In recent times, investor consideration has been fixated on the “Magnificent Seven,” particularly Nvidia, whose shares have skyrocketed by a whole lot of p.c. The explosive rise of synthetic intelligence (AI) throughout industries has radically reworked the funding panorama and propelled company income to new heights. This has attracted investments value a whole lot of billions of {dollars}.

Supply: publiccomps

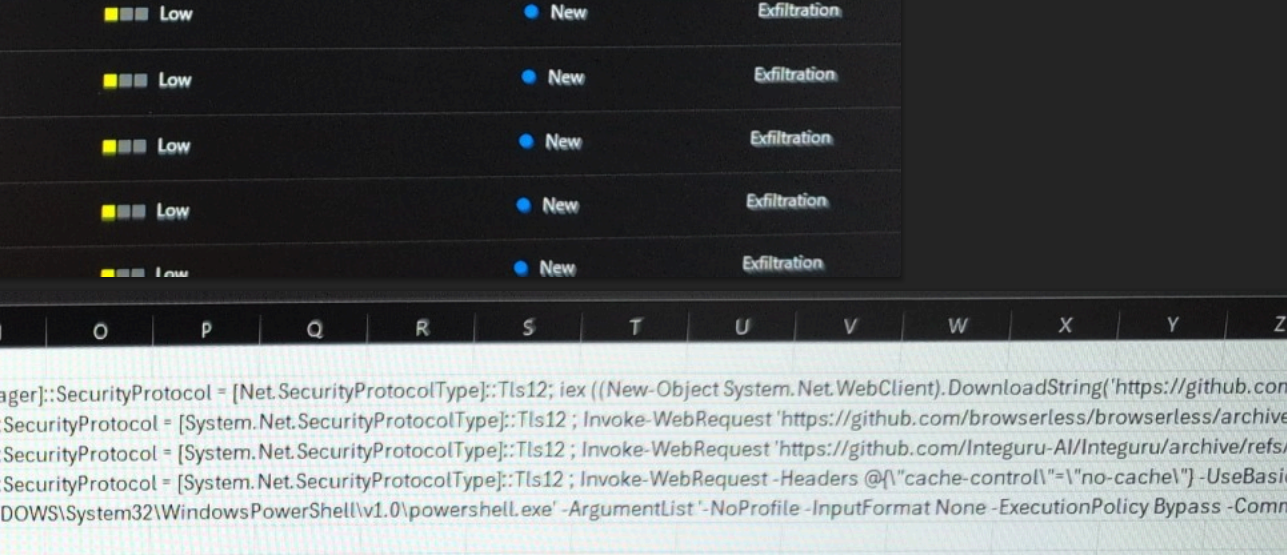

However the AI revolution isn’t nearly cloud gamers and chipmakers. Information facilities — or as Nvidia CEO Jensen Huang calls them, “AI factories” — are huge amenities that require way over simply top-tier chips. Let’s check out the businesses quietly benefiting within the background from the rising AI funding growth.

Section Considered one of AI: Compute Energy

Earlier than your ChatGPT immediate turns right into a significant response, a number of key processes happen:

Your knowledge is shipped to the cloud, the place it’s processed by high-performance chips in knowledge facilities. This stage entails firms like Nvidia, AMD or Broadcom, which focus on growing superior GPUs, CPUs, and accelerators — important elements for the huge computations AI fashions demand.

Whereas main cloud gamers are the biggest prospects of those companies, many are actually growing their very own chips to avoid wasting prices. Amazon has its Trainium and Inferentia chips, Google has Tensor, and Microsoft has Maia. These may change into critical opponents to established chip giants. On the similar time, they current a chance for TSMC, the dominant participant in chip manufacturing.

Section Two of AI: Infrastructure

To perform, these chips require huge technological infrastructure. They should talk with each other, retailer knowledge, and function repeatedly — all whereas consuming huge quantities of electrical energy and producing warmth. This creates alternatives throughout a number of sectors:

- Networking gear – Essential for transferring large volumes of information and enabling server communication. Moreover Nvidia’s personal options, opponents right here embody Broadcom, Cisco, and Arista.

- Information storage and reminiscence – AI fashions should retailer huge quantities of information. Excessive-speed reminiscence chips like HBM3 or superior SSDs face relentless demand. Key gamers embody Micron and Samsung.

- Servers, cooling, and backup energy – These guarantee uninterrupted operation of information facilities. AI fashions require cutting-edge cooling methods and specialised servers. Main firms right here embody SuperMicro and Dell.

