After a quick restoration on September 10, 2024, the general crypto market as soon as once more seems for a large decline. Following the discharge of america Client Worth Index (CPI) and the opening bell of the US market, main cryptocurrencies together with Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and others, have fallen considerably.

Crypto Market Huge Latest Decline

In accordance with the coinmarketcap, up to now hours BTC, ETH, SOL, and DOGE have skilled worth declines of 1.95%, 1.85%, 2.10%, and a pair of.35%, respectively.

This worth decline means that traders and crypto fans aren’t proud of the newest CPI report. Though CPI has dropped to 2.5%, considerably decrease than the earlier month’s 3.0%, it signifies that inflation is cooling down.

The Potential Cause for Bitcoin Worth Decline

Nevertheless, the potential purpose behind the market sell-off is the notable Bitcoin dump by short-term holders and miners.

A distinguished crypto analyst made a put up on X (beforehand Twitter) stating that Bitcoin short-term holders seized the latest worth leap on September 10, and offloaded almost 14,816 BTC value $850 million. In one other put up, the analyst famous that Bitcoin miners have additionally bought off a big 30,000 BTC value $1.71 billion up to now 72 hours.

Bitcoin Technical Evaluation and Upcoming Ranges

In accordance with the professional technical evaluation, BTC seems bearish because it not too long ago broke yesterday’s low and fell under the $56,000 degree. Moreover, the 200 Exponential Transferring Common (EMA), a technical indicator typically utilized by merchants to identify long-term tendencies, exhibits Bitcoin is in a downward development.

Primarily based on the historic worth momentum, if BTC closes a every day candle under the $56,000 degree, there’s a excessive chance that it may drop to $54,000 or decrease if the bearish development continues.

Bearish On-chain Metrics

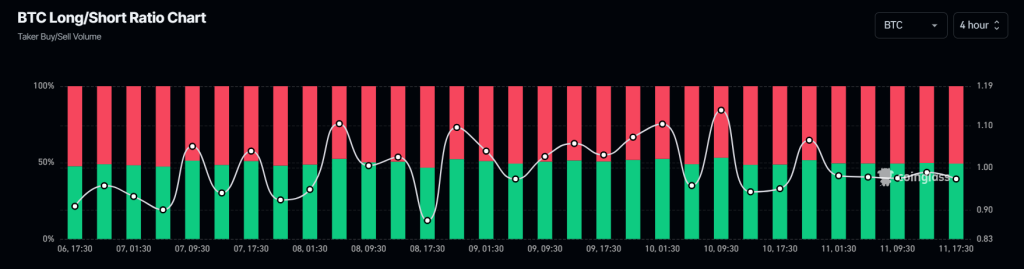

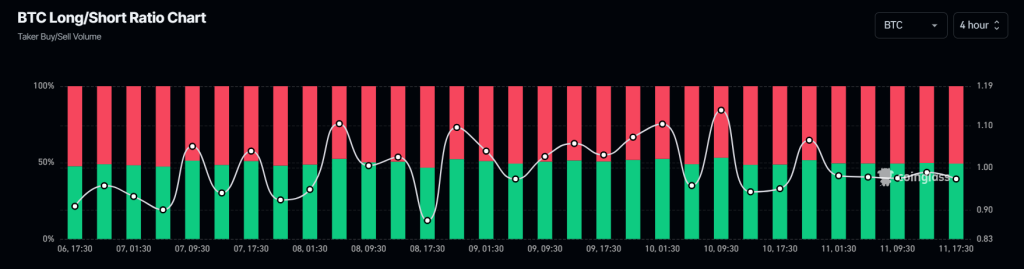

Nevertheless, this bearish outlook is additional supported by on-chain metrics. Coinglass’s BTC Lengthy/Brief ratio at the moment stands at 0.881 (the worth under 1 signifies bearish market sentiment). Moreover, BTC’s future open curiosity has additionally dropped by 1.5% and continues to say no.

In the meantime, 53.14% of prime Bitcoin merchants maintain quick positions, whereas 46.86% maintain lengthy positions, highlighting that bears are at the moment dominating the asset and have the potential to create further promoting strain.