A chart of accounts organizes and categorizes monetary transactions. This information explains how a chart of accounts works and supplies examples.

A chart of accounts lists all the account names in an organization’s common ledger. This monetary group instrument categorizes these accounts by sort and offers a clearer image of an organization’s monetary well being. Understanding and making a chart of accounts is without doubt one of the first important steps to performing accounting and bookkeeping in your personal small enterprise.

Leap to:

How does a chart of accounts work?

A chart of accounts could be regarded as a submitting system in your monetary accounts. Not solely does the chart of accounts type these monetary accounts by class, it additionally assigns each a singular title and numerical code. Principally, a chart of accounts supplies a single centralized reference that lists and organizes all monetary accounts throughout the complete enterprise.

Why is the chart of accounts necessary?

The chart of accounts organizes your small business’ monetary accounts into easy-to-understand teams. Many necessary monetary stories, such because the stability sheet and revenue assertion, are created utilizing data from the chart of accounts. A chart of accounts is without doubt one of the primary cornerstones used to evaluate your small business’ monetary well being and is a key a part of any small-business monetary accounting software program.

What are the advantages of a chart of accounts?

Decreased errors

A chart of accounts ensures that every transaction is mapped to the proper account, decreasing monetary errors throughout the enterprise. It helps higher cash administration and improves the general monetary well being of the enterprise.

Improved visibility

In a chart of accounts, every monetary account and sub account is assigned its personal figuring out title and numerical code. This offers leaders very particular visibility into how cash is transferring throughout the corporate, permitting them to make higher enterprise choices.

Extra correct reporting

A chart of accounts additionally helps higher monetary reporting, bettering each the accuracy and specificity of enterprise stories. The chart of accounts varieties the muse upon which the monetary stories are constructed.

Larger compliance

Utilizing a chart of accounts in tandem with different accounting finest practices may also help your small business keep compliant with all related federal, state and native tax legal guidelines. The data contained within the chart of accounts additionally makes it attainable in your accounting software program to mechanically generate compliant monetary statements, akin to tax varieties.

How is a chart of accounts organized?

Charts of accounts can comply with many alternative buildings and could be modified to fulfill nearly any measurement or sort of enterprise. The pliability implies that they are often tailored to suit your wants, however it may well make issues a bit difficult when creating your first chart of accounts.

In the event you haven’t already selected a template to make use of in your chart of accounts, then we advocate itemizing the accounts within the order they’ll seem on monetary statements. So begin with the stability sheet accounts, then the revenue assertion accounts and so forth. A fundamental chart of accounts will comprise the next 5 classes:

- Property.

- Liabilities.

- Fairness.

- Income.

- Bills.

You probably have many monetary accounts, you possibly can break these down into additional subcategories — akin to working revenues or non-operating losses — to maintain the whole lot organized. You may even break them up additional by enterprise perform or firm division if you might want to, however most small-business homeowners don’t must get that granular.

Methods to arrange a chart of accounts

It’s necessary to arrange the chart of accounts accurately the primary time round, since you must use the identical system from 12 months to 12 months to keep up consistency.

To arrange a chart of accounts, first checklist out all of your monetary accounts, then type them by the 5 classes listed above. If essential, maintain sorting the accounts into varied subcategories, features and divisions till you might be happy with the lists.

