An analyst has revealed a easy technique for getting and promoting Bitcoin utilizing the historic sample adopted by two BTC on-chain indicators.

These Bitcoin On-Chain Indicators Have Adopted A Particular Sample Traditionally

In a post on X, CryptoQuant creator Axel Adler Jr. mentioned a easy technique for timing shopping for and promoting strikes for Bitcoin. The technique relies on the pattern witnessed traditionally in two BTC on-chain metrics: the Web Unrealized Loss (NUL) and Web Unrealized Revenue (NUP).

As their names counsel, these indicators preserve monitor of the whole quantity of unrealized loss and unrealized revenue that the traders are at the moment carrying.

These metrics work by going by the transaction historical past of every coin in circulation to see what value it was final transacted at. Assuming that the final switch of every coin was the final time it modified arms, the value at its prompt would act as its present price foundation.

If the earlier value for any coin was lower than the present spot value of the cryptocurrency, then that coin is at the moment carrying a revenue. The NUP subtracts the 2 to calculate the precise unrealized achieve for the coin.

Equally, the NUL does the identical for cash which have their price foundation above the most recent worth of the asset. These indicators then sum up this worth for the whole provide and divide the sum by the present market cap.

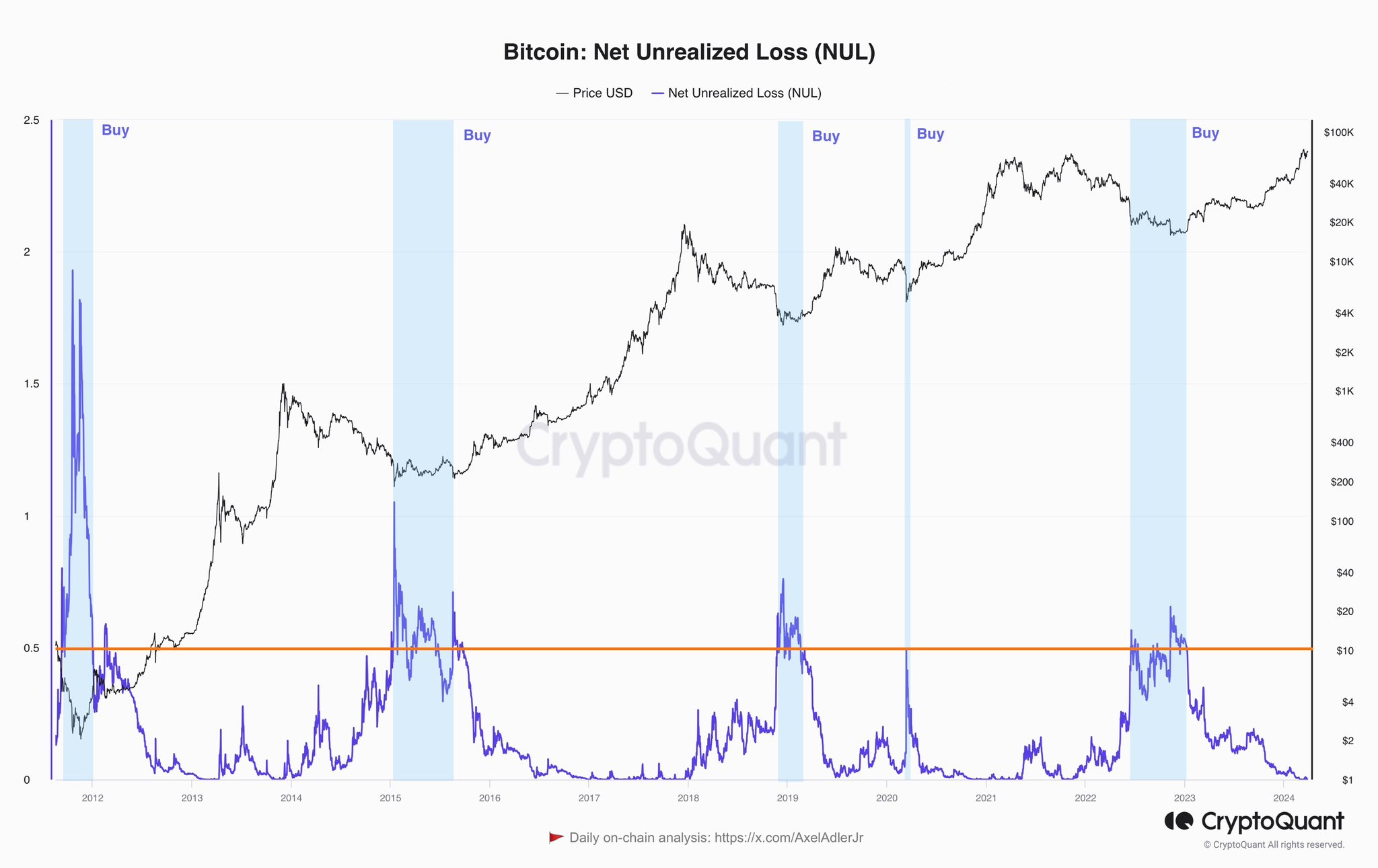

Now, first, here’s a chart shared by the analyst for the NUL that reveals a sample that the metric has been following all through the historical past of Bitcoin:

The worth of the metric appears to have been heading down in latest days | Supply: @AxelAdlerJr on X

The Bitcoin NUL seems to have traditionally damaged above the 0.5 degree when the asset’s value has traded round bear market lows. In response to Axel, the indicator on this territory can be the second to purchase extra.

