TRON (TRX) founder Justin Solar has come out in protection of the community stablecoin, USDD. The digital asset started deppeging from the U.S. greenback worth and hinted at one other catastrophic occasion within the crypto market, just like the one skilled by Terra (LUNA) and its native stablecoin UST.

Associated Studying | TA: Bitcoin Dives 10%, Why BTC May Even Break $25K

On the time of writing, the worth of TRON’s stablecoin has been climbing again to its 1:1 parity to the U.S. greenback. Earlier, the digital asset began trending to the draw back forcing the TRON DAO Reserve, the entity chargeable for defending USDD’s peg, to deploy $2 billion.

This created a rise in promoting strain for TRX which moved to the draw back on the again of this occasion, and a crypto market already trending to the draw back together with conventional investments.

Justin Solar wrote the next by way of his Twitter account, presently, TRX shorters had the chance to benefit from market situations:

Funding fee of shorting TRX on Binance is damaging 500% APR. Trondao Reserve will deploy 2 billion USD to struggle them. I don’t assume they will final for even 24 hours. Quick squeeze is coming.

The TRON DAO Reserves continued to inject hundreds of thousands to guard the USDD peg to the U.S. greenback. As a consequence of its mint and burn mechanism, the worth of TRX broke under essential assist ranges however turned extra steady as USDD returned to its U.S. greenback parity.

In the previous few hours, the entity in command of defending USDD claims it has elevated the stablecoin’s collateralization to satisfy “excessive market situations”. The collateralization fee reported by this entity stands above 300%. The entity wrote the next:

To safeguard the general blockchain trade and crypto market, TRON DAO Reserve have elevated 650,000,000 USDC provide on TRON. At present USDC provide on TRON has reached $2.5 billion.

Who Is Shopping for TRX, Circumstances For A Quick Squeeze?

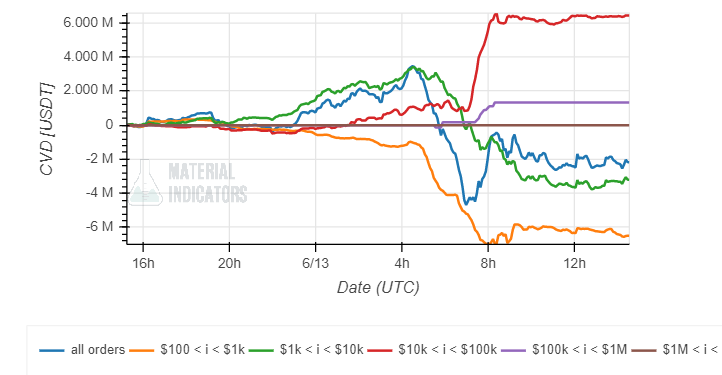

Information from Materials Indicators reveals skinny assist for TRX’s value because it approaches these ranges. At present, there are round $500,000 in bid orders with no additional assist under.

This implies TRX’s value may proceed to see losses if bulls are unable to keep up present ranges. Extra knowledge from Materials Indicators data a rise in promoting strain from small buyers.

As seen under, retail buyers (yellow and inexperienced on the chart) have been shaken out of their positions as TRX crashes. Bigger buyers appear extra resilient and keen to purchase into the present value motion.

Associated Studying | Bitcoin Drops To 18-Months Lows, Has The Market Seen The Worst Of It?

This might assist a brief squeeze situation, as Solar claimed. Nevertheless, the market continues to pattern to the draw back and will re-test decrease ranges.