newbie

The Inside Price of Return, typically abbreviated as IRR, is a crucial monetary metric utilized by numerous traders, together with cryptocurrency merchants and actual property traders, to gauge the potential profitability of their investments. This device allows them to estimate potential money inflows, or optimistic money flows, and predict the proportion return they could accrue from investments (e.g., an actual property property or a cryptocurrency like Bitcoin) over outlined time intervals.

For instance, whether or not you’re an actual property investor or a crypto dealer, you would possibly use the IRR to estimate how a lot revenue you possibly can make over a particular time frame. The IRR can present you the annual development fee of potential return you would possibly get out of your investments, like an actual property property or a cryptocurrency like Bitcoin.

Right this moment, I’ll take a better take a look at this key monetary device and study how you should use it each as a crypto or a conventional investor. Moreover, I can even present you methods to discover the IRR. Having used it up to now, I can inform that though no device can really ever let you know what’s going to occur to a specific asset, it nonetheless makes your life as an investor infinitely simpler.

What Does Inside Price of Return Imply?

In a nutshell, the Inside Price of Return (IRR) is a calculation used to estimate the profitability of potential investments. It’s the low cost fee that makes the online current worth (NPV) of all money flows (each optimistic and damaging) from a specific funding equal to zero. IRR offers an efficient solution to calculate and evaluate the potential return of various investments, enabling traders to prioritize the place they put their cash.

For crypto merchants, understanding IRR will be essential in assessing which cryptocurrencies to spend money on. Given the risky nature of the market, the calculated IRR may give a sign of the long-term potential of a cryptocurrency, serving to to appreciate whether or not it matches into the dealer’s general funding technique.

Bear in mind, although, whereas IRR is a priceless device, it shouldn’t be the one metric used when making funding selections. At all times contemplate a broad vary of things, together with market traits, danger tolerance, and funding timeline, whether or not you’re dabbling in actual property, delving into cryptocurrency, or exploring different kinds of investments.

What Is IRR Used for?

The Inside Price of Return (IRR) has many purposes in monetary decision-making — cryptocurrency traders can respect it too. Usually, it’s used to judge the potential profitability of investments. When contemplating potential tasks, the IRR may give a sound concept of which mission would possibly yield greater returns. IRR is actually a yardstick that helps you evaluate and distinction totally different funding alternatives.

The IRR is expressed as an annual fee, which implies it tells you the annual development fee of your funding. Within the realm of cryptocurrency, the IRR can be utilized to estimate the annual development fee {that a} potential crypto funding might ship.

Calculating the IRR generally is a great way of projecting your funding returns and figuring out the potential success of your funding technique. If you happen to’re a crypto dealer contemplating investing in new digital currencies or preliminary coin choices (ICOs), the IRR can supply priceless perception into the funding’s potential efficiency.

However bear in mind, the IRR shouldn’t be the be-all and end-all. It needs to be considered one of a number of instruments used to judge potential investments. Different elements, reminiscent of market situations, the credibility of the mission, the staff behind the cryptocurrency, and the specifics of the expertise, also needs to be taken into consideration.

Understanding IRR

The calculation of Inside Price of Return (IRR) consists of a number of essential components. Let’s talk about each intimately.

Preliminary Funding

The preliminary funding quantity is a vital issue within the IRR calculation. It pertains to the amount of cash you initially spent on buying belongings. This capital outlay offers the muse on your funding and units the stage for future returns.

Future Money Flows

One other vital issue that influences the IRR is the anticipated future money flows. These are the projected earnings out of your funding. They could possibly be periodic, reminiscent of lease funds from actual property or potential earnings from the sale of a cryptocurrency at the next value sooner or later.

Money Movement Timing

The timing of those money flows is crucial, particularly for rental properties the place rental earnings is acquired regularly, both month-to-month or quarterly. The frequency and timing of those funds can drastically influence the general return in your funding.

Low cost Price

The low cost fee is a crucial part of the IRR calculation. Basically, it’s the return you’d must justify the chance of the funding. If the IRR exceeds your low cost fee, it could sign a doubtlessly worthwhile funding, no matter whether or not it’s actual property or cryptocurrency.

Holding Interval

The whole time you intend to carry an funding, sometimes called the holding interval, may also drastically have an effect on the IRR. Longer holding intervals can typically yield extra substantial returns.

Different Components

There are various different elements that may affect this metric. For instance, exterior elements can considerably influence future money move projections. Market volatility, regulatory modifications, or broader financial traits can all have an effect on the profitability of an funding.

