Reconciling your financial institution transactions to what you are promoting ebook is important to the monetary well being of your organization. Nonetheless, if you happen to’ve by no means reconciled your organization’s transactions earlier than, the method can sound a bit intimidating.

Learn on to find the important steps in financial institution reconciliation and to see a number of examples of what a financial institution reconciliation may appear to be.

1

QuickBooks

Workers per Firm Dimension

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Workers), Small (50-249 Workers), Medium (250-999 Workers), Massive (1,000-4,999 Workers)

Micro, Small, Medium, Massive

Options

API, Common Ledger, Stock Administration

2

Acumatica Cloud ERP

Workers per Firm Dimension

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Workers), Small (50-249 Workers), Medium (250-999 Workers), Massive (1,000-4,999 Workers)

Micro, Small, Medium, Massive

Options

Accounts Receivable/Payable, API, Departmental Accounting, and extra

What’s financial institution reconciliation?

A financial institution reconciliation assertion compares an organization’s checking account steadiness to the steadiness on its accounting data. A financial institution reconciliation will present any discrepancies between the 2 accounts. Financial institution reconciliation helps corporations detect each unintentional errors and intentional fraud.

Why is financial institution reconciliation necessary?

Financial institution reconciliation advantages corporations in quite a few methods. To begin with, the financial institution reconciliation course of will enable you uncover and repair errors in your books. It is going to additionally enable you determine fraud, wrongful funds, extra charges and different improper funds which might be costing what you are promoting cash.

Financial institution reconciliation additionally helps you keep on prime of the monetary well being of what you are promoting. The financial institution reconciliation course of permits you to monitor what you are promoting’ profitability over time. It is possible for you to to categorise tax-deductible bills as you undergo your data, serving to you get tax breaks and making certain you’re able to file taxes.

Varieties of financial institution reconciliation

Along with finishing an total financial institution reconciliation, you may additionally want to do a reconciliation for under sure sorts of transactions. Listed here are 5 varieties of financial institution reconciliation that each enterprise proprietor ought to know:

Vendor reconciliation

Vendor reconciliation helps you notice any variations between funds to suppliers and the final ledger. It entails evaluating statements from distributors to the transactions on the final ledger to make sure the general steadiness is correct.

Buyer reconciliation

Should you let clients purchase your services or products on credit score, you then’ll have to conduct a buyer reconciliation. Throughout this course of, buyer transactions made on credit score are in comparison with the accounts receivable ledger in addition to the receivables management account, which is a part of the final ledger.

Bank card reconciliation

In distinction to buyer reconciliation, bank card reconciliation entails purchases your personal enterprise has made on credit score. Throughout this course of, you’ll examine transactions made on firm bank cards to receipts and expense reporting to make sure all purchases are accounted for and that no payments go unpaid.

Money reconciliation

Companies with retail places might want to conduct a money reconciliation on the finish of every work day. In a money reconciliation, cashiers confirm that the sum of money remaining within the register matches up with the transactions carried out that day.

Steadiness sheet reconciliation

Steadiness sheet reconciliation confirms that every one of an organization’s monetary statements are correct. Throughout this course of, the balances on the steadiness sheet are in contrast in opposition to the final ledger in addition to different supporting documentation like financial institution statements and invoices.

How one can do a financial institution reconciliation

Collect your paperwork

To conduct a financial institution reconciliation, you have to your financial institution data for a set time period, normally the previous month. You may entry this knowledge by referring to your final banking assertion or logging into your on-line enterprise financial institution accounting.

Some accounting apps can even robotically import your banking transactions, rushing up the reconciliation course of. Additionally, you will want entry to your organization books for that very same time period, whether or not that’s in a spreadsheet, logbook or accounting software program.

Examine your books and financial institution accounts

When you’ve bought all of your paperwork collectively, examine your books to your financial institution statements to determine discrepancies. As an example, you might need logged a fee to a vendor in your books, however that fee may not have really hit your checking account but. Create a listing of all of the discrepancies and attempt to decide the reason for every.

Modify the books and checking account

When you’ve bought a grasp checklist of discrepancies, it is advisable to add your lacking ebook transactions to your checking account and your lacking financial institution transactions to your books. Be certain all withdrawals and deposits are accounted for in the course of the interval you’re reconciling.

Examine the adjusted balances

When you’ve made all the required additions and subtractions, it’s time to check the ebook steadiness to the financial institution steadiness. Should you’re executed your calculations proper, these two numbers must be precise and equal, and also you’ll have completed with the financial institution reconciliation course of.

