was additionally a part of the administration workforce on the world’s largest hedge fund, Bridgewater. At Moniepoint, Swiatek’s expertise in monetary inclusion can be delivered to bear in constructing an execution working system, driving technique and execution by constructing insurance policies and instruments. Moniepoint provides fee, banking, credit score and enterprise administration instruments to over 600,000 companies and processes a month-to-month TPV of over $10 billion. The fintech is backed by Lightrock, Novastar and QED, the worldwide fintech investor whose managing companion Nigel Morris co-founded Capital One.

Funds large Stripe seems to nonetheless be attempting (onerous) to boost enterprise funding. Eric Newcomer reported final week that the corporate is now elevating 6 BILLION DOLLARS as an alternative of the $2 billion to $3 billion it was believed to be attempting to safe, in accordance with earlier studies. In keeping with Eric, Thrive Capital, Basic Catalyst, Andreessen Horowitz, and Founders Fund are taking part within the spherical together with Goldman Sachs non-public wealth shoppers. In the meantime, there was chatter on Twitter in regards to the firm’s choice to now not return a $15 dispute payment for efficiently contested disputes. In the meantime, there additionally appears to be some chatter about how FedNow, a real-time funds system that the Federal Reserve is rolling out within the subsequent couple of months, may impression Stripe negatively. Oh, and for one fintech observer’s opinions on why the corporate, regardless of its challenges, “can’t lose,” head right here.

Development tech startup Kojo is increasing into fintech. The supplies administration firm has launched a brand new Bill Matching product designed to assist contractors handle their spend, eradicate billing errors and simplify funds. Led by 31-year-old founder and CEO Maria Davidson, Kojo says it’s utilized by 11,000 development professionals throughout the nation. The corporate has raised greater than $84 million. TechCrunch lined its final increase right here.

Funding and M&A

Seen on TechCrunch

Indian fintech unicorn Slice acquires stake in a financial institution

Why unicorn Socure selected to take a $95M credit score facility

Fynn raises $36M for a platform to finance college students in vocational training

Synctera raises $15M to assist corporations launch embedded banking merchandise in Canada

Elyn barely delays on-line funds so you’ll be able to strive earlier than you pay

Open banking startup Abound nabs $601M to supercharge its AI-based shopper lending platform

Candidly picks up scholar debt reduction the place new US insurance policies go away off

And elsewhere

FilmHedge closes $5M Sequence A funding; $100M credit score facility

French fintech Aria baggage €50m debt facility

Brazilian B2B funds platform Barte raises $3M

SaaS fintech Growfin lands $7.5M

Tiger World leads $6.5M Monnai deal

Insurify to accumulate Evaluate.com

Okay, effectively, with that, I’m out of right here for now. Subsequent week is spring break for my household, so I can be largely out and the superb Christine Corridor can be taking on the e-newsletter for me. However I’ll be again for the March 26 version! Till then, take excellent care!! xoxo, Mary Ann