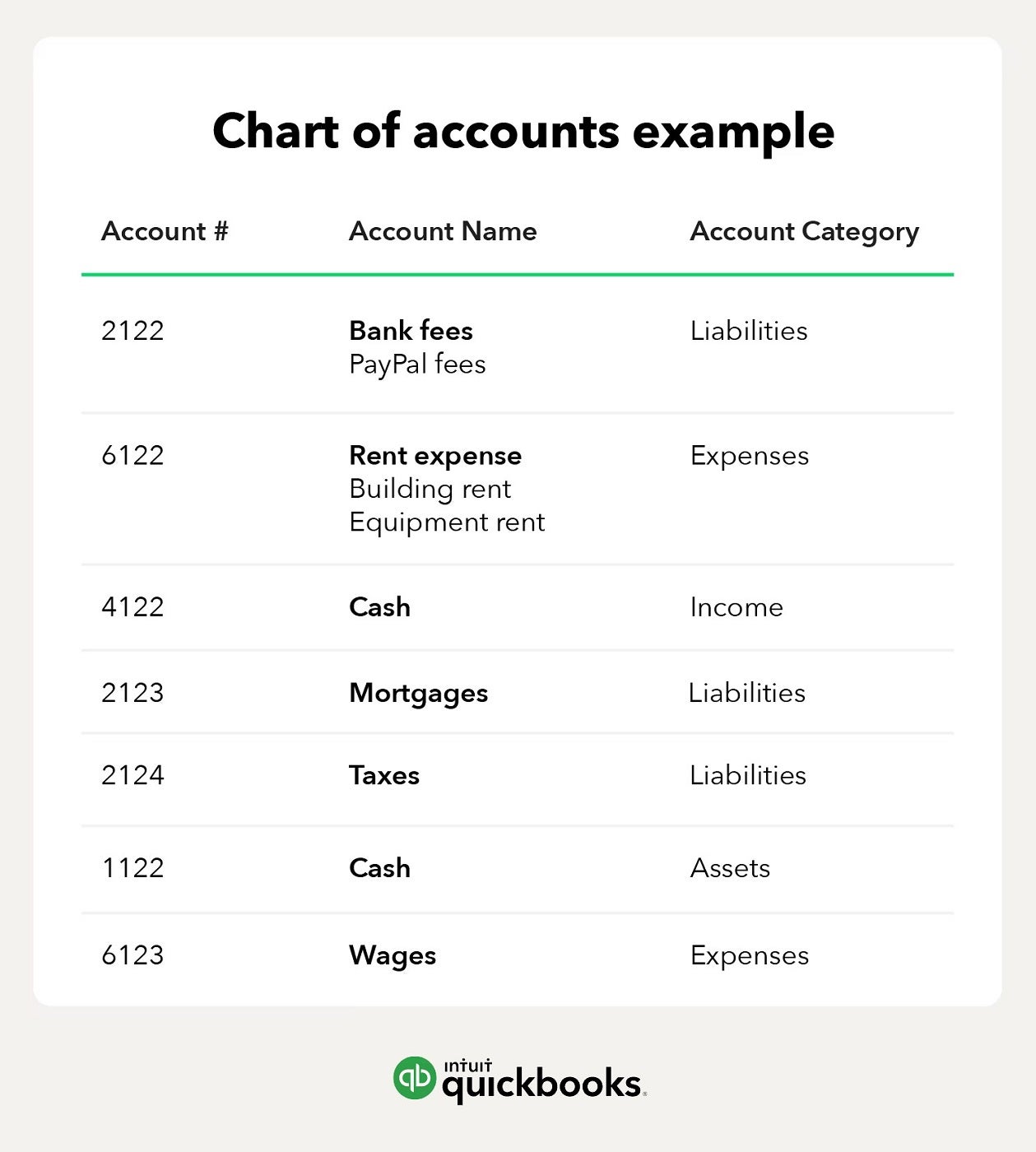

After you have got a very sorted checklist, it’s time to offer every account a singular however brief title and outline, akin to “payroll tax bills” or “gross sales returns and allowances.” Every account must also be given a singular numerical code to establish it. Many corporations use a distinct quantity sequence for every sort of account. As an example, asset accounts may use the numbers 100–199 and legal responsibility accounts may use the numbers 200–299.