Appropriate errors if crucial

Widespread accounting errors will impression a financial institution reconciliation. Some frequent errors to be careful for embrace knowledge entry errors, omissions errors, transposition errors, fraudulent transactions and an incorrect starting money steadiness. Additionally, be careful for service charges you’ve forgotten to account for.

Examples of financial institution reconciliation

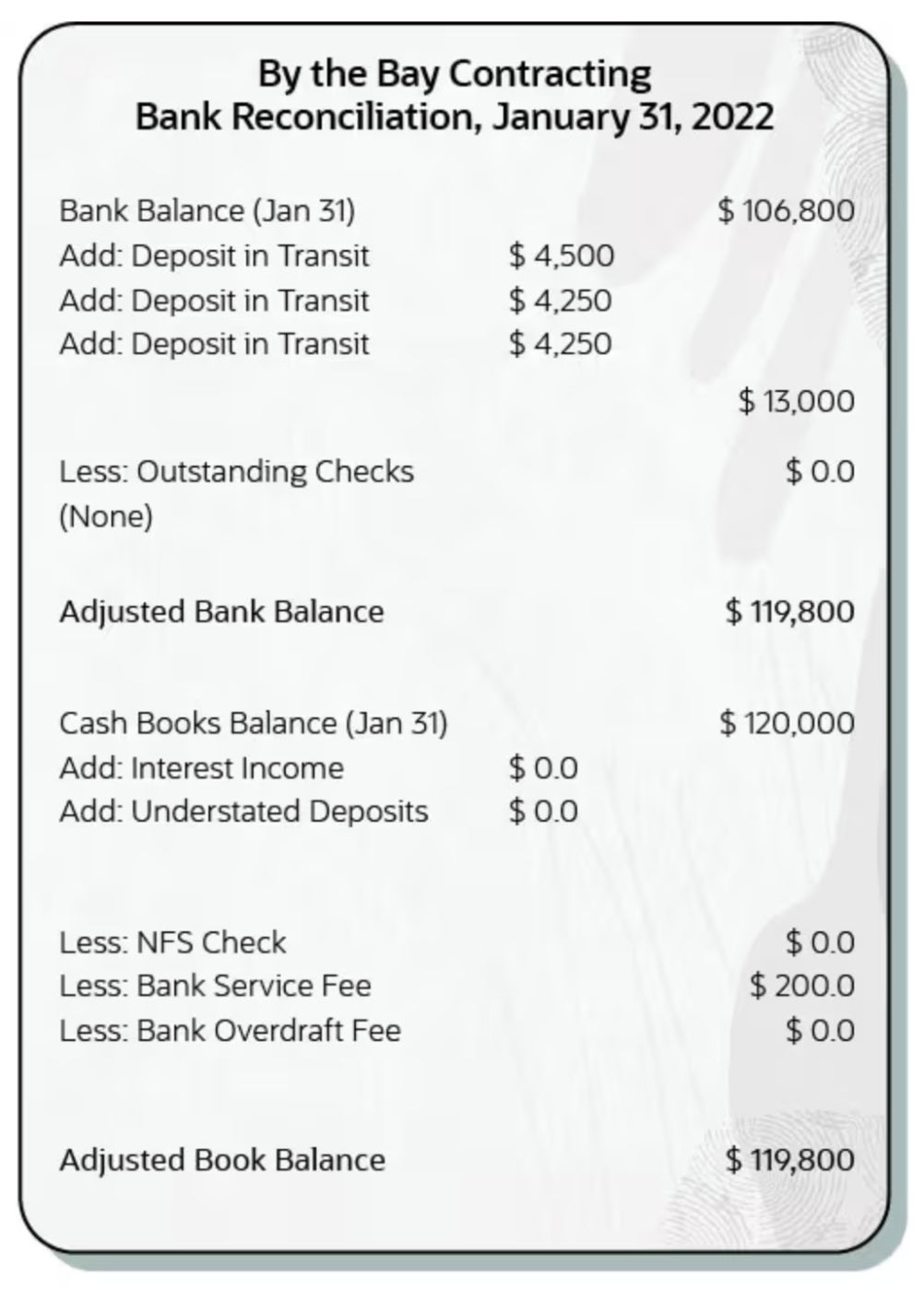

Easy financial institution reconciliation instance

Our first financial institution reconciliation comes courtesy of NetSuite, an enterprise accounting software program, and encompasses a mock firm referred to as By the Bay Contracting. As you’ll be able to see on this easy instance, the corporate wants so as to add $13,000 in whole to its financial institution steadiness and subtract $200 in charges from its books to make every thing steadiness out.

