Whereas it may be extremely profitable, cryptocurrency buying and selling can also be fraught with a variety of dangers and challenges. Even skilled merchants can lose cash in the event that they’re not cautious. One such hazard that buyers must be looking out for is one thing known as slippage. On this article, we’ll outline what slippage in crypto is, take a look at the way it can have an effect on merchants, and provide some tips about keep away from it. Keep protected on the market!

What Is Slippage?

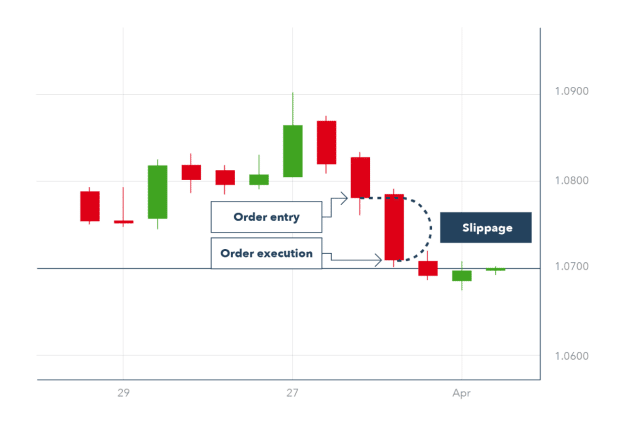

Slippage is the distinction between the anticipated value of the commerce and the precise value at which the commerce is executed. It usually happens when there’s a sudden change in market situations, resembling a pointy improve in rates of interest. Whereas all sorts of transactions are vulnerable to slippage, it’s commonest in fast-moving markets. For instance, in case you are shopping for an asset for $100 and its market value all of a sudden jumps to $105, you’ll expertise slippage. Whereas slippage will be pricey, it’s normally not an indication of fraud or poor-quality securities. As an alternative, it’s merely a mirrored image of the truth that costs can change shortly in unstable markets.

What Is Slippage in Crypto?

Okay, we’ve bought the conventional slippage coated, however what’s slippage in crypto? Merely put, crypto slippage refers back to the distinction between the anticipated value of a cryptocurrency transaction and the precise value at which it’s executed. This may occur when buying and selling on decentralized exchanges, the place speedy modifications in value on account of unstable buying and selling exercise can result in important discrepancies between the supposed transaction value and the ultimate settled value. Slippage is especially pronounced in crypto markets on account of their excessive volatility and generally decrease liquidity in comparison with conventional monetary markets.

The influence of slippage within the crypto world can range; it would work in favor of the dealer if the asset’s value improves between the time of order placement and execution, an occasion often called optimistic slippage. Nonetheless, extra usually, merchants expertise unfavorable slippage, particularly during times of excessive volatility when the value strikes towards the dealer’s curiosity. This may improve the price of entry right into a place or scale back the income when promoting. Crypto merchants can decrease slippage by buying and selling on extra liquid markets or setting limits on their trades to regulate the worst value at which they’re prepared to commerce, thereby managing the potential monetary influence associated to the present market value and anticipated value slippage.

