Alphabet inventory has stable development expectations and a powerful moat. So why is the inventory down a lot this 12 months? The Day by day Breakdown dives in.

Friday’s TLDR

- GOOG inventory has tumbled

- The basics are clear

- However what in regards to the dangers?

Deep Dive

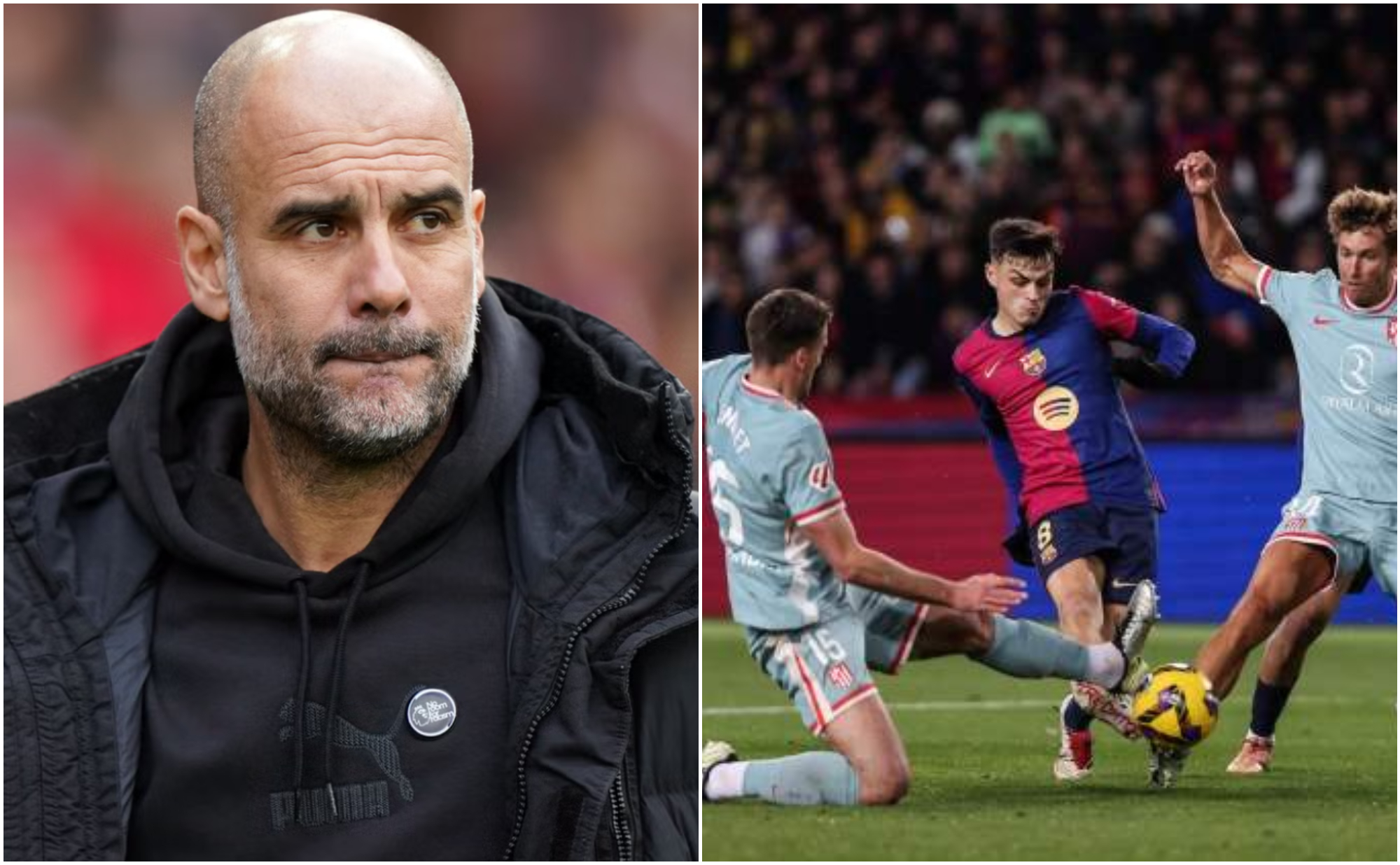

Let’s name it what it’s: It’s been a troublesome stretch for the Magnificent 7. With simply two classes left in Q1, Meta is the one one which’s greater to date this quarter. In the case of pulling again from its 52-week highs, Apple has the greatest efficiency with a 14% decline.

Sheesh!

