USDT, also referred to as Tether, has turn out to be an integral a part of cryptocurrency markets since its launch in 2014. Pegged 1:1 to the US greenback, it’s the most generally used stablecoin with a market capitalization of over $83 billion as of October 2023. However it is usually controversial, with opaque reserves and questions round its long-term viability.

Right here is an in-depth have a look at how USDT works, its significance in crypto, and the dangers it presents.

What’s USDT? Overview of Tether Stablecoin Cryptocurrency

At its core, Tether capabilities as a stablecoin, which means every token is backed by an equal quantity of conventional fiat forex.

This peg to the greenback goals to reduce volatility in comparison with different cryptocurrencies like Bitcoin and Ethereum. USDT operates on completely different blockchains like Bitcoin, Ethereum, Tron and others, permitting it to be transferred seamlessly between completely different networks.

Crypto merchants depend on USDT as a steady retailer of worth when buying and selling between completely different digital property. It is usually broadly used on decentralized finance (DeFi) platforms for lending, borrowing, and making funds.

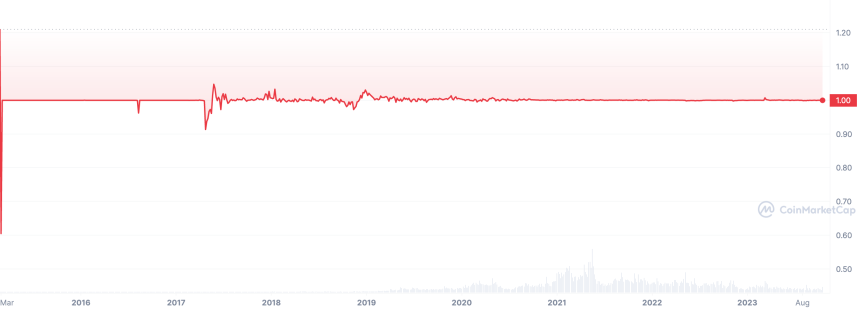

USDT worth: $1

USDT Market Cap: ~$83 billion (as of October 2023)

Key Options of USDT Crypto

The important thing options that outline Tether embrace:

- Pegged 1:1 to the US greenback – USDT goals to take care of parity with the greenback

- Operates on completely different blockchains – Permits switch between networks

- Hedges in opposition to crypto volatility – Acts as a steady haven when markets are fluctuating

- Large adoption – Used extensively in crypto buying and selling and DeFi protocols

How Does USDT Preserve Its Greenback Peg?

In keeping with Tether Restricted, the corporate behind USDT, each token in circulation is backed 1:1 by their reserves, which embrace each conventional forex and money equivalents. When consumers buy USDT by depositing $1 per token, new tokens are issued whereas the {dollars} are held in reserves.

This mechanism theoretically permits customers to redeem every USDT to USD. By permitting two-way convertibility between USDT and {dollars}, the availability can alter to take care of the 1:1 parity.

Nevertheless, Tether’s reserves have been shrouded in secrecy through the years, resulting in allegations that the corporate doesn’t maintain enough greenback reserves to again all USDT in circulation. Tether settled a case with the New York Lawyer Normal in 2021, agreeing to launch periodic reviews on its reserves.

To this point, the redemptions have typically maintained the greenback peg. However questions linger over the breakdown of reserves and their adequacy as USDT provide has ballooned.

USDT Value Chart from CoinMarketCap

The Function and Significance of USDT in Crypto

Regardless of the opacity, USDT continues to play a massively vital position in cryptocurrency markets. It is among the most generally traded crypto property, with each day buying and selling volumes within the billions of {dollars} in opposition to property like Bitcoin.

Exchanges depend on stablecoin buying and selling pairs like BTC/USDT to allow merchants to hedge threat throughout instances of excessive volatility.

USDT can be broadly built-in into DeFi protocols like lending and borrowing platforms, decentralized exchanges, yield farms, and extra. It supplies stability in an in any other case risky surroundings for decentralized finance.

The demand for USDT buying and selling, transactions, and parking worth in a steady asset continues to drive rising adoption.

Future Outlook for Tether Stablecoin

Going ahead, the largest risk to USDT is the danger of shedding its 1:1 greenback peg and collapsing in worth if its reserves are insufficient. Tether additionally faces potential regulatory crackdowns from authorities who might threaten its viability. Competing stablecoins like USDC and BUSD are extra clear about reserves and will acquire share.

Nevertheless, USDT retains first-mover benefit and the community results of wider integration in crypto infrastructure. It continues to take care of peg stability via redemptions to this point. If Tether can present better transparency and embrace compliance, USDT might retain its dominant place for a while. However merchants ought to train warning and perceive the dangers of relying an excessive amount of on USDT long-term.

Regardless of controversies round reserves and regulation, Tether stays an integral cog within the crypto economic system machine. However because the market matures, stablecoins constructed on better transparency and compliance are more likely to emerge as leaders.