When calculating IRR, additionally it is important to contemplate the chance value — the potential returns from different investments that you simply would possibly miss out on by selecting the present one. Moreover, understanding the typical value of your investments over time can present a extra life like foundation for IRR calculations.

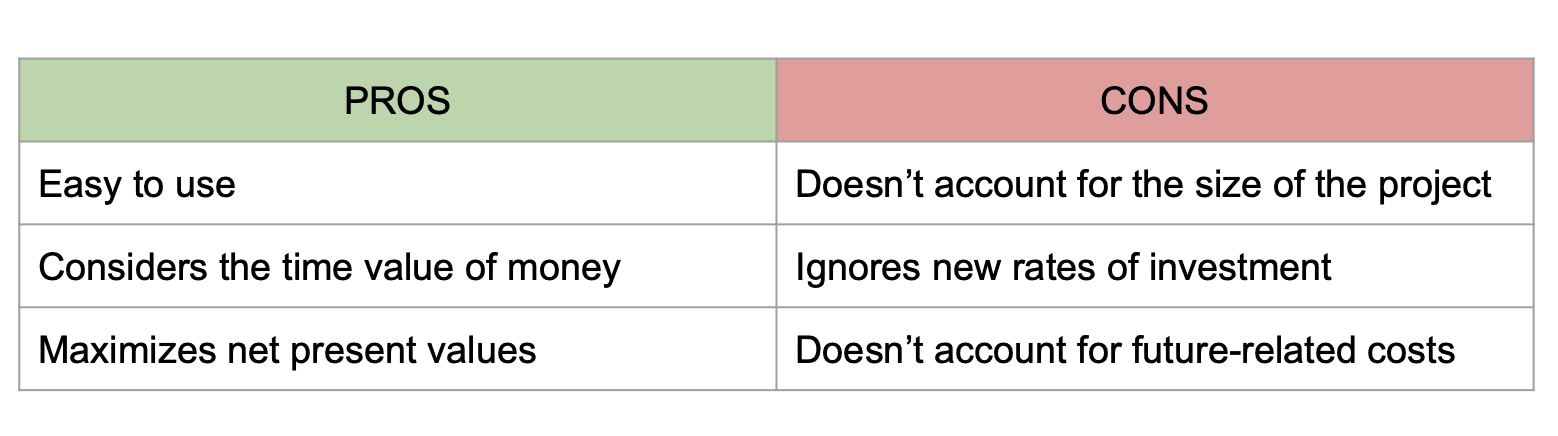

The Limitations of IRR

Identical to the rest on this world, the IRR has its professionals and cons. Whereas IRR is very useful, it’s not with out limitations, particularly on the subject of the risky nature of cryptocurrency. For example, it assumes that the longer term money flows from an funding will be reinvested on the identical fee because the IRR itself, which isn’t at all times the case in real-world situations, therefore a reinvest fee problem.

One other limitation is that IRR doesn’t contemplate the scale of the funding. Two investments might have the identical IRR, however vastly totally different funding sizes and whole returns. A cryptocurrency with a decrease IRR however a bigger scale might yield a better whole return.

Calculating IRR for cryptocurrency investments will be considerably difficult as a result of market’s excessive volatility. Moreover, there could also be intervals of damaging money flows that will complicate the monetary evaluation. Nonetheless, for long-term investments in cryptocurrencies the place you count on a major value enhance over time, the IRR can present a priceless perspective on potential returns.

Nonetheless, regardless of these hurdles, IRR stays a useful gizmo in discounted money move evaluation, serving to traders consider actual property investments and different funding choices. For example, it could actually assist decide the hurdle fee, which is the minimal fee of return anticipated by an investor to contemplate an funding. If the IRR surpasses this hurdle fee and reveals a suitable fee, the funding is seen as doubtlessly worthwhile.

The IRR will also be notably helpful when evaluating totally different funding tasks, because it offers a easy, standardized solution to evaluate anticipated returns.

