LiftOff’s VP of International Gross sales, Joey Fulcher dives into the outcomes of the corporate’s latest survey to elevate the lid on why App Entrepreneurs are optimistic concerning the future – regardless of market challenges.

At the moment, hundreds of thousands of cellular video games struggle for consideration in an more and more crowded business. Even video games with international IPs can wrestle to reach the cellular market. Current examples embody Apex Legends Cell, The Strolling Useless: Betrayal and Full Metallic Alchemist Cell. One report discovered that 83 p.c of launched cellular video games fail inside three years.

Sport builders additionally cope with a rising variety of privateness modifications impacting profitability, even years after the introduction of Apple’s App Monitoring Transparency. And but, regardless of all these challenges, cellular sport entrepreneurs are beneath stress to extend UA and income. This raises the query: how are app entrepreneurs responding?

To seek out out, we lately launched our 2024 App Marketer Survey, which surveyed greater than 500 cellular entrepreneurs working with month-to-month advert budgets starting from $50,000 to over $1,000,000 throughout a number of areas and app verticals. Our survey discovered that almost all app entrepreneurs are chasing more and more aggressive KPI targets, have enhanced budgets and rising assets, and are usually optimistic concerning the future.

Whereas the total report options enter from each non-gaming and gaming app entrepreneurs, we needed to share the specifics of how sport entrepreneurs responded to the survey to assist extra entrepreneurs contextualise business modifications and maximise their return on their advert spend.

Return on advert spend is the most important precedence for sport entrepreneurs

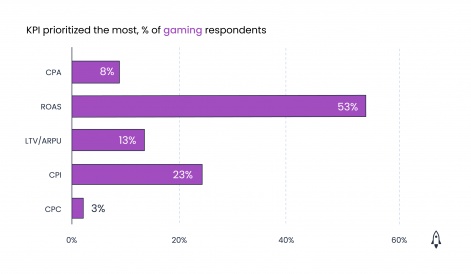

The king of metrics for many sport entrepreneurs continues to be return on advert spend (ROAS). 53 p.c of gaming respondents cited ROAS as their high precedence, adopted by price per set up (CPI) at 23 p.c and lifelong worth (LTV) at 13 p.c. Comparatively, 31 p.c of non-gaming respondents mentioned ROAS is their main focus, marking a major divergence. One other notable distinction was that price per motion (CPA) got here in second place at 27 p.c for non-gaming entrepreneurs.

KPI prioritised essentially the most, p.c of gaming respondents

Given the important thing variations between gaming and non-gaming advertisers, the divide makes a whole lot of sense. Sport builders aren’t aiming simply to carry new customers in—they’re launching advanced LiveOps methods to maintain them repeatedly engaged.

So, whereas it’s nonetheless important to grasp how a lot it prices to initially purchase a person, having a agency grasp on how a lot income they’re producing over time is a greater indicator of the well being of an advert marketing campaign. Compared, non-gaming app verticals (akin to courting and health) count on excessive churn charges to scale, so preliminary set up metrics are way more crucial.

One of many best methods for gaming entrepreneurs to spice up ROAS is to concentrate on economical advert codecs. Entrepreneurs flock to playable adverts as they provide the bottom CPI, however playables have the worst return on advert spend. Our 2023 Cell Advert Inventive Index analysed the D7 ROAS of all 5 main advert codecs and located that native and banner adverts got here out on high at 18 p.c and 17 p.c, with playables registering at 12 p.c.

Entry to high quality customers is crucial for demand-side platforms

Demand-side platforms (DSP) are invaluable companions to cellular entrepreneurs. They supply applied sciences that allow entrepreneurs to radically enhance their advert marketing campaign efficiency via cross-device focusing on, artistic optimisation, and viewers segmentation. For gaming advertisers, high DSPs can present improved entry to high-quality customers (those that will almost definitely change into paying customers).

Most of our survey respondents agreed with that sentiment, with 58 p.c of entrepreneurs from gaming and non-gaming apps stating that entry to “high quality customers” is the highest precedence when choosing a DSP. That marked a 40 p.c leap over those that acknowledged the power to scale campaigns was their main focus.

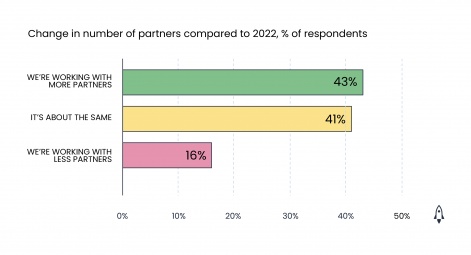

With 43 p.c of gaming respondents stating they’re working with extra companions, selecting a DSP who might help you obtain your objectives is extra important than ever. A DSP ought to have the ability to provide the most effective of all worlds, enhancing scalability however with a particular concentrate on rising the variety of high-quality customers. For instance, with Liftoff Speed up, you’ll be able to attain over three billion distinctive customers in additional than 190 nations with superior machine-learning fashions that focus on high-quality app customers.

