On-chain information reveals that whales and new wallets are scooping extra Maker (MKR), which appears to be propping the token, fanning demand. As of September, MKR is likely one of the top-performing tokens, including roughly 120% in three months from June 2023 lows.

When writing, MKR is altering fingers above $1,300 and inching nearer to July 2023 highs. Notably, MKR is up 14% previously week of buying and selling, driving market cap above $1.27 billion and buying and selling quantity by 36% on the final day.

Whales And Contemporary Wallets Shopping for Maker (MKR)

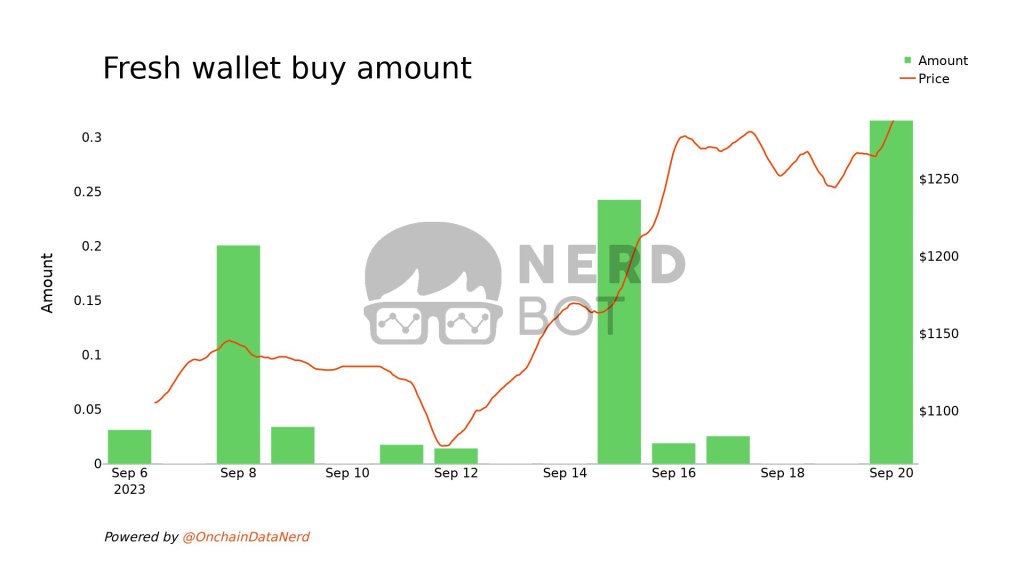

Trackers word that within the final week of buying and selling, a whale, “0xad0”, purchased 1261 MKR value $1.62 million at a mean value of $1,290. Furthermore, wanting on the developments, whale and contemporary pockets actions have been heightened over the earlier week. With extra accumulation, the token has been monitoring increased in tandem.

Parallel information from Lookonchain confirms this growth, particularly from early September. Earlier this month, a whale sold $1.13 million of Ethereum and acquired an equal quantity in MKR on Binance.

This transaction comes a day after one other entity moved $12.3 million of MKR from Binance. Nevertheless, whereas whales seem like loading up extra MKR, Vitalik Buterin, the co-founder of Ethereum, offered his stash of MKR for ETH on September 2.

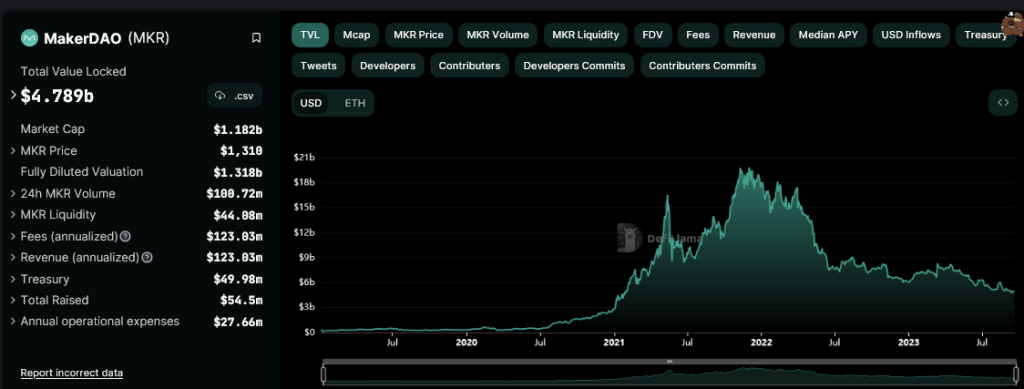

Maker Finance is a decentralized lending and borrowing platform on Ethereum. As of September 20, the protocol had a complete worth locked (TVL) of over $4.8 billion, in response to DeFiLlama. Extra information reveals that the platform held $109.56 million of MKR, its native token, and totally different stablecoins value $49.58 million.

DAI Yield Rising, New Burning Construction Applied Fueling Bulls

MakerDAO, a decentralized autonomous group (DAO), manages DAI, an algorithmic stablecoin that passes yield to the holder. Holders of MKR, the native token of Maker, can even vote on proposals.

Following the transient USDC depegging in March 2023, the DAO decreased its reliance on the USDC, a centralized fiat-backed stablecoin. In early August, the group additionally voted to briefly enhance the DAI Financial savings Fee (DSR) from 3.19% to eight%, incentivizing customers to mint DAI by way of the Spark Protocol.

Apart from modifications to the DSR, MakerDAO additionally launched an improved sensible burn mechanism the place collateralized debt positions (CDPs) to again circulating DAI might be closed freely with out inflicting stablecoin shortages out there. On this new association, circulating MKR can be purchased and burned impartial of CDP closure, permitting the protocol to be extra versatile in mild of market modifications.

Nevertheless, with this, each burning decreased circulating provide, which has supported costs as value motion revealed.

Characteristic picture from Canva, chart from TradingView