- Renewable power – Information facilities have excessive power wants and depend on constant energy provide. This advantages power suppliers, significantly in areas like Texas or Virginia. Corporations like Vistra and NRG Vitality are already seeing a transparent uptick in demand.

Section Three of AI: Purposes

As soon as firms safe the infrastructure from phases one and two, the important thing query turns into: How can AI drive income and revenue development? This part at the moment consists of software program firms that may use AI to spice up the effectivity of their merchandise. Examples embody:

- Social media and promoting – AI improves advert concentrating on and content material personalization

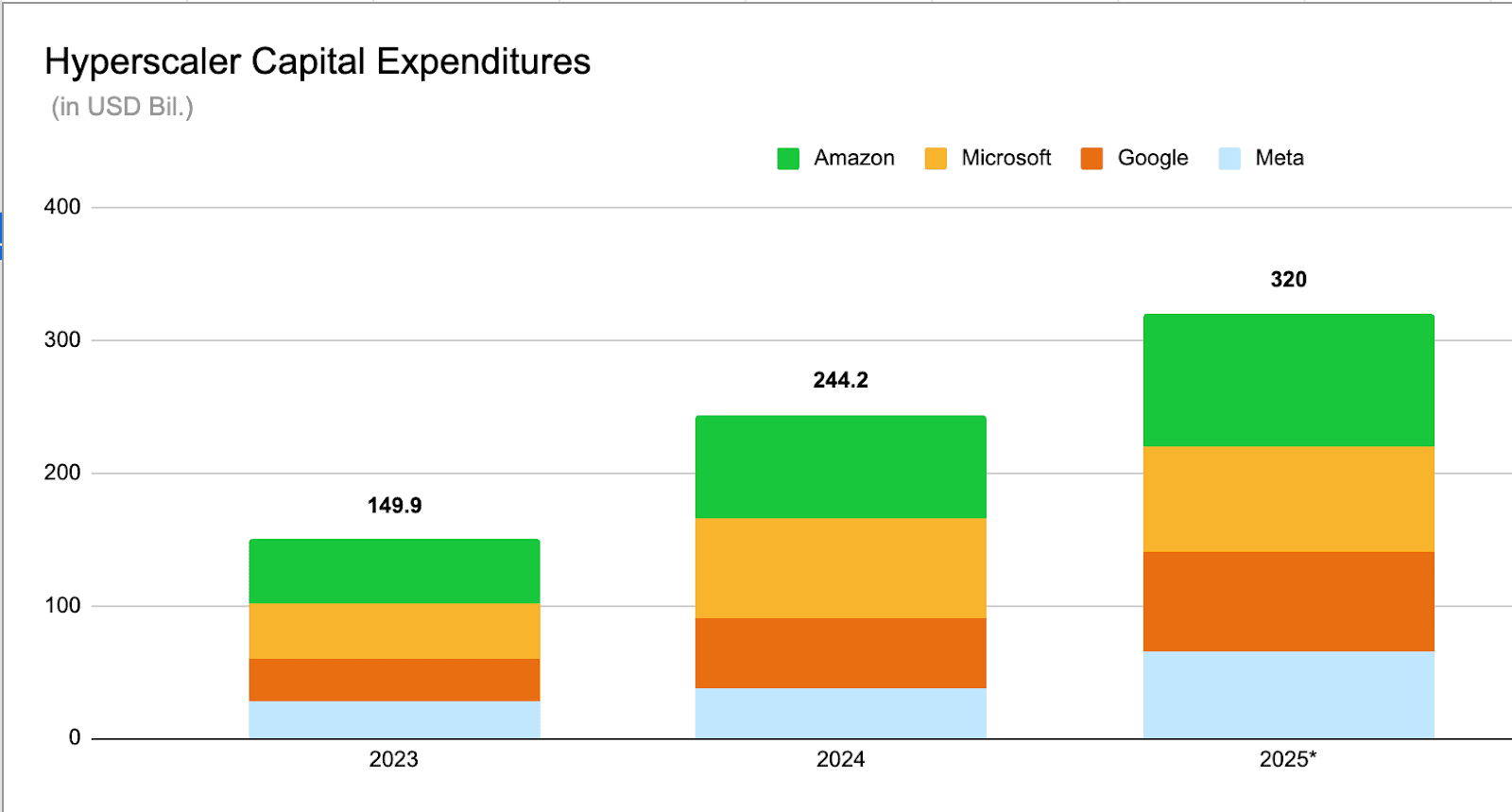

- Cybersecurity – AI helps detect and block cyber threats

- E-commerce – AI personalizes provides, enhances buyer assist, and optimizes logistics

- Healthcare – AI assists in diagnostics, drug analysis, and enhancing affected person care

- Media – AI generates content material, analyzes developments, and automates manufacturing

- Mobility – AI powers autonomous driving, seen as the long run by many automobile firms

Corporations on this third part are sometimes extra resilient to geopolitical dangers, akin to commerce wars. That is the place a few of the greatest funding alternatives may emerge within the coming years.