Media combine modelling is influencing advert spend

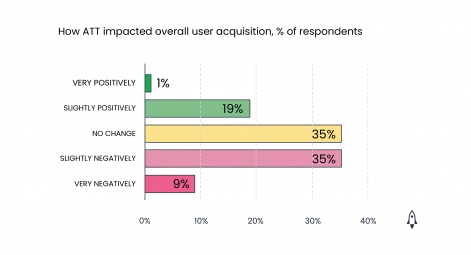

It’s been nearly two years since Apple launched its person privateness framework, App Monitoring Transparency (ATT), but many cellular entrepreneurs proceed to face its impression on UA. Virtually half (44 p.c) of the gaming entrepreneurs who responded to the survey indicated that ATT continued negatively impacting person acquisition in 2023, with 41 p.c saying they spent much less on iOS campaigns.

Cell entrepreneurs are contending with the drastic discount in granular knowledge via media combine modelling (MMM), a extra conventional manner of gauging the effectiveness of campaigns primarily based on spend allocation. It assesses the affect of promoting and promoting initiatives to grasp the mixed results of assorted inner and exterior elements on reaching particular objectives, akin to income or some other KPIs.

Virtually half of the survey respondents had adopted MMM, with 10 p.c utilizing it solely and 39 p.c utilizing a mixture of MMM and a cellular measurement companion’s (MMP) attribution modelling. Of these entrepreneurs who use media combine modelling, 61 p.c acknowledged they’d modified their advert spend because of the knowledge.

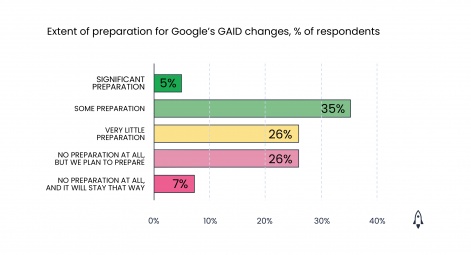

Google’s GAID modifications are coming, and few are ready

Whereas media combine modelling is a superb answer to among the challenges ATT poses, extra is required to cope with extra intensive privateness modifications coming down the street. In 2024, Google is anticipated to deprecate GAID (Google Promoting ID).

Regardless of this, many gaming respondents mentioned they’d finished little to organize for Google’s GAID modifications. Barely over 1 / 4 of respondents indicated that they’d finished little or no preparation, with an extra 33 p.c reporting no preparation. Most respondents indicated that they’d a minimum of some understanding of the modifications, though 28 p.c mentioned they weren’t aware of them.

Apple’s ATT got here into motion with out a lot warning, taking a whole lot of entrepreneurs unexpectedly, whereas Google introduced its plans years in the past. Entrepreneurs stand to profit from profiting from this superior warning. They need to be trying to comprehensively perceive these modifications and their impression on how their marketing campaign success is measured.

A lot of the identical could possibly be mentioned of SKAN 4. Simply over a 3rd of gaming survey respondents (34 p.c) acknowledged that they’re nonetheless unfamiliar with the modifications Apple launched, regardless of SKAN 4 launching over a yr in the past, which means they could possibly be lacking out on a number of key advantages. For instance, SKAN 4 permits advertisers to obtain as much as three postbacks primarily based on a unique exercise window (0-2 days, 3-7 days, and 8-35 days, respectively), enabling advertisers to grasp higher how customers have interaction with their app as much as 35 days after set up.

The long run appears promising for video games advertising and marketing

These are difficult instances for the gaming business, however there are a lot of alternatives for attentive builders. Privateness modifications are reworking the UA panorama, and layoffs are at an all-time excessive. Even so, sport entrepreneurs appear cautiously optimistic concerning the future, with 52 p.c of respondents stating that they really feel the subsequent 12 months can be an enchancment during the last.

A lot of which may be as a result of budgets seem barely extra beneficiant this time, assuaging some stress of hitting loftier targets. Virtually half of all gaming entrepreneurs who responded count on their finances to a minimum of considerably enhance in 2024, with an extra 18 p.c anticipating it to extend considerably. Assets additionally look to extend in a number of areas throughout the board, significantly natural social/viral, influencer, and neighborhood constructing.

However to capitalise on the alternatives out there and benefit from the accessible assets, sport entrepreneurs ought to look to trusted advert companions to assist them obtain their objectives for the yr forward.