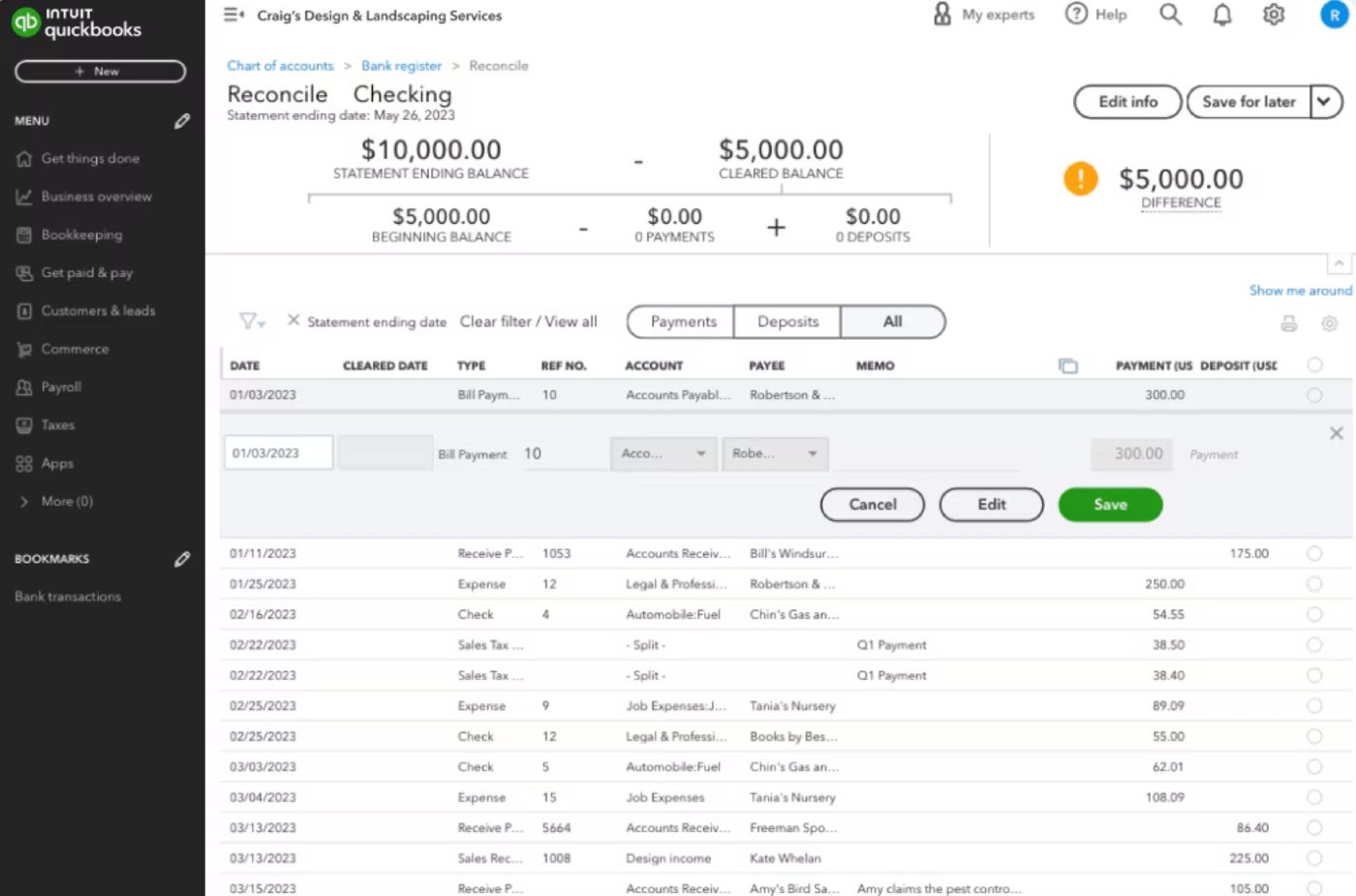

Advanced financial institution reconciliation instance

Our subsequent instance reveals a extra sophisticated financial institution reconciliation in QuickBooks. As you’ll be able to see, there’s a $5,000 discrepancy between the statement-ending steadiness and the cleared steadiness for Drag’s Design and Landscaping Providers. The enterprise proprietor wants so as to add all excellent funds and deposits till the 2 balances match up.

