Within the dynamic panorama of cryptocurrency, the completion of Ethereum’s transition to Ethereum 2.0, referred to as “The Merge,” on September 15, 2022, stands as a pivotal second in blockchain historical past. This replace represents greater than a technological development — it’s the daybreak of a brand new period for Ethereum.

Hello, I’m Zifa. On this article, I’ll information you thru The Merge, exploring its affect on Ethereum and its that means for our crypto group.

What Is Ethereum Merge?

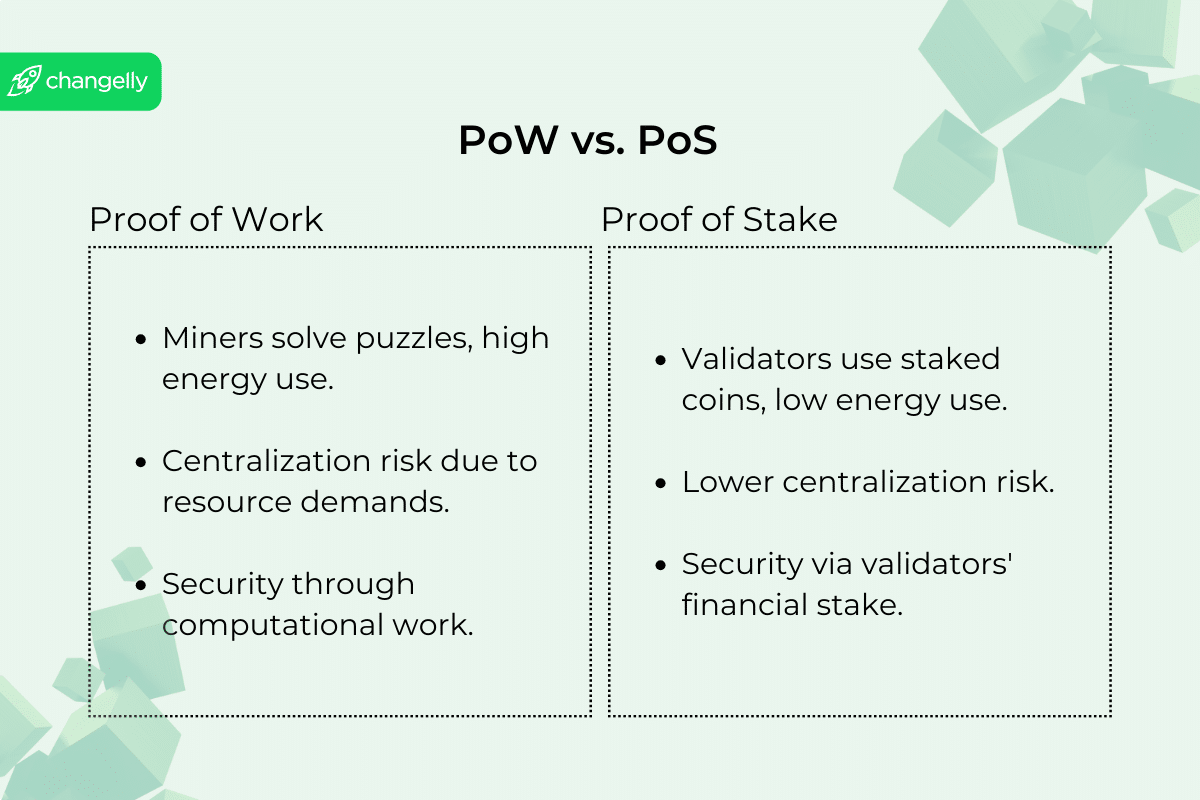

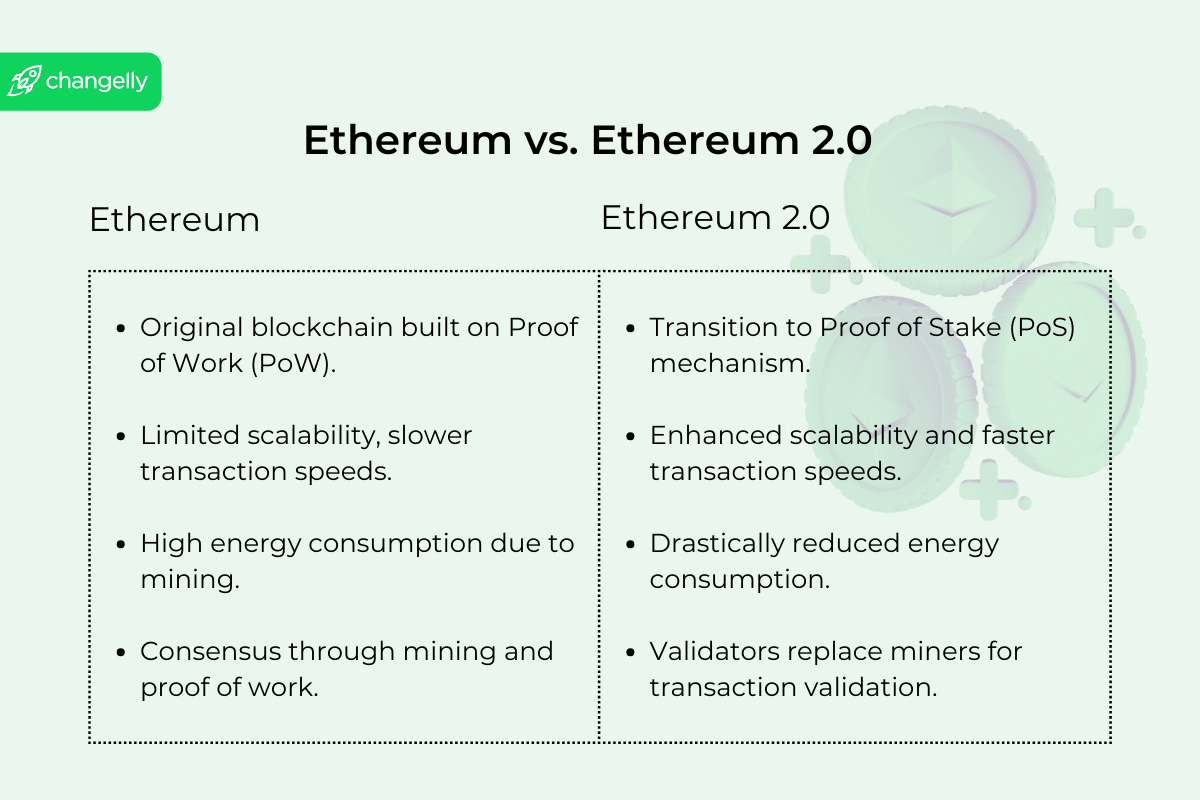

The Ethereum Merge, a landmark occasion within the blockchain realm, marked the transition from Ethereum’s authentic proof-of-work (PoW) consensus mechanism to the much-anticipated proof-of-stake (PoS) system in Ethereum 2.0. This transition was not merely a shift in how Ethereum operates; it signified a transformative strategy to blockchain expertise with far-reaching implications for safety, transaction pace, and community effectivity.

Ethereum’s Authentic PoW Mechanism

Ethereum, like many different cryptocurrencies, initially operated on a PoW mechanism. Below PoW, miners used highly effective computer systems to resolve advanced mathematical puzzles. The method of efficiently fixing these puzzles, referred to as ‘mining,’ validated transactions and added new blocks to the blockchain. Whereas safe, it was energy-intensive. The aggressive nature of mining led to an arms race in computational energy, leading to vital electrical energy consumption and environmental issues. PoW supplied strong safety because of the computational work required, making fraudulent actions like double-spending virtually infeasible. Nonetheless, this safety got here at the price of scalability and pace, with the community typically going through congestion and excessive transaction charges throughout peak utilization.