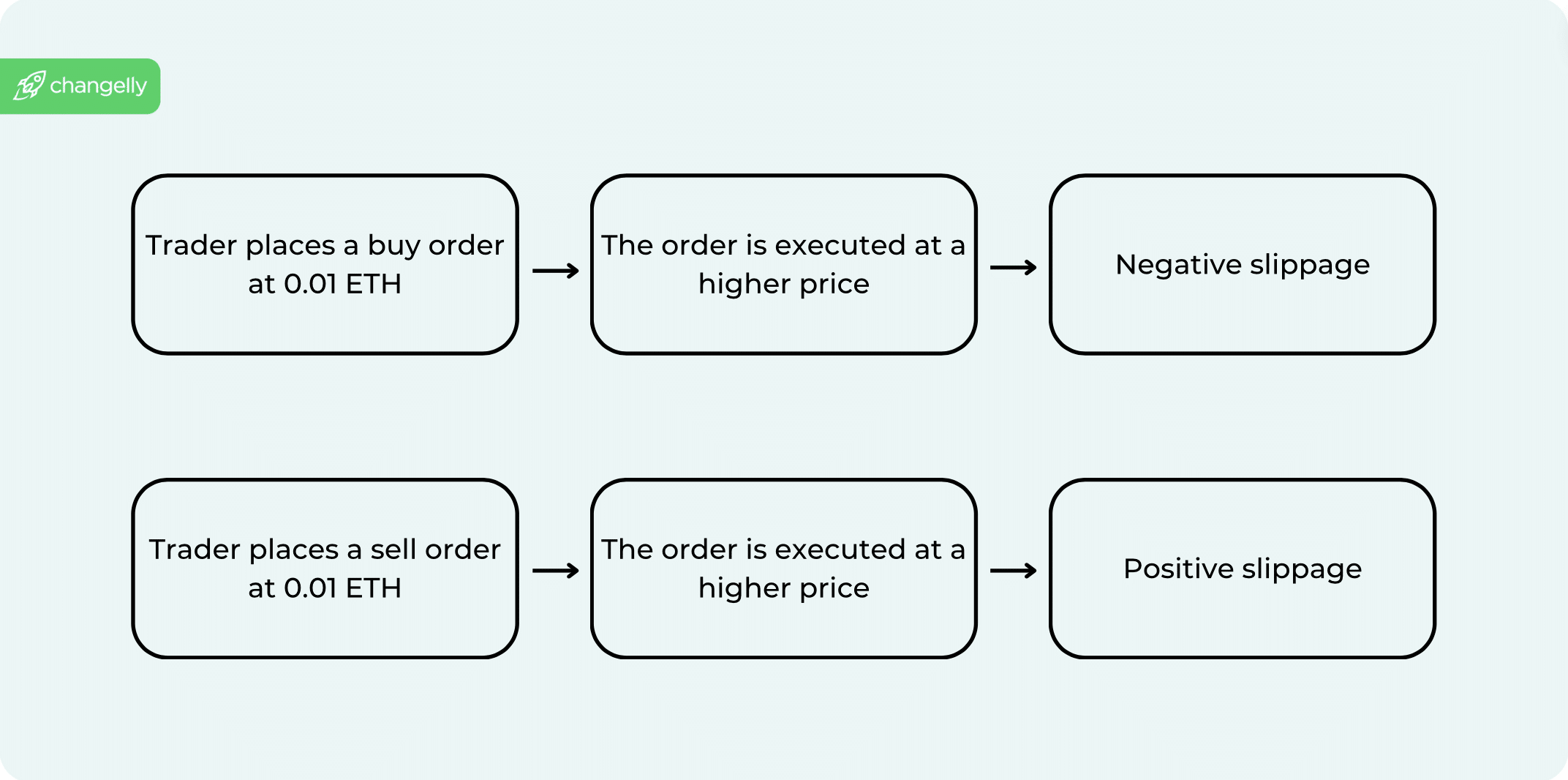

Optimistic vs. Detrimental Slippage

Slippage can occur in each rising and falling markets and will be optimistic or unfavorable. Optimistic slippage happens when the order is executed at a value higher than anticipated, whereas unfavorable slippage occurs when the order is crammed at a worse value. Whereas each sorts of slippage can have an effect on buying and selling outcomes, optimistic slippage is mostly thought-about extra advantageous for merchants. That’s as a result of optimistic slippage represents a chance to purchase or promote at a greater value than anticipated, whereas unfavorable slippage merely represents a loss. As such, most crypto merchants try to attenuate unfavorable slippage whereas maximizing optimistic slippage.

Examples of Slippage

Let’s say you wish to buy the cryptocurrency listed on a crypto buying and selling platform for $10.00. After inserting your market order, you uncover that it was truly filed for a better value of $10.50.

This case illustrates unfavorable slippage since you bought an order at a better value than anticipated, lowering the general buying energy of your funds.

Optimistic slippage, alternatively, happens if you place a purchase order at $10.00 however shut it at solely $9.50. Your buying energy rises on account of the decreased value.

How Does Slippage Work?

An asset is bought or bought at the absolute best value when an order is executed on an change. Slippage can occur between the time when a commerce is initiated and when it’s accomplished since a cryptocurrency’s market value would possibly fluctuate swiftly.

