Return on Funding (ROI) measures the profitability of an funding. This information explains what ROI is and offers a step-by-step information on find out how to calculate it.

Return on funding (ROI) helps enterprise homeowners and buyers work out how worthwhile an funding is. ROI is calculated by dividing internet revenue by the price of funding, then changing that determine right into a share. Whether or not you’re seeking to develop your corporation or simply attempting to decide on the perfect shares on your 401K, figuring out find out how to calculate and interpret ROI is important monetary data.

Soar to:

What’s ROI?

ROI stands for “return on funding.” ROI is a straightforward calculation that’s used to judge the profitability of a selected funding, i.e., how a lot cash your funding has made (or misplaced). It may also be used to check the profitability of a number of investments by calculating the ROI for each after which evaluating them.

Modified ROIs could also be utilized in conditions exterior of monetary investments. For instance, social media ROI is used to calculate how a lot income was generated from a social media marketing campaign to see if the prices of the marketing campaign had been worthwhile.

How one can calculate ROI

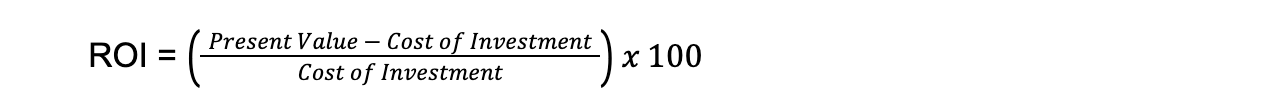

Luckily, the method to calculate the return on funding may be very easy. You divide the online revenue by the price of funding, then multiply it by 100 to get a share:

In case you don’t already know the online revenue, you possibly can determine that out by subtracting the price of the funding from the current worth of the funding throughout the identical method:

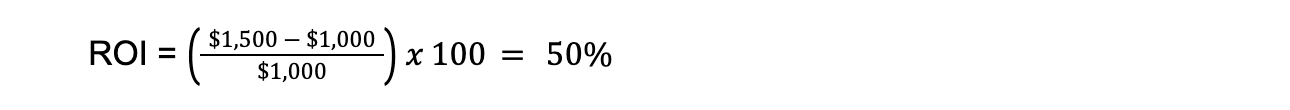

So, let’s say that you simply invested $1,000 in a catering enterprise final yr, and now your shares within the enterprise are value $1,500. Right here’s how you’d calculate your ROI utilizing the second method:

|

In case you’re a enterprise proprietor, then correct accounting is important for protecting monitor of the numbers wanted to calculate ROI. Accounting software program makes it straightforward to trace your income and bills. Nonetheless, not all small-business accounting software program will calculate ROI for you, so that you’ll most likely have to trace the numbers and work out ROI by yourself. |

How one can use ROI

Whereas ROI doesn’t seize the total monetary image, it’s a straightforward and fast approach to determine the profitability of an funding. A optimistic ROI means you’re creating wealth in your funding, and a detrimental ROI means you’re shedding cash in your funding. The upper the optimistic ROI is, the extra worthwhile and environment friendly that specific funding is.

ROI may also be used to check the profitability and effectivity of a number of investments. To do that, you’d calculate the ROI for every particular person funding, then examine the chances to see how they stack up. When utilizing ROI to check investments, needless to say the ROI calculation leaves out sure data, comparable to how way back you made every funding.

What is an efficient ROI?

A great ROI depends upon many various elements, together with the kind of funding, the state of the market, the period of time that has handed and the investor’s private tolerance for threat. What constitutes a great ROI for a public inventory will not be the identical as a great ROI for a personal small enterprise. What one investor considers an important ROI might seem to be a nasty ROI to a different investor.

For instance, 10% is taken into account an average-to-good ROI for investments within the inventory market. The S&P 500, an index that serves as a benchmark for the general U.S. inventory market, has a mean return of barely above 10%, so something higher than that may be a good ROI. Nonetheless, a ten% return on funding could be thought of really wonderful for presidency bonds, which generally return 5%–6% per yr.

That being mentioned, a detrimental ROI is unquestionably a nasty ROI as a result of it signifies that you’re shedding cash (i.e., you’re getting much less cash out of the funding than you place in). It is best to keep away from detrimental ROI investments and concentrate on alternatives which have a optimistic ROI every time attainable, nevertheless it’s as much as you if you wish to give an funding extra time to carry out.

What are the restrictions of ROI?

Since ROI is such a easy calculation, it leaves out some essential data. For starters, it doesn’t account for inflation, which might cut back the true value of an funding. Extra difficult formulation comparable to internet current worth (NPV) do take inflation into consideration, however they’re harder to calculate than ROI.

ROI additionally doesn’t account for the time that has elapsed between the preliminary funding and the present worth. Getting a 50% price of return in a single yr is way completely different from getting a 50% price of return over a decade. That is why many individuals use ROI alongside the speed of return (ROR) to account for the timeframe in addition to the return on funding.

ROI additionally focuses solely on the cash side and doesn’t account for any environmental, social or well being impacts of the investments. As an illustration, some buyers favor to not put money into cigarette producers irrespective of how nice the ROI is due to the confirmed detrimental impacts of cigarette smoking. Different initiatives, comparable to retrofitting factories to be LEED licensed, might negatively impression ROI within the brief time period however have useful results for staff, society and the planet over the long term.

What are the purposes of ROI?

ROI has many potential purposes for enterprise homeowners and buyers. For enterprise homeowners, return on funding helps them calculate if their numerous ventures are creating wealth, and if that’s the case, how a lot. For a enterprise to remain worthwhile, it should have a optimistic ROI, making this one of many key metrics to trace over time with the assistance of accounting apps and enterprise intelligence software program.

ROI can be essential for buyers of all types, whether or not you’re actively placing your personal cash into the inventory market or simply have a compulsory 401K by means of your employer. ROI helps you determine how particular person shares and funds are performing relative to one another and the remainder of the market, serving to you to make knowledgeable selections about the place to speculate your cash.