Ethereum has seen robust shopping for curiosity lately after breaking by means of some key resistance ranges. Its market dominance is rising, particularly now that Bitcoin has bounced again above $85,000. On high of that, a number of on-chain indicators are exhibiting optimistic indicators, suggesting rising bullish momentum as Ethereum strikes close to a descending resistance line. Nonetheless, a drop in whale curiosity would possibly change the forecast.

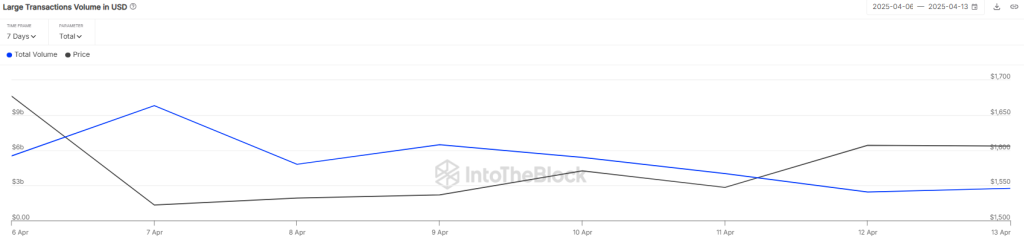

Ethereum’s Massive Transaction Quantity Declines

Ethereum has seen rising shopping for curiosity lately, with its worth rising almost 6% over the previous week. In keeping with information from Coinglass, about $82.8 million price of buying and selling positions in Ethereum had been liquidated, with patrons shedding round $43.5 million and sellers about $39.2 million.

Final week, ETH dropped to its lowest level since March 2023. Nonetheless, a pause in tariffs helped the value get well barely. Nonetheless, this restoration hasn’t been sufficient to spice up investor confidence. Glassnode information exhibits that the variety of wallets holding not less than $1 million price of ETH has dropped considerably this 12 months, hitting the bottom stage since January 2023. This factors to a decline in curiosity from wealthier buyers.

In keeping with information from IntoTheBlock, the quantity of huge Ethereum transactions has dropped considerably. Whale exercise has fallen from a peak of $9.81 billion to simply $2.75 billion, exhibiting a transparent decline in curiosity from large buyers. Latest exercise helps this pattern—on April 14, a whale moved 20,000 ETH (price about $32.4 million) to the Kraken trade, probably in preparation for promoting.

Additionally learn: Cardano Worth Prediction 2025, 2026 – 2030: Will ADA Worth Hit $2?

Including to the stress, an on-chain analyst reported that an early investor from Ethereum’s 2015 ICO has been constantly promoting. On April 13, this whale bought 632 ETH, price round $1 million.

In the meantime, market sentiment stays blended, and Ethereum’s open curiosity (the entire worth of excellent derivatives contracts) has dropped by 1.16%, now sitting round $17.91 billion. This dip in open curiosity might decelerate Ethereum’s restoration and improve the possibilities of a short-term pullback.

What’s Subsequent for ETH Worth?

Ether has bounced again from the important thing $1,500 stage, as sellers are struggling to push the value any decrease. Consumers are actually targeted on holding the value above a descending resistance line to strengthen the present bullish momentum. In the mean time, ETH is buying and selling round $1,640, up greater than 2% prior to now 24 hours.

The transferring averages are pointing upward, and the RSI is in optimistic territory—each indicators that patrons presently have the benefit. If they will preserve the value above the descending resistance line, ETH would possibly make a powerful transfer towards the necessary $2,000 stage within the coming hours.

Then again, if sellers wish to regain management, they’ll have to push the value beneath the EMA20 pattern line. If that occurs, Ether might drop towards $1,384—a key assist stage. A break beneath that would sign a short-term shift in momentum in favor of the bears.