How one can Calculate Slippage in Crypto

Right here’s how one can calculate slippage in crypto:

- Determine the Anticipated Worth: That is the value you hope to purchase or promote a crypto asset at if you place an order.

- Decide the Precise Execution Worth: That is the value at which your commerce is definitely executed on the change.

- Calculate the Distinction: Subtract the anticipated value from the precise execution value.

- Convert to Share: Divide the distinction by the anticipated value after which multiply by 100 to get the proportion of slippage.

Right here’s the system for calculating slippage in crypto:

Slippage % = ((Precise Execution Worth – Anticipated Worth) / Anticipated Worth) * 100

Calculating slippage is essential for understanding how market situations, resembling liquidity and volatility, can have an effect on your buying and selling final result, particularly on decentralized exchanges the place value modifications will be swift and sizable. This perception helps in setting more practical commerce methods, resembling utilizing restrict orders to cap potential slippage.

What Causes Slippage?

A sure variety of consumers and an equal variety of sellers are required to execute the proper order. If there’s an imbalance, costs will fluctuate, and slippage will observe.

As talked about earlier, slippage can happen in each rising and falling markets. It’s normally attributable to an absence of liquidity within the crypto market or excessive value volatility.

Low Market Liquidity

In a low liquidity market, there is probably not sufficient consumers or sellers to fill all orders on the requested value, which ends up in slippage.

Worth Volatility

Excessive value volatility could cause slippage as costs can transfer all of a sudden and unexpectedly. Since massive market orders are inclined to influence the market value considerably, slippage can even happen once they’re positioned. For instance, if a big purchase order is positioned for an asset that isn’t continuously traded, its value might sharply improve as consumers compete for the out there shares. This may trigger slippage for subsequent purchase orders as a result of the asset might commerce at a better value than anticipated.

Would you wish to get extra helpful tips about crypto buying and selling? Subscribe to our weekly publication to remain up to date on the newest crypto traits!

What Is Slippage Tolerance?

Slippage tolerance is a setting that permits merchants to specify the utmost quantity of slippage they’re prepared to just accept for his or her order. It’s constructed into restrict orders as a method to account for instability or volatility available in the market.

For instance, should you place a purchase order for a inventory at $10 with a slippage tolerance of 5%, your order is not going to fill until you should purchase the shares for not more than $10.50 — that shall be your minimal value. Slippage tolerance is usually expressed as a share however will also be represented by a sure variety of ticks or pips. For some merchants, slippage is an accepted value of buying and selling; for others, it’s thought-about unacceptable and must be minimized.

There are just a few alternative ways to take care of slippage. A method is to easily settle for it as a price of buying and selling and issue it into your general technique. One other manner is to attempt to keep away from it by utilizing restrict orders as a substitute of market orders and/or by buying and selling when the market is most steady. This manner merchants guarantee they are going to buy the belongings on the precise value they need.

Some merchants even attempt to reap the benefits of slippage by inserting restrict orders outdoors of the present bid-ask unfold; if their order fills, they pocket the distinction between the execution value and the present bid or ask value. Merchants who function in unpredictable markets or on crypto tasks with little liquidity and excessive commerce quantity, resembling coin launch tasks, sometimes profit from having a low slippage tolerance.