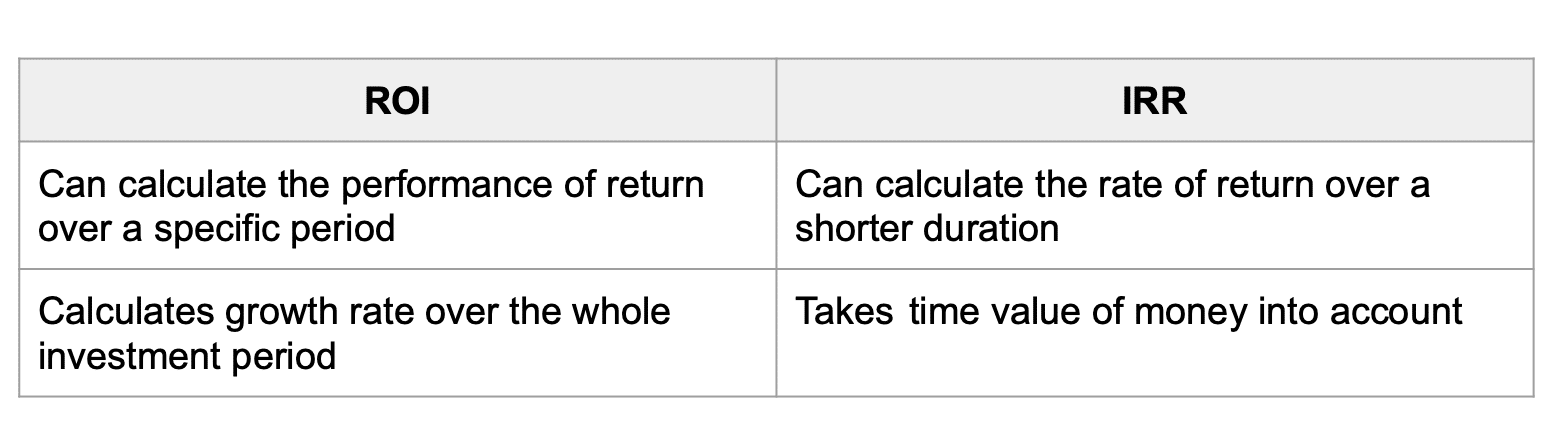

IRR vs. ROI

IRR and ROI (Return on Funding) are each essential monetary metrics utilized by traders, however they serve totally different functions and supply totally different data.

ROI is a simple metric that calculates the return of an funding relative to its preliminary value. It’s calculated by subtracting the preliminary funding from the ultimate worth, dividing by the preliminary funding, and multiplying by 100 to get a proportion. ROI is a helpful measure for evaluating the profitability of various investments, but it surely doesn’t consider the time worth of cash or the length of the funding. It’s notably weak on the subject of longer time frames and something that locations concentrate on periodic money flows.

Alternatively, IRR offers a extra complete image by contemplating the time worth of cash. It calculates the annual development fee that might make the online current worth of all money flows from a mission equal to zero. This implies it additionally considers when the returns are anticipated to happen, which will be notably helpful for long-term investments.

For cryptocurrency merchants, each metrics can present priceless insights. ROI may give a fast snapshot of potential returns, whereas IRR can supply a extra in-depth take a look at the funding’s potential over time. Nonetheless, as a result of risky nature of cryptocurrencies, these metrics needs to be used as a part of a broader funding evaluation technique.

Calculate IRR

Calculating the Inside Price of Return (IRR) might sound advanced at first, particularly in a fluctuating market like cryptocurrencies, however it’s not as daunting because it seems. Listed here are the steps:

- Determine your preliminary funding. That is the entire quantity of capital you’ve got put into the funding at the start.

- Estimate the longer term money flows. These are the potential earnings you anticipate from the funding over a time frame. Within the crypto world, this is likely to be the anticipated sale worth of your digital belongings.

- Upon getting the above knowledge, you employ trial and error to seek out the low cost fee (IRR) that makes the online current worth (NPV) of your funding zero.

The goal is to seek out an IRR that balances the preliminary funding with the longer term money flows when each are dropped at current worth phrases.

IRR Components

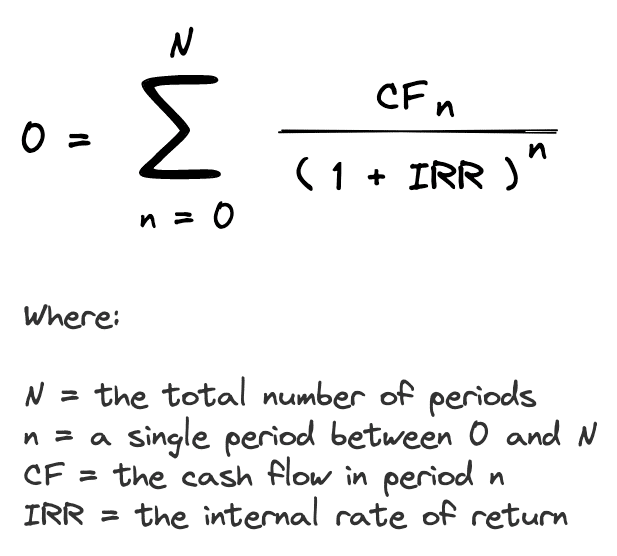

The method for IRR is a bit advanced as there isn’t any easy method for calculating IRR. It’s often calculated through a technique of trial and error or utilizing monetary calculators or software program. Nonetheless, right here’s what it conceptually appears to be like like:

Or, in textual content type:

0 = NPV = Preliminary Funding + [CF1 / (1+IRR)^1 ] + [CF2 / (1+IRR)^2 ] + … + [CFn / (1+IRR)^n ]

The place:

- NPV is the Internet Current Worth, which we need to equate to zero.