Overview of the PoS Mechanism in Ethereum 2.0

The Merge launched the PoS mechanism to Ethereum, revolutionizing the best way transactions are validated and blocks are created. In PoS, community validators substitute miners. As an alternative of fixing puzzles, validators are chosen to create new blocks and validate transactions based mostly on the quantity of cryptocurrency they maintain and are prepared to ‘stake’ as collateral. This shift considerably reduces the vitality requirement, because it eliminates the necessity for energy-intensive mining operations.

PoS gives a number of different advantages over the normal proof-of-work (PoW) mannequin: it eliminates the necessity for costly {hardware}, opens the door to better scalability potential, and reduces the danger of community centralization. Ethereum co-founder Vitalik Buterin has lengthy supported PoS, advocating its effectivity and safety enhancements consistent with Ethereum’s imaginative and prescient for a sustainable and scalable blockchain community.

Learn additionally: PoW vs. PoS.

The Merge: Understanding Key Ideas

The Beacon Chain: The Spine of the PoS System

The Beacon Chain, launched in December 2020, is the cornerstone of Ethereum’s transition to a proof-of-stake (PoS) system. Because the spine of Ethereum 2.0, it essentially redefines the best way the community operates. In distinction to the unique Ethereum blockchain (Eth1), which relied on the energy-intensive proof-of-work (PoW) mechanism, the Beacon Chain makes use of PoS to attain consensus. This includes validators as a substitute of miners. Validators are chosen to verify blocks and validate transactions based mostly on their stake within the community, which is a certain quantity of Ether locked within the system. The Beacon Chain is essential for coordinating these validators, managing stakes, and overseeing consensus guidelines. This shift not solely drastically reduces the vitality consumption of the Ethereum community but in addition paves the best way for a safer and scalable blockchain. The Beacon Chain operates in parallel with the prevailing Ethereum chain, making certain a easy transition and continued operation throughout the improve course of.

Sharding: Enhancing Scalability and Effectivity

Sharding is a key characteristic in Ethereum 2.0 that guarantees to boost the community’s scalability and effectivity. Basically, sharding includes dividing the Ethereum community into a number of parts, referred to as ‘shards.’ Every shard comprises its personal impartial state, that means a novel set of account balances and good contracts. The thought is to unfold the community’s load throughout these shards. This division permits for transactions and good contracts to be processed in parallel, slightly than consecutively as within the authentic Ethereum blockchain. In consequence, the community can deal with extra transactions at a time, decreasing congestion and enhancing transaction speeds. Sharding is especially essential as Ethereum continues to develop in recognition, with an growing variety of decentralized purposes (dApps) and customers demanding extra from the community. By implementing sharding, Ethereum 2.0 goals to considerably enhance the community’s capability, making it extra environment friendly and scalable for a world person base.

Slashing: Sustaining Community Integrity

Slashing is a vital safety mechanism inside the PoS system of Ethereum 2.0. It acts as a deterrent towards dishonest or malicious habits by validators. Within the PoS context, validators are chargeable for validating transactions and creating new blocks. They need to stake a certain quantity of Ether as collateral. If a validator acts maliciously — as an example, by making an attempt to govern the community or validating fraudulent transactions — a portion of their staked Ether is ‘slashed,’ or eliminated, as a penalty. This mechanism ensures that validators have ‘pores and skin within the recreation,’ making it economically disadvantageous for them to behave towards the community’s finest pursuits. Slashing is designed to guard the integrity and safety of the Ethereum community, making certain that validators are incentivized to keep up sincere and dependable operations. By slashing, Ethereum 2.0 strengthens its safety framework, fostering a extra reliable and steady blockchain ecosystem.

When you’re seeking to seamlessly change Ethereum and different cryptocurrencies, Changelly is a superb platform to think about, because it gives swift transactions and a variety of altcoin choices.