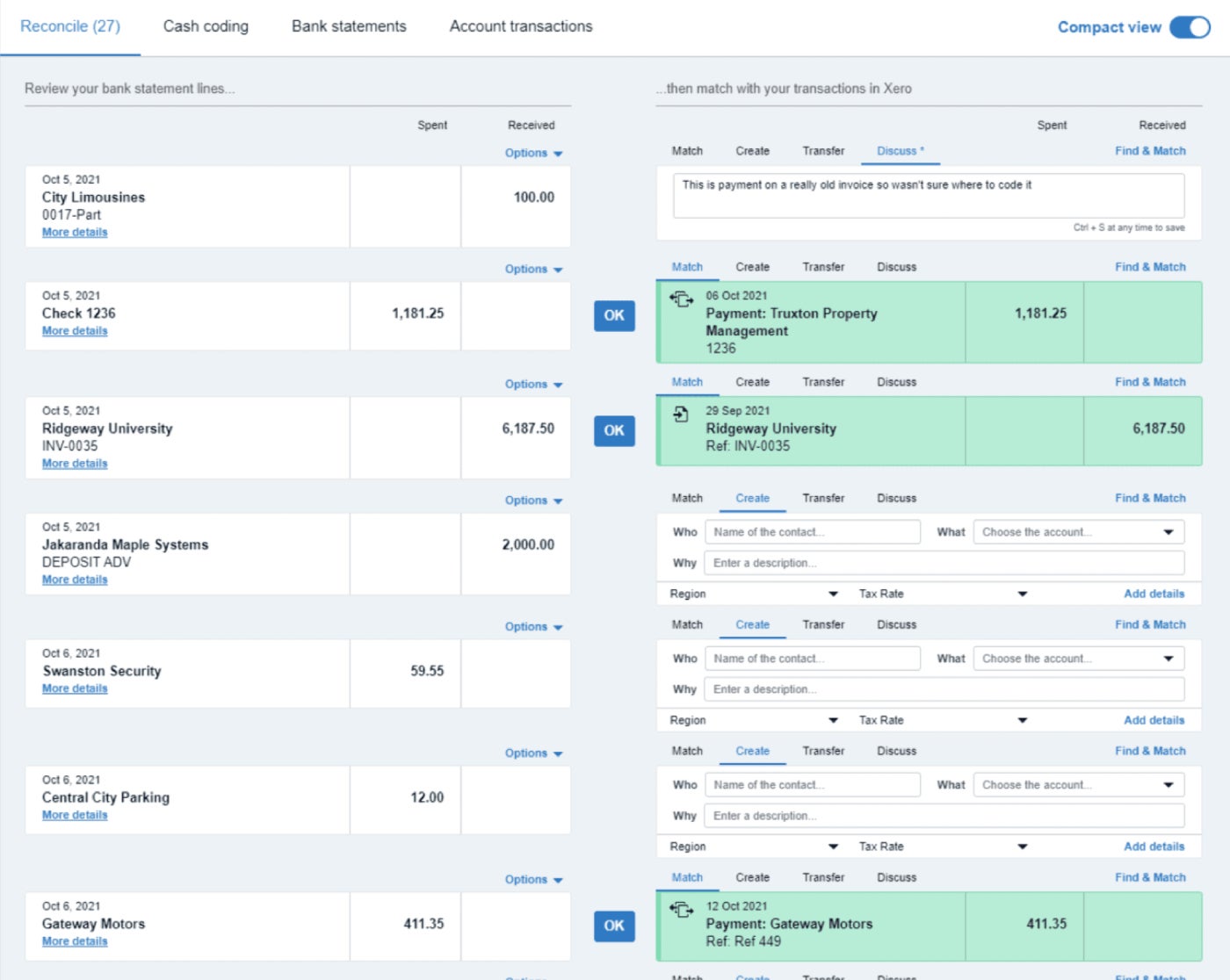

Financial institution reconciliation software program instance

Our remaining financial institution reconciliation instance demonstrates how a software program like Xero can import and categorize financial institution transactions to hurry up financial institution reconciliation. As seen within the instance, the accounting software program robotically matches financial institution assertion hyperlinks to recorded transactions in Xero and prompts you so as to add unrecorded financial institution transactions to your books.

Widespread financial institution reconciliation questions

What’s the that means of financial institution reconciliation?

Financial institution reconciliation is the method of evaluating an organization’s checking account steadiness to the steadiness on its accounting data to verify that every one transactions have been accounted for.

What’s one objective of financial institution reconciliation?

The aim of a financial institution reconciliation is to evaluation all transactions which have been recorded in your financial institution statements and books. Creating financial institution reconciliations helps determine unrecorded transactions and fraudulent or faulty prices.

What are the 4 steps in financial institution reconciliation?

After gathering your paperwork, the 4 predominant steps of financial institution reconciliation are evaluating your books and financial institution statements, adjusting the books and financial institution to appropriate discrepancies, evaluating the adjusted balances to one another and fixing any remaining errors if crucial.

What’s an instance of financial institution reconciliation?

If an organization’s financial institution statements present that it has $10,000 in money, however the books solely present that they’ve $9,000, then the corporate should carry out reconciliation to determine the lacking $1,000 in deposits.