- CF1, CF2 … CFn are the longer term money flows anticipated in intervals 1, 2 … n.

- IRR is the Inside Price of Return we’re looking for.

The method primarily calculates the current worth of every future money move after which provides these up along with the preliminary funding. We iterate this course of with totally different IRRs till we discover one which makes the entire (or NPV) equal to zero.

Calculate IRR in Excel

Excel makes the method of calculating IRR a lot less complicated with its built-in IRR perform. Right here’s methods to use it:

- First, open Excel. In several cells of a column or row, put the preliminary funding (as a damaging quantity as a result of it’s cash going out) and all the longer term money flows (as optimistic numbers as a result of they’re cash coming in).

- For instance, you probably have an preliminary funding of $500 in a cryptocurrency and count on to have returns of $200, $250, and $300 over the subsequent three years, you’ll put “-500” in cell A1, “200” in cell A2, “250” in cell A3, and “300” in cell A4.

- Then, in a brand new cell, kind the method “=IRR(A1:A4)” and press Enter.

- The worth that seems within the cell the place you entered the method is the IRR of the funding.

Keep in mind that the outcome given by Excel is in decimal type, so multiply by 100 to get a proportion. In our crypto buying and selling situation, the IRR would offer an estimate of the annual return fee you possibly can count on out of your funding.

Use IRR in Funding

The Inside Price of Return (IRR) is a key device in an investor’s arsenal when assessing the potential profitability of investments, together with these within the realm of cryptocurrencies. When evaluating a number of funding alternatives, you should use the IRR to rank them so as of their projected charges of return. Usually, investments with greater IRRs could be thought-about higher funding alternatives.

through GIPHY

Make the most of all instruments at your disposal to take advantage of your funding. Supply: Pudgy Penguins

By assessing numerous potential investments, your chosen fee of return can considerably affect your monetary success. Nonetheless, investing solely primarily based on IRR will be dangerous, notably within the risky world of cryptocurrencies. Whereas IRR considers the time worth of cash and anticipated future money flows, it doesn’t issue within the dimension of the mission, the chance concerned, or market traits.

Due to this fact, whereas a excessive IRR would possibly point out a doubtlessly profitable funding, it’s essential to contemplate different elements, just like the mission’s credibility, its place out there, and your individual danger tolerance for a complete monetary evaluation. At all times be certain that your decision-making course of is well-informed and thorough, whether or not you’re investing in actual property, delving into cryptocurrency, or exploring different kinds of investments.

IRR Instance in Crypto

Let’s take a sensible take a look at how IRR can work in a crypto context. Suppose you’re a crypto dealer planning to take a position $1,000 in a specific cryptocurrency. You are expecting that the funding will present money flows of $300, $400, and $500 over the subsequent three years.

To seek out the IRR, you possibly can use Excel or a monetary calculator to unravel the IRR on this state of affairs. After inputting the preliminary funding and the longer term money flows, the IRR perform could offer you an IRR of, say, 20%.

Which means, primarily based in your projected money flows, your funding within the cryptocurrency is anticipated to generate an annual return of 20%. Nonetheless, do not forget that the precise return could differ, particularly as a result of unpredictable nature of cryptocurrency markets.

What Is a Good Inside Price of Return?

What is taken into account a “good” IRR can depend upon numerous elements, together with the kind of funding and the investor’s particular person monetary targets and danger tolerance.

For conventional investments, an IRR that exceeds the price of capital (the return fee you possibly can get from another funding with comparable danger) is usually thought-about good. Many traders would possibly search for an IRR that’s considerably greater than the price of capital to compensate for the chance concerned.

Within the context of cryptocurrencies, defining a “good” IRR will be tougher as a result of extremely risky nature of the market. Whereas a excessive IRR might sound promising, it’s essential to contemplate the extent of danger and the potential for drastic value fluctuations.

As a rule of thumb, the next IRR signifies a extra worthwhile funding alternative, but it surely ought to by no means be the one think about your decision-making course of. At all times contemplate different elements, such because the mission’s potential, market traits, and your private danger tolerance.

Disclaimer: Please be aware that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.