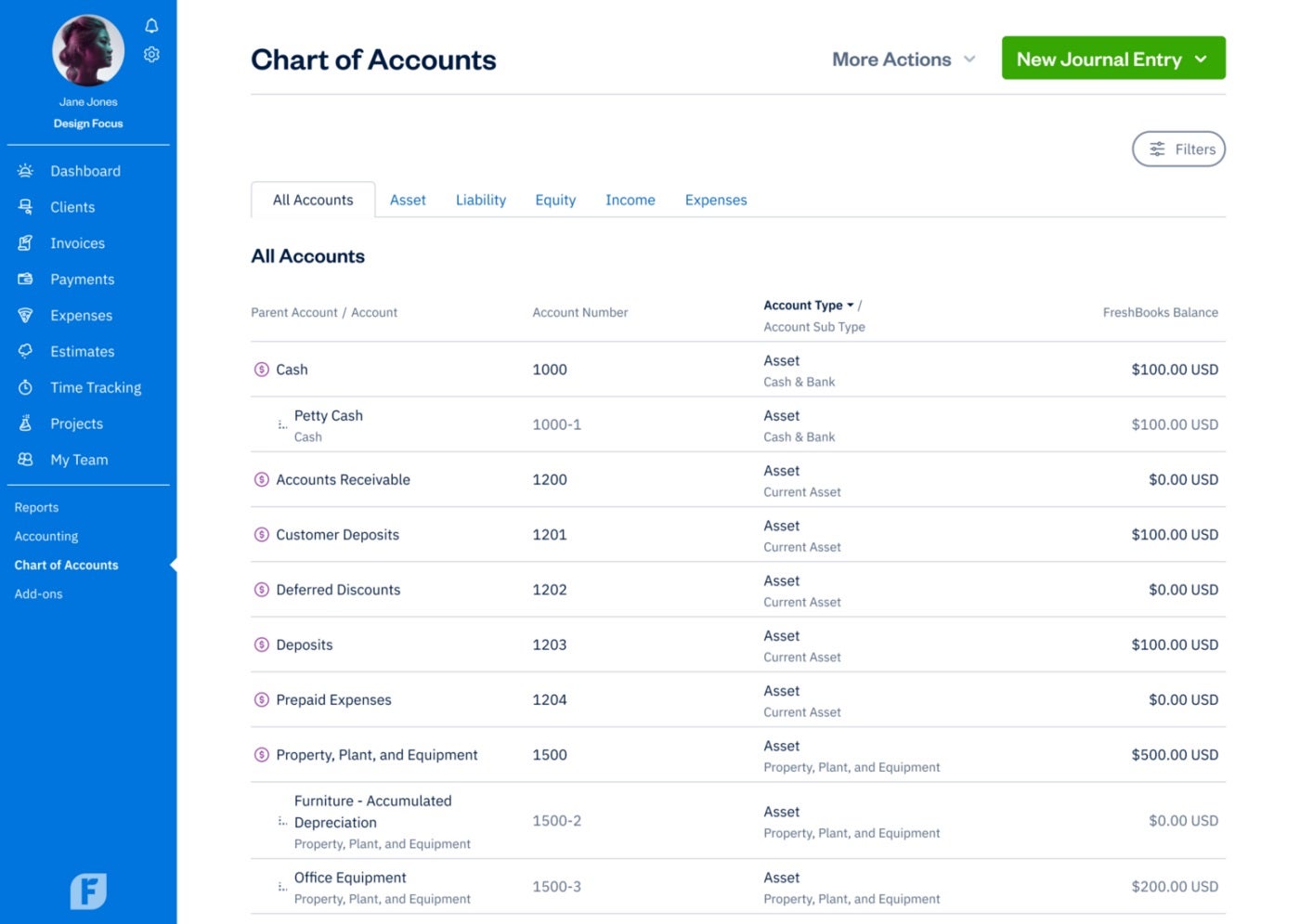

Some accounting apps, like QuickBooks, will really arrange a chart of accounts for your small business mechanically, which is extraordinarily handy. You may customise the chart of accounts by varied actions, akin to including subsequent accounts, marking outdated accounts inactive or modifying account numbers.

