In a stunning flip of occasions, the approval of spot Bitcoin (BTC) exchange-traded funds (ETFs) has not yielded the anticipated instant upside affect on the Bitcoin value.

Opposite to expectations inside the crypto group, BTC has skilled a pointy drop of over 16% for the reason that ETF approval on Wednesday, January 11, dipping under the important thing $40,000 degree. The failure of BTC bulls to carry the assist degree has led to a testing part on the $38,000 degree, accompanied by a 4.5% value drop inside the previous 24 hours.

Bitfinex Whales Buck The Pattern

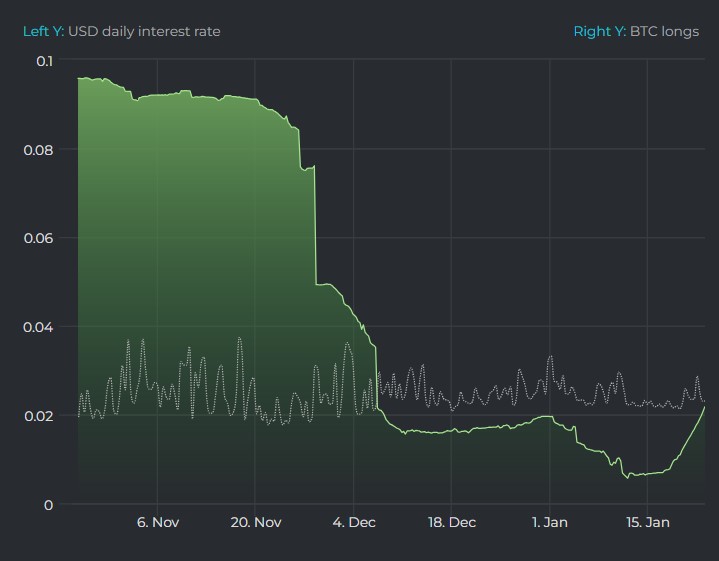

Amidst the market volatility, in accordance to Datamish, Bitfinex whales have accrued Bitcoin lengthy positions since November 2023. This accumulation of roughly 4,230 BTC since January 17 marks the primary sustained improve in Bitfinex BTC lengthy positions following a sharp decline in November final yr.

Nevertheless, the latest downturn within the BTC value could be partly attributed to elevated promoting stress from miners and asset supervisor Grayscale. Grayscale has notably elevated its BTC sell-off for the reason that ETF buying and selling commenced.

Transferring a major quantity of BTC from the Grayscale Belief tackle to Coinbase, totaling 69,994 BTC ($2.9 billion), has influenced the market dynamics.

Moreover, stories point out substantial sell-offs of Grayscale’s Bitcoin Belief GBTC shares, together with a notable sale of twenty-two million GBTC shares by the FTX property, value practically $1 billion.

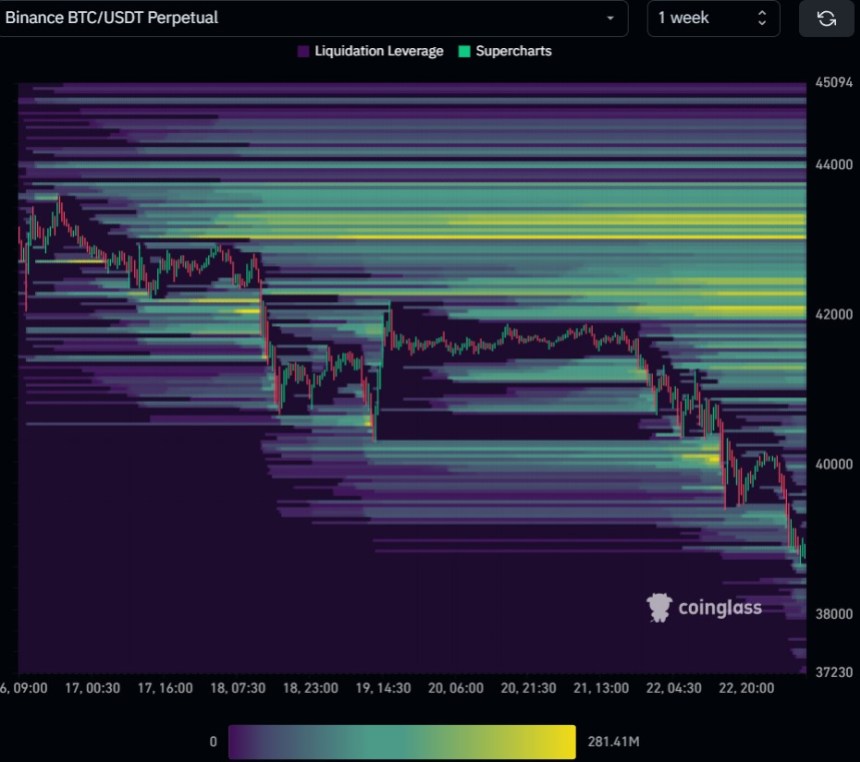

Bitcoin Liquidation Zones Wiped Off

The affect of Grayscale’s sell-off is obvious in CoinGlass’ liquidation heatmap, which reveals notable liquidation zones being wiped off within the 1-week chart.

Whereas Grayscale’s BTC dump has contributed to the value drop, the elevated accumulation of BTC lengthy positions on Bitfinex signifies a possible change in sentiment. A value reversal might happen if the $38,000 assist line holds, pushing BTC again above $40,000.

Moreover, excluding Grayscale, institutional buyers and asset managers concerned within the ETF market have collectively acquired over 86,320 BTC at a mean value of $42,000, representing a considerable $3.63 billion funding.

Market specialists reminiscent of Ali Martinez recommend that these establishments are prone to undertake a strategic, long-term view quite than have interaction in peak purchases. This degree of institutional funding underscores the rising recognition of Bitcoin as a legit asset class and signifies confidence in its long-term progress potential.

At the moment, the Bitcoin value is at $38,800, reflecting a considerable year-to-date decline of over 12% and a 9.7% drop up to now seven days. The length and extent of the promoting stress brought on by Grayscale’s BTC dump stay unsure, leaving the query of how a lot additional the BTC value might decline.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual danger.