How Does USDT Work?

There are just a few key mechanisms that allow USDT to perform as a stablecoin pegged to the US greenback:

Minting and Issuing New USDT

Tether mints new USDT when consumers deposit $1 per token with the corporate. The {dollars} are added to reserves, whereas an equal quantity of USDT is issued on the blockchain ledger. This USDT enters circulation when transferred to the client’s pockets deal with. The minting helps alter provide to match demand.

Sending and Receiving USDT Transactions

As soon as issued, USDT might be transacted between addresses on its supported blockchains like every other cryptocurrency. Senders can broadcast transactions and pay small community charges to ship USDT to recipients’ pockets addresses. These peer-to-peer transactions are recorded transparently on public blockchain explorers.

Buying and selling USDT on Exchanges and DeFi

USDT is listed as a buying and selling pair on most main centralized crypto exchanges in addition to decentralized exchanges. Merchants can use USDT to purchase and promote different cryptos like Bitcoin in a steady method when volatility is excessive. In decentralized finance, USDT additionally serves as a steady forex for lending, borrowing, liquidity provision, and extra.

Redeeming USDT for {Dollars}

In concept, USDT holders can redeem every token for precisely 1 US greenback from Tether Restricted. That is made potential by the underlying reserves that again every token. Redemptions assist keep the 1:1 peg when USDT falls under $1 on exchanges. Nevertheless, Tether reserves the precise to delay or deny redemptions in some circumstances.

Professionals and Cons of USDT Stablecoin

USDT supplies stability amid crypto volatility but in addition carries dangers:

Professionals

- Keep away from volatility by parking worth in USDT

- Seamless transfers between blockchains

- Large acceptance in crypto ecosystem

- Helpful for decentralized buying and selling and finance

Cons

- Opaque reserves increase viability considerations

- Regulatory crackdowns might threaten operations

- Reliant on Tether’s redemption coverage to take care of peg

- Weak to financial institution runs if reserves are insufficient

Tether pioneered stablecoins in crypto however clear alternate options like USDC are rising. Regulatory path will play a key position in figuring out whether or not USDT maintains dominance long-term.

In conclusion, USDT stays indispensable for crypto buying and selling and finance right now. However prudent customers ought to assess dangers of relying extensively on USDT if its opaque operations and reserves increase too many questions on its sustainability. Because the sector develops, the steadiness and transparency supplied by its rivals might make them a safer guess over the approaching years

USDT FAQ: Tether Regularly Requested Questions & Solutions

What’s USDT TRC20?

USDT TRC20 is the model of Tether stablecoin issued on the Tron blockchain as a TRC20 token. It permits sooner transactions and decrease charges in comparison with USDT on Ethereum. USDT ERC20 is on the market solely on Ethereum.

What does USDT imply?

USDT stands for United States Greenback Tether. It’s a cryptocurrency issued by Tether that’s pegged 1:1 to the US greenback. Every USDT token is backed by $1 in reserves based on Tether Restricted.

What’s the distinction between USDC and USDT?

USDC is issued by Circle whereas USDT is issued by Tether. USDC has better transparency on reserves and audits in comparison with the extra opaque USDT. Nevertheless, USDT presently has wider adoption in crypto buying and selling and DeFi purposes.

What’s Tether USDT?

Tether USDT is a stablecoin cryptocurrency whose worth is pegged to the US greenback on a 1:1 foundation. It permits crypto merchants and customers to keep away from volatility by storing worth in USDT tokens backed by equal USD reserves.

What does USDT stand for?

USDT stands for United States Greenback Tether. It’s the ticker image used to designate the Tether stablecoin whose worth is pegged to the US greenback.

Is USDT a cryptocurrency?

Sure, USDT is a cryptocurrency token issued on numerous blockchains. Nevertheless, not like risky cryptos, USDT is a stablecoin designed to have a steady worth via US greenback reserves.

What’s the USDT token contract deal with?

The USDT token deal with permits customers to confirm USDT transactions on block explorers. For instance, the USDT Ethereum contract deal with is 0xdac17f958d2ee523a2206206994597c13d831ec7.

What’s the present worth of USDT?

The worth of USDT is pegged to $1.00 USD. It goals to take care of parity with the greenback via Tether Restricted’s greenback reserves that again every USDT token 1:1.

What’s USDT crypto used for?

USDT supplies stability versus risky crypto property. It’s used for buying and selling, funds, incomes yield, loans, and different monetary actions the place dollar-pegged stability is most popular.

The place can I purchase USDT cash?

USDT might be bought on most main crypto exchanges like Binance, Coinbase, Kraken, KuCoin and so on. You’ll be able to commerce {dollars} or cryptos like BTC for USDT tokens on these centralized platforms.

Is it secure to put money into USDT stablecoin?

USDT does carry dangers associated to transparency and reserves that must be thought-about. Stablecoins like USDC with extra transparency might probably be safer long-term investments.