Analytics platform Santiment is taking a look at two crypto property recording triple-digit p.c will increase over a comparatively quick time period.

Beginning with decentralized finance (DeFi) platform UniSwap (UNI), Santiment says that the crypto asset has appreciated by over 150% over a interval of practically two months.

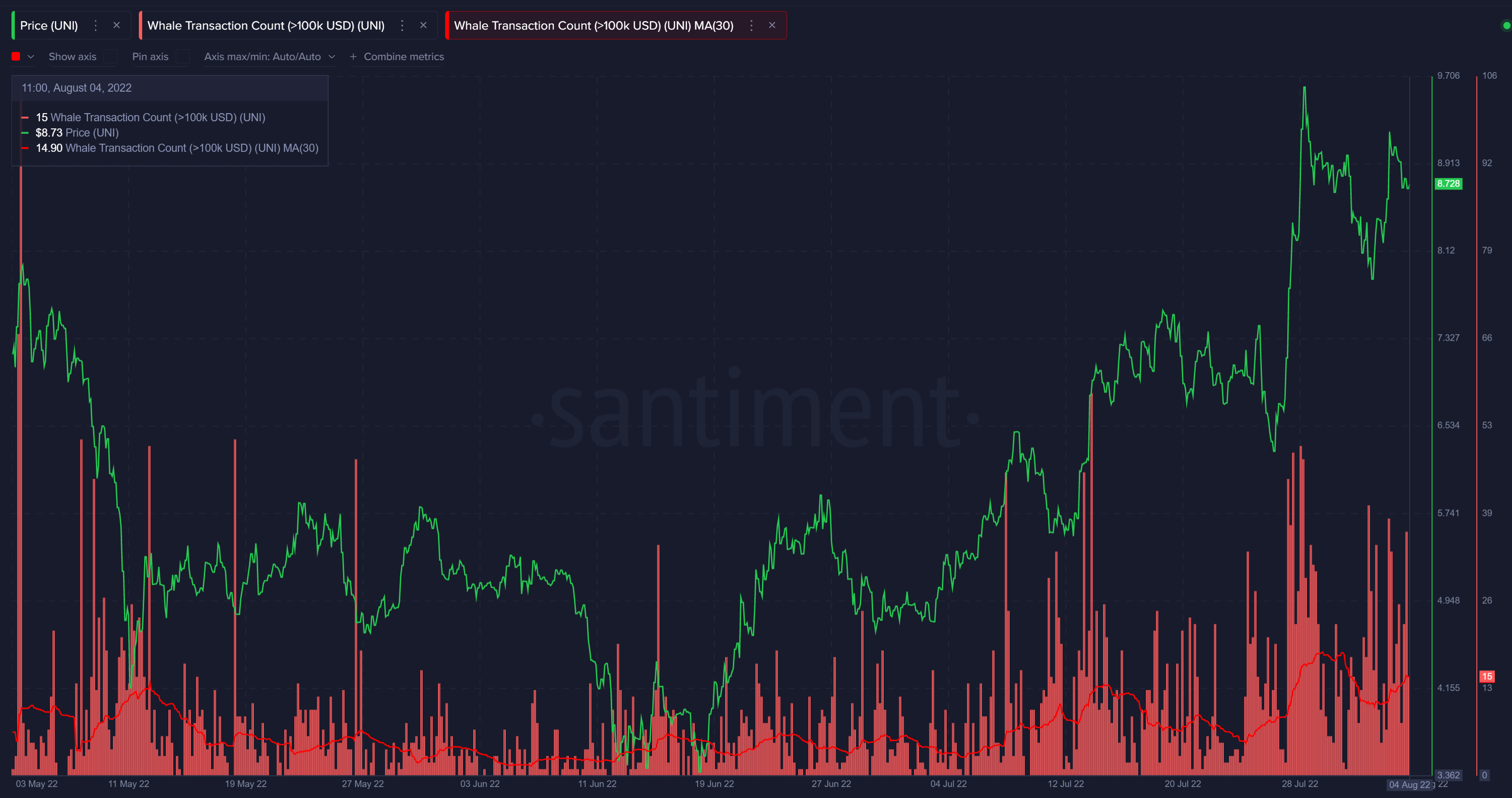

“Uniswap has been on fairly the tear up to now seven weeks, decoupling from the remainder of the altcoin pack in a number of cases, and leaping +153% since June 18th.”

In response to Santiment, the each day tackle exercise of Uniswap has risen and enormous holders of the crypto asset additionally proceed to build up.

“It’s additionally nice to see that shark and whale addresses have been accumulating heavier and heavier percentages of Uniswap’s general provide since Might. The 100k to 1m UNI addresses, specifically, noticed an enormous accumulation spike simply two weeks in the past. And continued worth rises quickly adopted.

And talking of whales, the quantity of huge transactions (which we deem to be transactions valued at $100,000 or extra) are rising again to Might ranges as nicely. We will clearly see the most important clump of huge whale transactions that started forming one week in the past, simply previous to the most important worth rise as much as $9.69.”

Uniswap is buying and selling at $8.96 at time of writing.

The crypto analytics agency says that regardless that those that purchased Uniswap 30 days in the past are in double-digit income, those that bought the crypto asset a 12 months in the past are nonetheless in losses.

Consequently, Santiment says that Uniswap might fall in worth over the quick time period however it’s nonetheless undervalued over the long term.

“We will see that the 30-day Market Worth to Realized Worth (MVRV) is at present as much as +22.5%, which is nicely above the backtested ‘Hazard Zone’ of +15% or extra. However even with mid-term buying and selling returns starting to overflow, the excellent news is that long-term merchants (within the 365-day MVRV) are nonetheless nicely below water. Which means there could also be an upcoming downturn within the subsequent week or two for UNI, however its future for the long-term nonetheless appears to be like to be undervalued.”

MVRV is the ratio of the current worth and the typical acquisition worth of the actual asset. A rise within the MVRV worth signifies an increase within the potential income.

Santiment subsequent appears to be like at Ethereum (ETH) scaling resolution Optimism (OP). In response to the analytics agency, Optimism has undergone a “basic dump and pump” transfer because it soared by barely over 300% from a July low of $0.45 to a excessive of $2 in August.

Optimism is buying and selling at $1.93 at time of writing.

The analytics agency says that Optimism may endure a correction of over 30% to a worth of simply above $1.297 over the quick time period based mostly on the Elliot Wave principle.

“Anticipate a correction to across the backside of wave 4 quickly, however no more, as 5 waves are inclined to proceed after that.”

The Elliott Wave principle states that the long-term worth development of an asset strikes in a five-wave sample whereas corrections transfer in a three-wave sample.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/Ekaterina Glazkova