Impacts of the Ethereum Merge

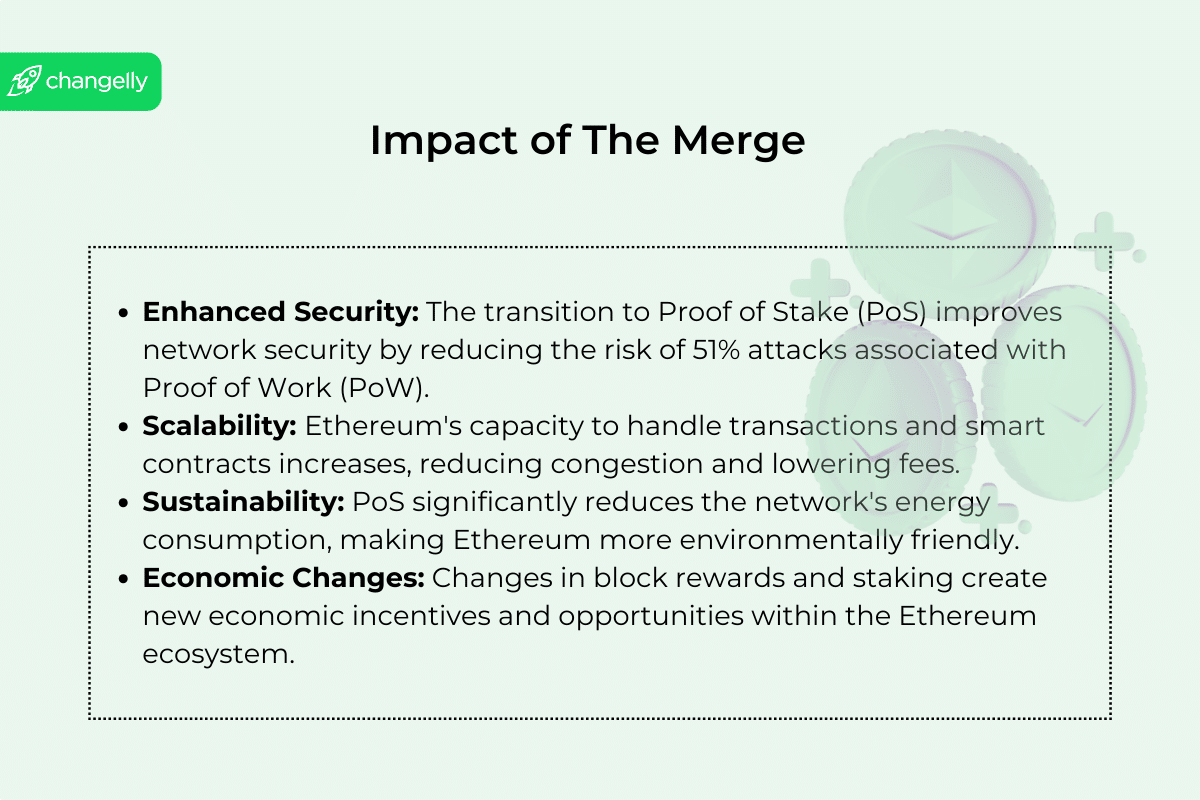

Safety: Enhancing the Ethereum Community

The Ethereum Merge enhanced the community’s safety. By transitioning from proof of labor to proof of stake, Ethereum shifted to a system much less weak to sure sorts of assaults, such because the 51% assaults which are extra possible in PoW. In PoS, the community safety is upheld by validators who’ve a considerable monetary stake within the ecosystem. This stake acts as a deterrent towards malicious actions, as validators stand to lose their funding in the event that they try and compromise the community. Moreover, the introduction of mechanisms like slashing reinforces sincere participation. This shift to PoS, subsequently, not solely improves vitality effectivity but in addition strengthens the general safety framework of Ethereum, making it extra strong towards threats and manipulations.

