Onchain Highlights

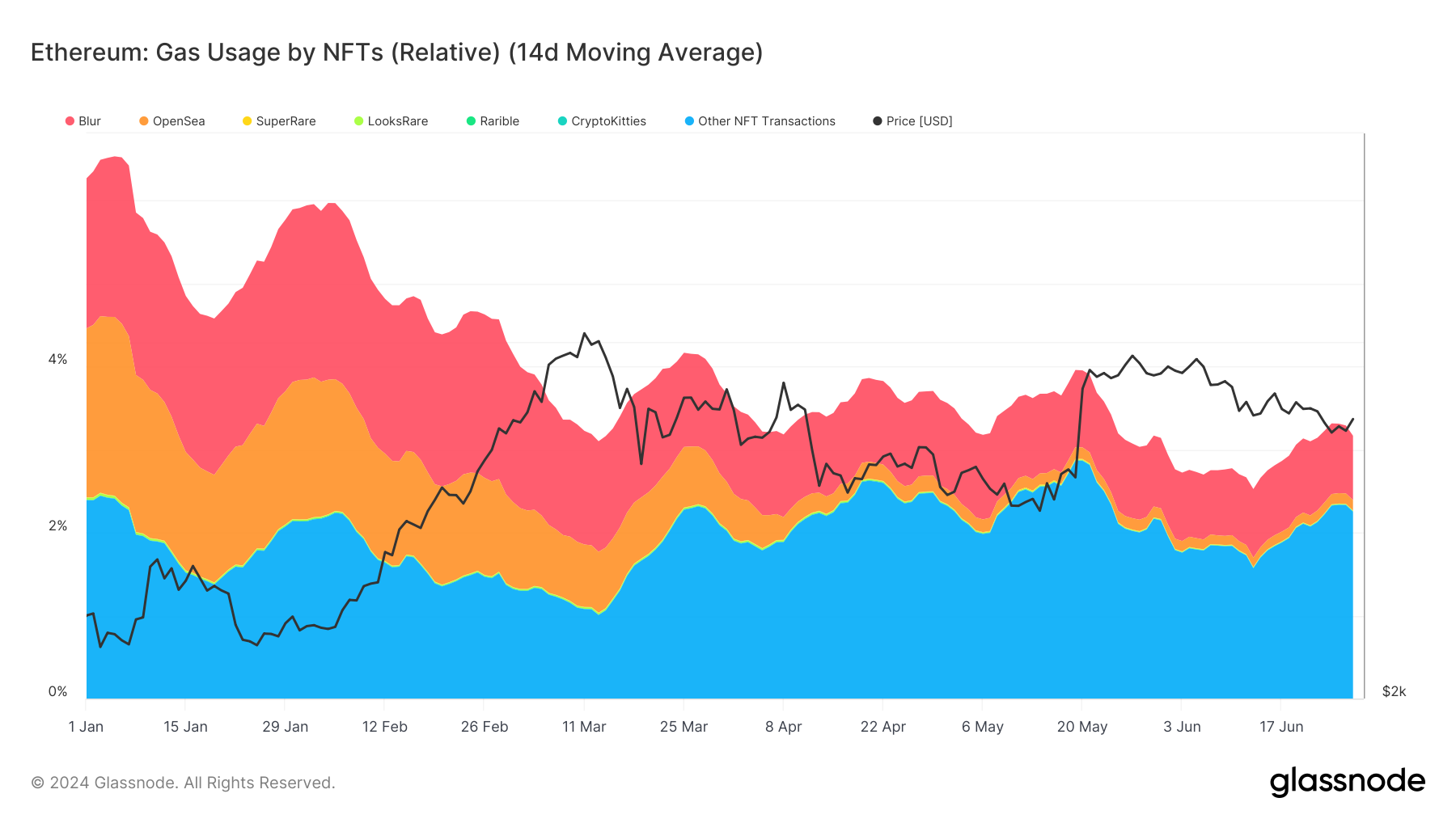

DEFINITION: The relative quantity (share) of fuel consumed by the Ethereum community by transactions interacting with non-fungible tokens. This class contains token contract requirements (ERC721, ERC1155) and NFT marketplaces (OpenSea, Blur, LooksRare, Rarible, SuperRare) for buying and selling these.

Ethereum’s fuel utilization by NFTs has exhibited important shifts over the previous few years, primarily as totally different platforms have gained and misplaced prominence. Latest information signifies that Blur and OpenSea have persistently dominated fuel consumption since early 2024.

This displays the growing exercise on these platforms as merchants and collectors proceed to interact within the NFT market. In distinction, platforms like Rarible and SuperRare present comparatively decrease fuel utilization, highlighting their smaller consumer bases or much less frequent transactions.