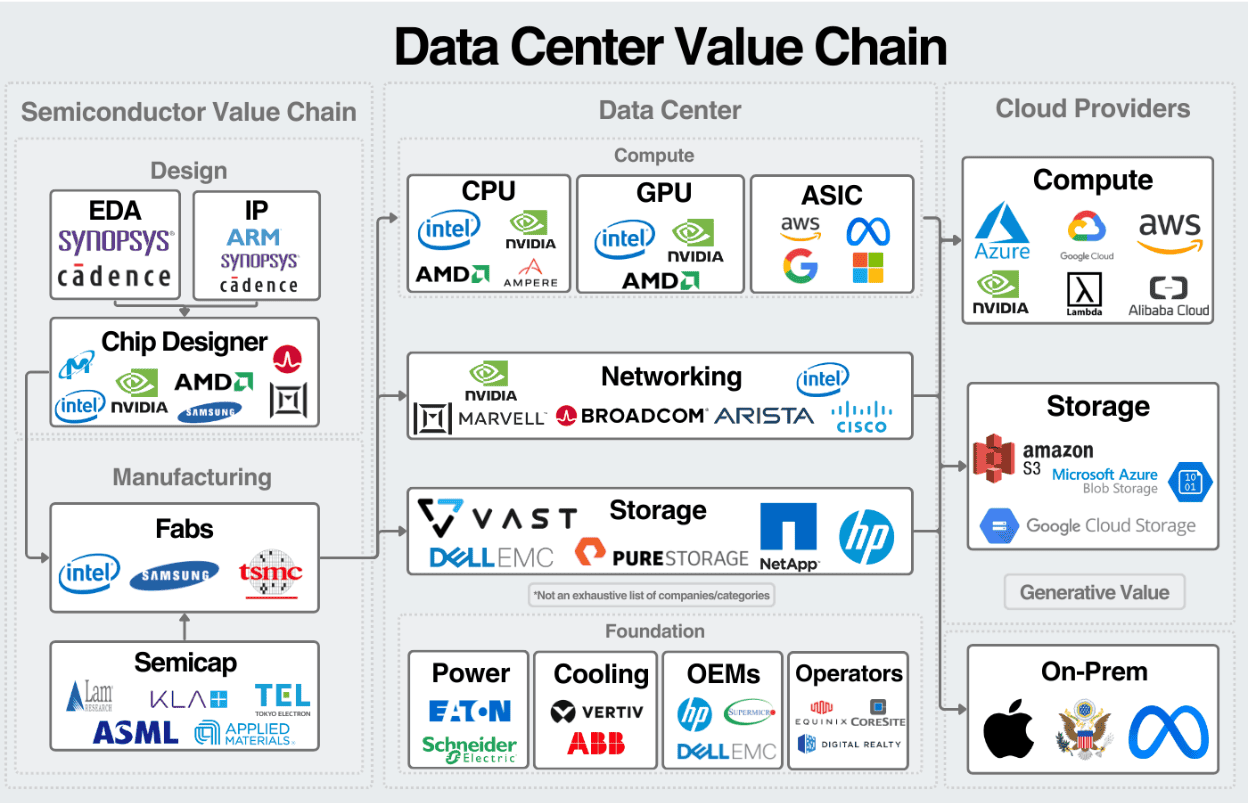

Supply: eToro

As we will see, AI investments proceed to surge. The 4 largest cloud giants within the U.S. alone plan to speculate greater than $300 billion subsequent 12 months, with a good portion directed towards AI infrastructure. On high of that, governments are supporting AI improvement — within the U.S., for example, by means of the Stargate venture, which is already channeling the primary tranche of a deliberate $500 billion funding over the subsequent 4 years.

A lot of this capital might profit smaller, specialised firms that target key elements of the AI ecosystem — from networking and power to servers, software program, and functions. The AI revolution continues to be in its early days, and extra funding alternatives are more likely to emerge within the years forward.

Whereas Nvidia and different tech giants dominate the headlines, the true funding gems typically lie within the shadows — among the many enablers of infrastructure, power, and supporting applied sciences. Hold an eye fixed not simply on the chips, but in addition on the businesses powering this technological revolution behind the scenes.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.