Bitcoin (BTC), the world’s largest cryptocurrency is poised for a large worth crash as whales and establishments have dumped notable BTC previously 24 hours. On September 5, 2024, previous to the opening of the US Inventory market, a wise Bitcoin whale dumped a big 680 BTC price $38.77 million to the Binance.

Whale Promote-off Thousands and thousands Price BTC

This sensible whale bought a big 4,562 BTC price $120.66 million at a median worth of $26,449 in late 2022. Nonetheless, he bought 3,938 BTC price $181 million when BTC was buying and selling close to the $46,000 degree. Combining all these sell-offs, this sensible whale has made a revenue of roughly $96 million.

The current large dump occurred when BTC was buying and selling close to the $57,000 degree and shaped a powerful bearish candle on the four-hour timeframe. Since this dump, the BTC worth has been constantly falling, heading towards the $54,000 degree. Moreover, dormant BTC holders have additionally develop into energetic, which is a probably bearish signal.

Bitcoin Worth May Fall to $54,000 Stage

In response to skilled technical evaluation, BTC seems tremendous bearish. It is usually forming a sample the place every current excessive worth is decrease than the one earlier than, and every low worth can also be decrease. This implies a downward pattern. If BTC closes a four-hour candle under the $56,000 degree, there’s a sturdy chance it may fall to the $54,000 degree within the coming days.

On-Chain Metrics Signaling Large Promote-off

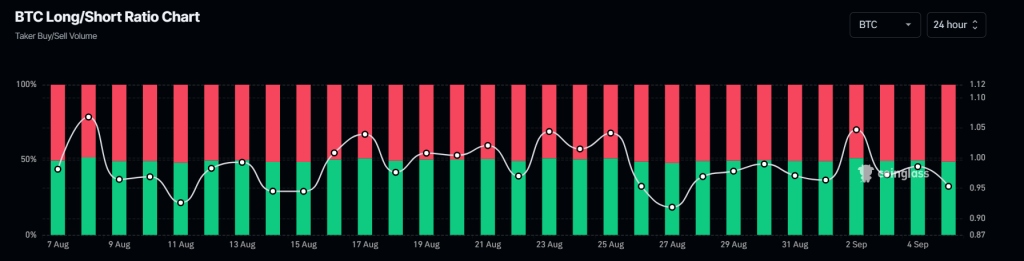

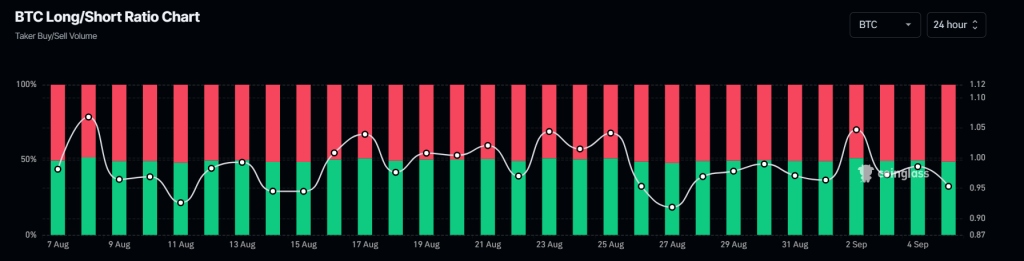

Apart from this worth motion, BTC’s on-chain metrics knowledge can also be signaling a large sell-off. CoinGlass’s BTC Lengthy/Quick Ratio chart is under one and at the moment stands close to the 0.953 degree indicating a bearish sentiment amongst merchants. At current, 51.2% of prime BTC merchants are holding bearish quick positions, whereas solely 48% are holding lengthy positions.

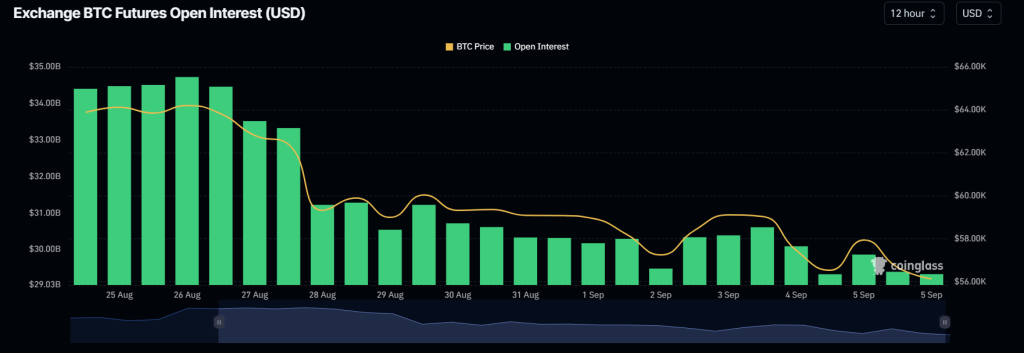

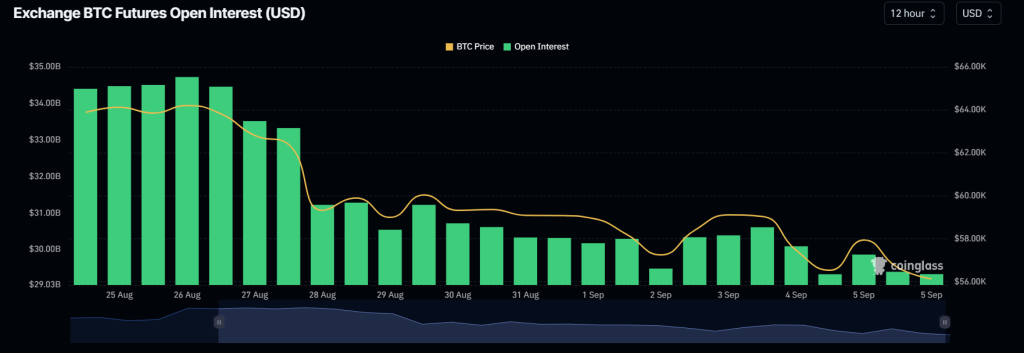

Moreover, BTC futures open curiosity has been constantly falling, indicating decrease curiosity from prime merchants amid bearish sentiment. Since August 24, 2024, the BTC’s open curiosity has dropped from $34.72 billion to $29.33 billion.

Bitcoin Worth Momentum

At press time, BTC is buying and selling close to the $55,900 degree and has skilled a worth drop of three.7% within the final 24 hours. In the meantime, its buying and selling quantity has elevated by 12% throughout the identical interval, indicating greater participation from merchants amid this sharp worth decline.