Scalability: Enhancements in Transaction Dealing with

One of many main objectives of the Merge was to put the groundwork for higher scalability of the Ethereum community. The transition to proof of stake is a step in the direction of a extra scalable system; it units the stage for future upgrades reminiscent of sharding. PoS permits for sooner processing of transactions in comparison with PoW, thereby growing the transaction throughput of the community. Because of this Ethereum can deal with extra transactions concurrently, decreasing congestion and enhancing person expertise. The anticipated introduction of sharding will take this functionality to a brand new degree: the community will be capable of course of many extra transactions in parallel, and Ethereum’s potential to scale and meet rising demand shall be boosted like by no means earlier than.

Sustainability: Environmental Influence of Transferring to PoS

The shift from PoW to PoS had a profound affect on Ethereum’s environmental footprint. PoW, identified for its excessive vitality consumption resulting from aggressive mining, was changed by the extra energy-efficient PoS mechanism. This variation considerably decreased the general vitality requirement of the Ethereum community. The discount in vitality consumption is a vital step in the direction of sustainability, aligning Ethereum with broader environmental objectives and making it extra interesting to environmentally aware traders and customers. This transfer marks a milestone within the blockchain business’s journey in the direction of greener and extra sustainable practices.

Transaction Charges: Potential Modifications in Charge Constructions

The Merge led to modifications that might doubtlessly affect Ethereum’s transaction payment construction. Whereas the quick impact on charges was not drastic, the transition to PoS and future scalability options like sharding are anticipated to scale back community congestion. Decrease congestion usually results in decrease transaction charges, as customers gained’t need to outbid one another as aggressively to get their transactions processed rapidly. Nonetheless, it’s essential to notice that charges are additionally influenced by demand for block area and community utilization, to allow them to fluctuate based mostly on general exercise on the Ethereum community.

Block Constructing and Reward Subsidy: Financial Implications

The transition to PoS additionally altered the financial dynamics of block creation and rewards inside the Ethereum community. Within the PoS system, validators obtain rewards for proposing and testifying to blocks, slightly than miners incomes rewards by way of block discovery as in PoW chains. This variation decreased the issuance charge of recent Ether, resulting in a lower in block reward subsidy by about 90%. This discount in new Ether issuance may have deflationary results on the Ethereum financial system, doubtlessly impacting Ether’s worth. Furthermore, the brand new mannequin aligns the pursuits of validators with the long-term well being of the community, as their rewards are straight tied to their stake and the general stability and safety of the system.

How Did The Merge Influence Customers and Traders?

- Staking Procedures and Rewards:

- Publish-Merge, Ethereum transitioned from mining to staking, essentially altering how community members earn rewards.

- Staking is accessible to anybody with a adequate quantity of Ether. The method includes holding and “staking” Ether to help community operations.

- This variation democratizes community participation, permitting broader person involvement in sustaining Ethereum’s safety.

- Influence on Funding Methods:

- The shift to staking introduces a brand new technique for passive earnings technology by way of staking rewards.

- Not like mining, staking is much less resource-intensive and gives extra predictable returns.

- The discount in Ether issuance post-Merge may affect its market worth, doubtlessly making Ether extra engaging for long-term funding.

Ethereum in a World Context

The Merge, a technological milestone in its personal proper, bolstered Ethereum’s stature within the international cryptocurrency market. As a number one blockchain platform, Ethereum’s shift to a proof-of-stake (PoS) mechanism resonates throughout the crypto panorama, influencing market dynamics and setting a precedent for different networks considering related transitions. This transfer reinforces Ethereum’s place as a forerunner in blockchain innovation and demonstrates its dedication to adapting and evolving in response to technological and environmental challenges.