How one can Keep away from Slippage

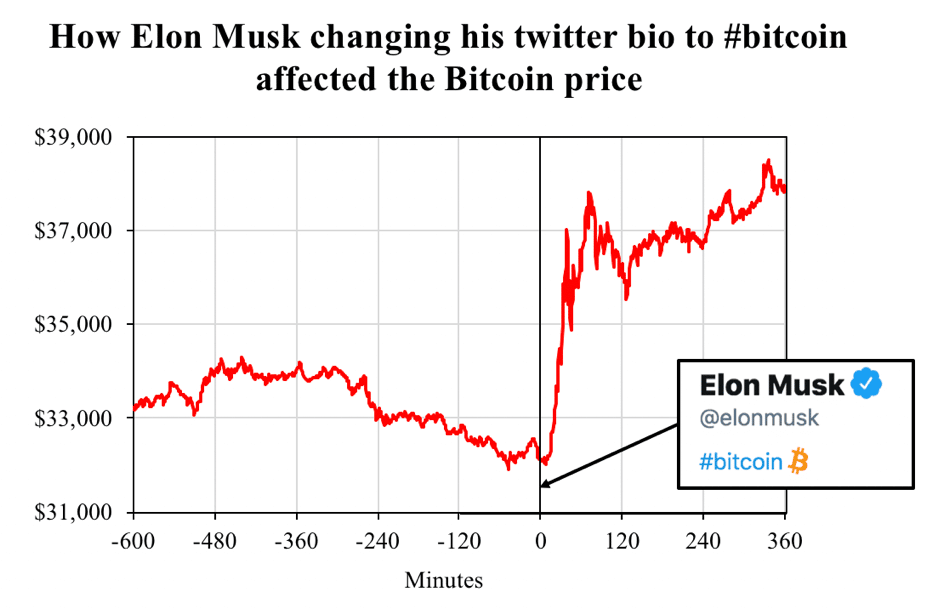

There may be now a method to absolutely remove slippage. Due to the dearth of construction and stability within the cryptocurrency market in comparison with the inventory or futures markets, the value of a token can shortly shift on account of influencers’ social media exercise. Because of this, it may be difficult to foretell when sure occasions that improve market volatility will happen. Nonetheless, there are particular actions you may take into account to attenuate slippage whereas buying and selling cryptocurrencies.

How one can Management and Decrease Slippage

- Place restrict value orders as a substitute of market orders.

This ensures you’ll solely purchase or promote on the value you need.

- Use a buying and selling platform with excessive liquidity.

This manner, there’s a greater likelihood that your order shall be crammed at a positive value.

- Keep away from buying and selling throughout high-volatility intervals and attempt to commerce throughout off-peak hours.

The markets are sometimes much less unstable throughout these instances, which may also help forestall massive deviations between the anticipated and precise commerce costs.

- Regulate information and main occasions.

The market is very turbulent throughout essential bulletins.

- Know the place your entrance and exit factors are.

This may also tremendously help in lowering threat as a lot as doable.

Whilst you can’t at all times management when slippage occurs, following the following pointers may also help decrease its occurrences.

FAQ

What’s regular slippage?

The slippage share represents the quantity of value motion for a sure asset. It’s essential to remember the fact that the slippage dimension is usually small. The slippage between 0.05% and 0.10% is typical. The slippage of 0.50% to 1% might occur in notably turbulent circumstances. Buyers ought to pay attention to what this implies in precise cash phrases.

What’s a 2% slippage?

2% slippage and better is taken into account extraordinarily harmful.

Does slippage matter in crypto?

Sure, slippage is a crucial issue to think about in each crypto buying and selling and investing. Earlier than coming into any transactions, merchants ought to at all times attempt to scale back slippage and make a slippage calculation.

Is excessive slippage good?

Excessive slippage is taken into account a foul signal for buying and selling because it characterizes a particularly unstable market.

Do you lose cash on slippage?

It is determined by the kind of slippage you’re experiencing, unfavorable or optimistic.

What’s a unfavorable slippage?

Detrimental slippage means the value distinction works towards you.

Is slippage a payment?

No, it’s the distinction between the supposed value and the executed value.

What is an efficient slippage tolerance?

It is determined by your buying and selling targets, and it is best to arrange a slippage tolerance share accordingly.

Why is slippage so excessive?

Excessive slippage sometimes happens throughout high-volatility market situations when a dealer’s order can’t be instantly matched by out there liquidity available in the market.

How do you commerce with low slippage?

Low slippage truly creates a very good setting for merchants.

Remaining Ideas

In the end, slippage is one thing that each dealer has to take care of in a technique or one other. By understanding what slippage is and the way it works, you may be sure that it doesn’t influence your buying and selling technique in a unfavorable manner. Whereas it could possibly usually be troublesome to keep away from utterly, merchants can decrease its results by utilizing restrict orders and monitoring market situations intently. By doing so, they may also help make sure that their trades are executed at costs which can be as near their expectations as doable.

Disclaimer: Please notice that the contents of this text should not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.