Alphabet stands out given analysts’ expectations for double-digit development and a ahead price-to-earnings of simply 18x — the bottom within the Magazine 7 group and under the S&P 500’s present a number of of 21x. Regardless of this, the inventory is down 13% this quarter and has fallen greater than 21% from its report excessive in early February.

Most of us know Alphabet because the guardian firm for Google — the preferred search platform (and web site) on the planet. The corporate additionally owns the second-most standard web site on the planet: YouTube.

Behind search and advert income, the agency additionally has a quickly rising however notably smaller enterprise with Google Cloud, whereas working different key enterprise segments, like Android and Google Play.

The Fundamentals

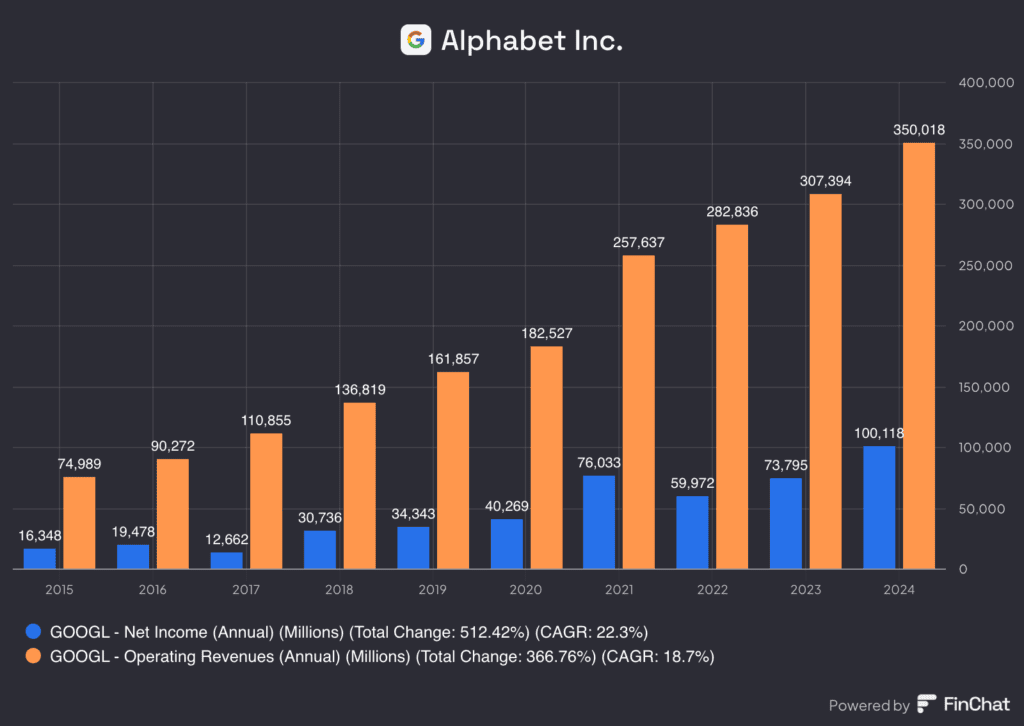

Over the long run, earnings are typically the principle driver for shares. For Alphabet, analysts anticipate adjusted earnings per share to develop 13.2% this 12 months and 15.3% in 2026. On the income entrance, analysts anticipate 17% development this 12 months, adopted by 11% development in 2026. Right here’s a have a look at earlier income and web revenue outcomes:

The corporate at the moment sits with $95.6 billion in money and short-term investments, a determine that’s anticipated to climb in 2025 and 2026 — though its potential acquisition of Wiz for roughly $32 billion continues to be within the combine.

All in all, Alphabet appears to test quite a lot of containers for long-term traders. It has proven sturdy development in income and earnings, analysts predict stable development over the following 12 and 24 months, it has a pile of money, and the valuation is the bottom amongst mega-cap tech.

So what’s weighing on Alphabet inventory?

Dangers Exists

Final quarter, Google’s Cloud unit grew 30% 12 months over 12 months and generated income of $11.96 billion, barely lacking expectations of $12.19 billion. That miss could appear small, significantly as the corporate generated total income of $96.5 billion that quarter. Nevertheless, traders are Google Cloud to be a significant contributor to future development. Plus, the agency is investing a big quantity into this unit and traders need to see that these investments are translating to stronger development.

Different dangers loom too.

Regulatory worries nonetheless swirl over Alphabet, as traders concern that federal companies will proceed to scrutinize the agency’s enterprise practices and hand out penalties or lawsuits for what’s deemed as unfair enterprise practices. The corporate faces financial dangers too, as current macro uncertainty might power companies to drag again on advert spend, impacting Alphabet’s companies and decreasing development expectations.