Regulatory Implications and Acceptance

Ethereum’s transition has drawn consideration from regulators all over the world, turning the highlight on the potential of blockchain expertise to align with international environmental objectives. By chopping its vitality utilization, Ethereum aligns with the rising regulatory give attention to sustainability, which may encourage broader acceptance and integration of cryptocurrencies into mainstream monetary techniques. Furthermore, Ethereum’s proactive strategy to scalability and effectivity points showcases the blockchain business’s potential for accountable and sustainable progress, doubtlessly shaping future regulatory frameworks and insurance policies within the crypto area. This international recognition and regulatory curiosity underscore Ethereum’s affect and the growing relevance of blockchain expertise in varied sectors.

The Merge Community Replace: Challenges and Criticisms

Ethereum’s shift to proof of stake (PoS) has been met with issues about centralization, a problem that persists a 12 months after The Merge. Within the PoS framework, validators who verify transactions and create new blocks are required to stake 32 ETH, roughly equal to $80,000. This excessive entry threshold raises issues that the community’s validating energy may focus within the fingers of some giant stakeholders or “whales.”

The technical and monetary complexities of organising and sustaining a validator node add to those issues. Missteps on this course of can result in penalties, dissuading smaller gamers from taking part. This case may doubtlessly restrict the range of validators, skewing energy in the direction of these with vital monetary sources and technical experience.

Previous to The Merge, there have been fears that PoS may result in elevated centralization inside Ethereum. Observations post-Merge point out that these fears could maintain some benefit. As an illustration, Lido, a significant decentralized staking pool, has amassed a considerable share of the overall staked ETH. As Lido’s share approaches the 33% mark—a degree thought of dangerous by many builders—the apprehensions relating to centralization and its implications for community safety develop extra pronounced.

Many customers thought that The Merge would result in fuel charges being trimmed down, solely to seek out out they had been unsuitable as a result of this main improve, developed over six years, had no direct impact on reducing these prices. Nonetheless, it’s essential to know that The Merge was not designed to straight tackle excessive fuel costs. Relatively, its position was to put the groundwork for subsequent upgrades, that are anticipated to progressively lower transaction prices.

Critics additionally level out potential shortcomings when it comes to safety, incentive constructions, and equity underneath the PoS mannequin. The focus of staking energy amongst just a few entities certainly poses safety dangers, however it’s greater than that. It challenges the decentralized nature of the blockchain, doubtlessly undermining the ideas of equity and equal alternative which are foundational to Ethereum.

Up Subsequent: What Is the Ethereum Cancun-Deneb (Dencun) Replace?

The Ethereum Cancun-Deneb (Dencun) Improve, scheduled for early 2024, is an enormous step in Ethereum’s ongoing improvement, specializing in enhancing the scalability, safety, and usefulness of the community. A vital part of this improve is the introduction of Proto-Danksharding, a precursor to the total implementation of Danksharding. This characteristic is predicted to considerably scale back transaction prices (fuel charges) and strengthen transaction processing capability by integrating knowledge ‘blobs,’ that are giant knowledge items that permit for extra environment friendly and cost-effective knowledge storage and transaction processing.

The Dencun improve, which incorporates each Cancun and Deneb enhancements, goals to refine Ethereum’s Execution Layer (EL) and Consensus Layer (CL). It incorporates a set of Ethereum Enchancment Proposals (EIPs) which are very important for the community’s development. These EIPs embrace EIP-4844 (Proto-Danksharding), which paves the best way for full Danksharding implementation and scalability enhancements, EIP-1153 for extra economical on-chain knowledge storage, EIP-4788 to boost cross-chain bridge structure and staking swimming pools, EIP-5656 for refined modifications to the Ethereum Digital Machine (EVM) for higher efficiency, and EIP-6780, advocating for the deprecation of the SELFDESTRUCT perform in good contracts.

The Dencun improve is anticipated to convey a number of enhancements to Ethereum, reminiscent of scalability enhancements, particularly benefiting layer 2 options, a big discount in fuel charges, developments in community safety, optimized blockchain knowledge storage, and improved cross-chain interactions.

Disclaimer: Please observe that the contents of this text are usually not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.

Disclaimer: Please observe that the contents of this text are usually not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.