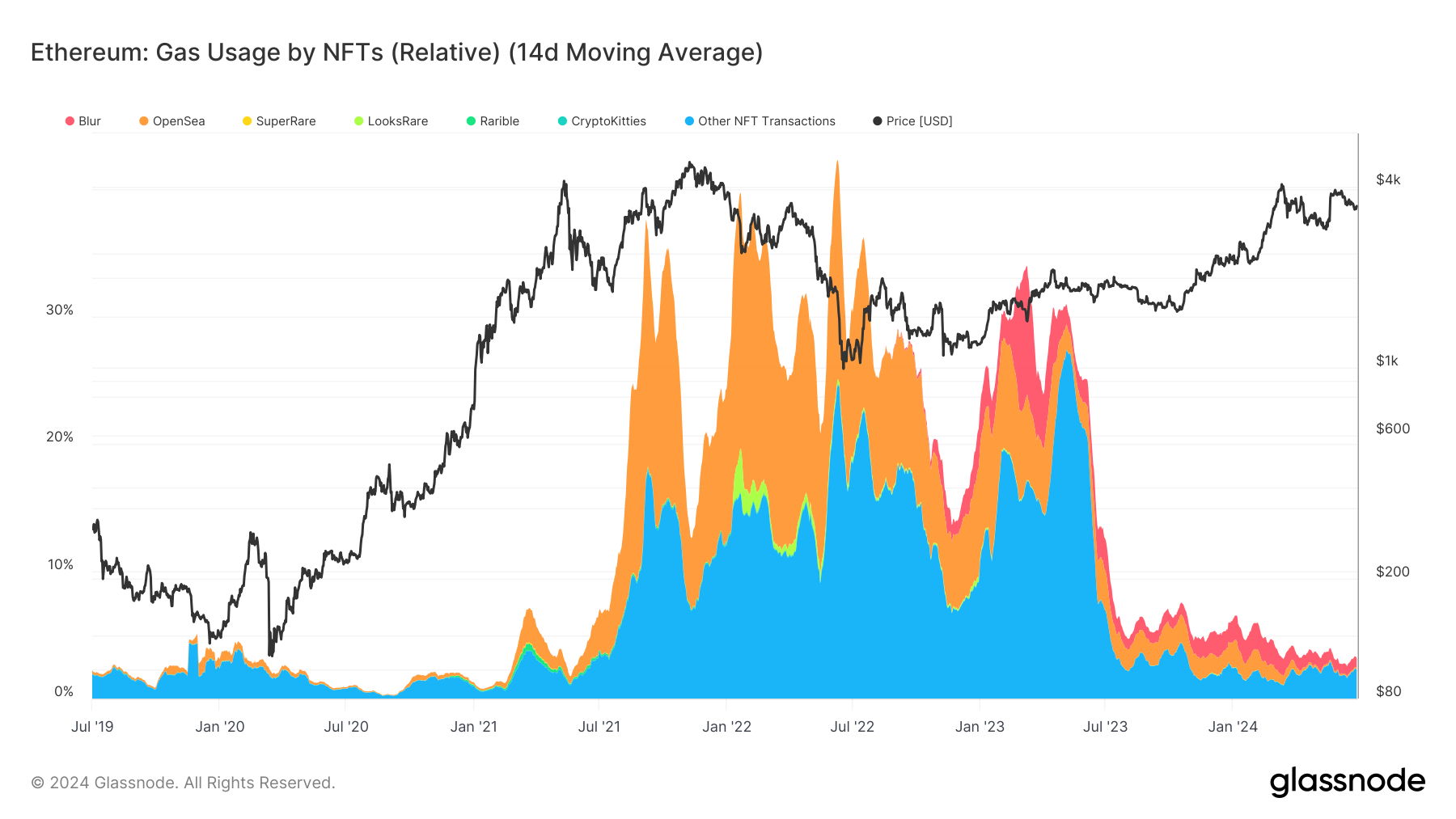

Traditionally, important spikes in fuel utilization by NFT transactions correlate with broader tendencies in Ethereum’s worth actions. For example, the surge in early 2021 coincided with a substantial bull run within the crypto market, driving extra transactions and better fuel charges. As Ethereum’s worth stabilized in mid-2023, NFT-related fuel utilization additionally normalized, illustrating the interconnectedness of those metrics.

The present panorama means that whereas new NFT marketplaces emerge, established platforms like Blur and OpenSea preserve relative dominance, regularly influencing Ethereum’s general fuel consumption patterns. This dynamic performs a vital position in understanding the operational prices and transaction effectivity of the Ethereum community.

Whereas relative utilization could also be appropriate with previous cycles, general NFT fuel utilization has plummeted since January 2023 as a proportion of general community exercise. At its peak, fuel utilization broke 40%, with a constant stage above 30%. Present ranges are under 4%, partly because of the growing recognition of layer-2s like Base and facet chains like Polygon and an general downtrend within the NFT market.