Lastly, competitors stays fierce, not simply in promoting, but additionally within the cloud the place Google contends with different juggernauts, like Microsoft Azure and Amazon Net Companies.

Need to obtain these insights straight to your inbox?

Join right here

The setup — Alphabet

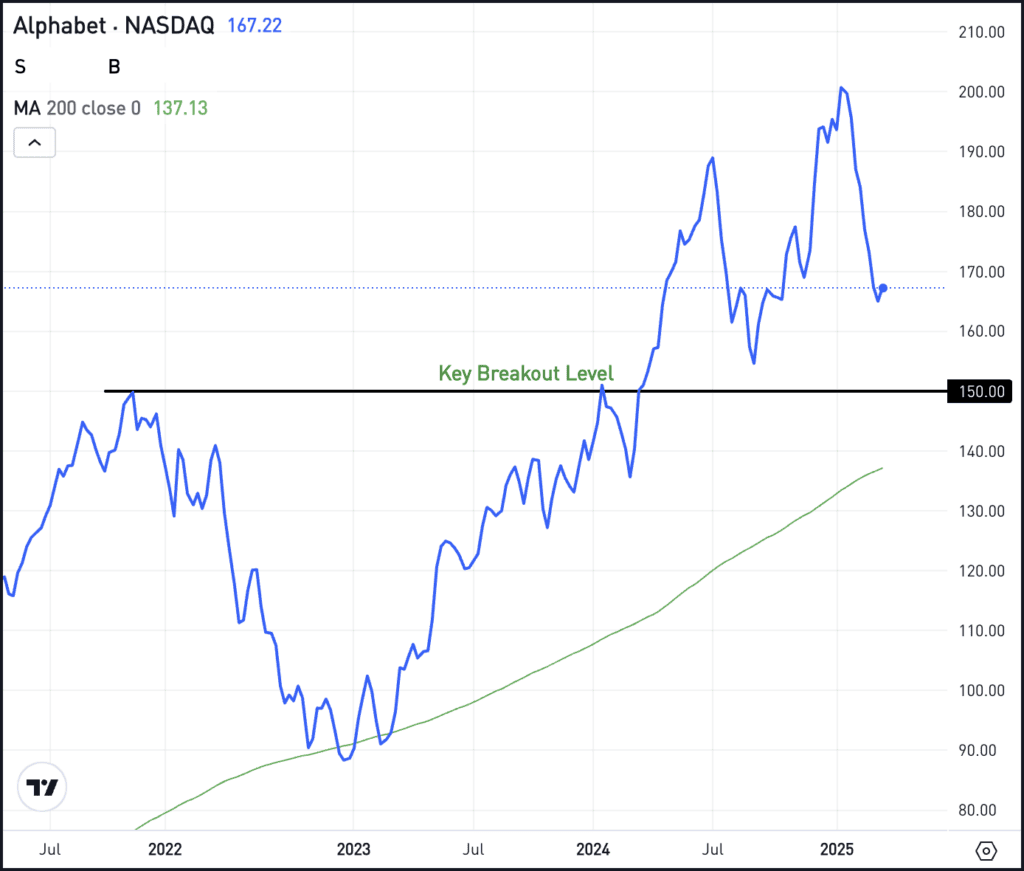

At the moment buying and selling within the mid-$160s, Alphabet shares have fallen notably from the current highs.

Nevertheless, it’s nonetheless buying and selling above the important thing breakout space close to $150, in addition to its 200-week shifting common, which has been a long-term stage of assist for GOOG and is at the moment close to $137 and rising.

In keeping with Bloomberg’s Analyst Suggestions, analysts have a median 12-month value goal of about $219, implying about 35% upside. In fact, simply because that’s the common goal, doesn’t imply the inventory will get there.

For traders who like fundamentals, they might discover the present 20% pullback as a horny entry level and one which correctly accounts for all the inventory’s present dangers. For others although, they might view the basics as enticing, however require a bigger pullback to correctly account for the dangers.

Ought to shares pull again much more, traders will need to preserve a detailed eye on the areas talked about above: The $150 breakout stage and the rising 200-week shifting common.

And lastly, some traders might not really feel that Alphabet has the aggressive benefit that might justify an funding, both at present ranges or decrease, and that’s okay too.

Choices

Shopping for calls or name spreads could also be one approach to reap the benefits of a pullback. For name patrons, it could be advantageous to have satisfactory time till the choice’s expiration.

For those who aren’t feeling so bullish or who’re in search of a deeper pullback, places or put spreads may very well be one approach to take benefit. They may also be used to hedge in opposition to additional declines.

To study extra about choices, contemplate visiting the eToro Academy.