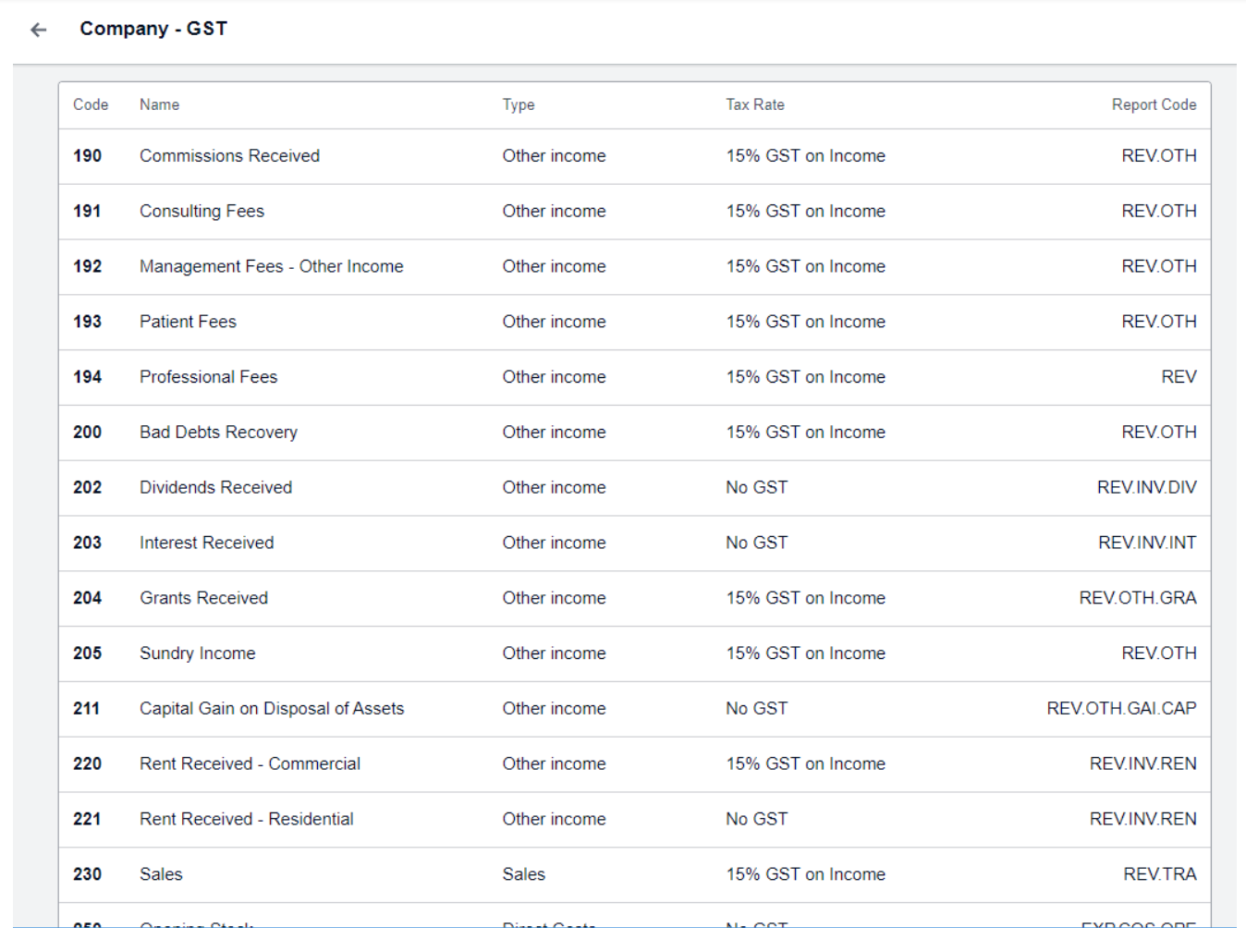

Chart of accounts examples

To offer you an instance of what a chart of accounts may appear to be, we’ve rounded up examples from three common small-business accounting software program platforms: QuickBooks, Freshbooks and Xero accounting.

Chart of accounts finest practices

Comply with GAAP ideas

Whereas there isn’t a mandated construction for a chart of accounts, when designing your chart, you must nonetheless comply with the rules set forth by GAAP or IFRS.

GAAP (typically accepted accounting ideas) are created and maintained by the Monetary Accounting Requirements Board (FASB) and apply to enterprise in america. IFRS (Worldwide Monetary Reporting Requirements) apply to companies outdoors the U.S. Take a look at our information to GAAP to be taught extra about these accounting ideas.

Select the proper degree of element

You don’t need your chart of accounts to be too granular or too broad. It ought to have sufficient subcategorization and element to be helpful — however not a lot that almost each transaction requires a distinct account. Most companies will discover that numerical codes which can be three to 5 digits lengthy will present an excellent stability of knowledge.

Benefit from accounting software program

Like we stated above, accounting software program can really generate a chart of accounts for you, which may be very handy. The perfect accounting software program can even use the data in your chart of accounts to mechanically generate monetary stories, so you can also make evidence-based choices.

Time any modifications accurately

Ideally, you’ll arrange your chart of accounts accurately firstly, so that you received’t must make modifications to it instantly. However as your small business grows, you may end up needing to make some updates to the chart of accounts. Any essential modifications ought to be on the finish of a monetary interval, akin to a fiscal quarter or fiscal 12 months, to forestall interruptions in transactions.

Need assistance choosing the proper accounting software program in your wants? Take a look at our informative guides and our high software program picks.