Submit the Spot Ethereum ETFs launch, the ETH worth has continued to battle unexpectedly, proving that the launch of the Spot ETFs had been a ‘promote the information’ occasion. To date, the second-largest cryptocurrency by market cap has misplaced round 10% of its worth because the Spot Ethereum ETFs buying and selling started on Tuesday, July 23, and will see additional decline from right here, in accordance with an evaluation from Matrixport.

Spot Ethereum ETFs Triggers Promoting

Following the launch of the Spot Ethereum ETFs, there was numerous pleasure out there, particularly round the truth that traders may now acquire publicity to ETH with out having to straight purchase the underlying token. Nevertheless, this pleasure has been short-lived as days after the launch, the ETH worth continues to battle.

Associated Studying

In a report launched on Thursday, Markus Thielen, Head of Analysis at Matrixport, outlined various explanation why the ETH worth was declining. As Thielen explains, whereas the inflows crossed $100 million on the primary day, the Grayscale Ethereum fund had been struggling outflows.

Similar to with the Spot Bitcoin ETFs launch, the Grayscale ETH fund, which holds round $9 billion in ETH, started recording outflows. This is because of the truth that Grayscale’s administration charges stay excessive with opponents providing charges as little as 0.19%. On the primary day alone, $481 million flowed out of the fund, and $326 million adopted the subsequent day.

Along with this, the Mt. Gox distributions started across the time of the Spot Ethereum ETFs launch, so this even additionally put additional promoting strain on the crypto market. Simply because the Bitcoin worth did with the Spot Bitcoin ETFs, the ETH worth has responded negatively to those outflows, resulting in a worth decline beneath $4,200.

Will The ETH Value Get well From Right here?

Outflows from the Grayscale ETH fund because the launch of the Spot Ethereum ETFs have been one of many main elements driving the ETH worth decline. Nevertheless, it’s not the one bearish growth that has emerged for the cryptocurrency.

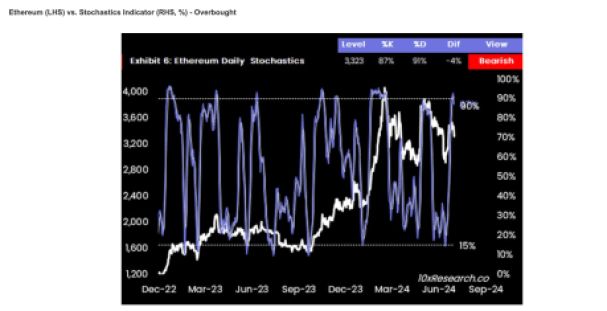

Thielen factors out that the ETH worth might have reached the highest, utilizing the every day stochastics indicator as a information. Now, when the worth of this indicator is low, it typically means a shopping for alternative and the worth is hitting a low. In the meantime, the worth being excessive means that the ETH worth might have hit its high.

Associated Studying

Based on the report, the ETH worth had hit a rating of 92% within the days main as much as the Spot Ethereum ETFs launch. Normally, a rating above 90% is bearish for the worth because it means the cryptocurrency is presently in overbought territory. Subsequently, the worth of the stochastic indicator is predicted to say no as traders offload their holdings.

To date, there have been a 5% decline from 92% to 87%, suggesting that there’s nonetheless an extended approach to go earlier than the ETH worth stops bleeding. “Contemplating the current rally and the potential overhang from Mt. Gox, the US earnings season, and the weak seasonals for August and September, it’d make sense to press the Ethereum brief a bit longer,” Markus Thielen stated in closing.

Featured picture created with Dall.E, chart from Tradingview.com