Lately, the metric has been floating across the zero mark, which means that there was any unrealized loss being held by the traders. This is sensible, because the cryptocurrency has set new all-time highs (ATHs). Naturally, 100% of the provision goes into revenue when an ATH is ready.

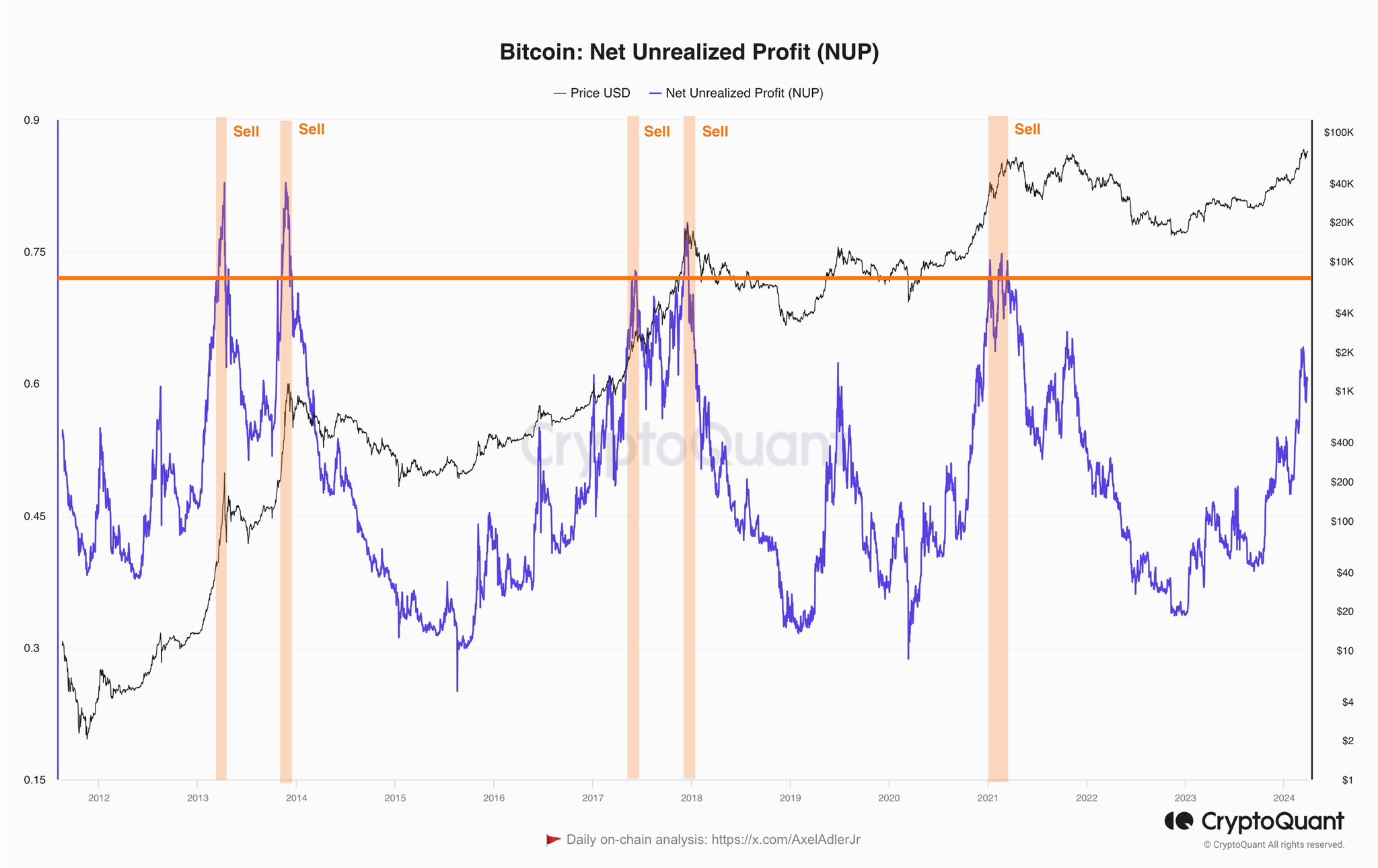

Just like the sample within the NUL, the NUP has been above the 0.7 degree throughout main tops previously, suggesting that it could be a great alternative to promote when the indicator is on this zone.

Seems to be like the worth of the indicator has been climbing up just lately | Supply: @AxelAdlerJr on X

As is seen within the chart, the NUP has been marching up with the latest rally in Bitcoin. Nonetheless, to date, the indicator hasn’t damaged above the seemingly essential 0.7 degree, implying that the market might not but be in an overheated place the place promoting can be preferrred, not less than in response to this technique.

The graphs of the 2 indicators, although, present that neither of them flagged the precise tops or bottoms within the asset. It’s particularly outstanding within the information of the NUP, the place the metric signaled “promote” throughout tops that have been merely midway by the bull run.

That stated, shopping for through the factors flagged by the NUL after which promoting on the overheated NUP values would have traditionally been worthwhile. In that sense, this may certainly be a “easy” technique for the asset.

It stays to be seen, although, whether or not these patterns will proceed to carry within the present Bitcoin cycle as properly.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $69,400, down 2% over the previous 24 hours.

The worth of the asset seems to have been shifting sideways just lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site completely at your individual danger.