The Worldcoin cryptocurrency undertaking, led by Sam Altman, the brains behind ChatGPT, is going through elevated scrutiny from regulators worldwide. The undertaking’s use of eye-ball scanning orbs for person enrollment has raised considerations about potential violations of information safety legal guidelines.

The distinctive technique of accumulating biometric information with out clear consent has prompted discussions on legality and ethics. Regulatory our bodies are intently analyzing the undertaking’s compliance with privateness rules, highlighting the challenges of balancing innovation with authorized and moral requirements.

The worth of biometric investments made by means of Worldcoin’s crypto-based “free cash” promise has decreased by half since its launch. This decline might be attributed to the rising considerations concerning the undertaking’s information assortment and the unease it induced regulators.

Why Is Worldcoin Token Crumbling?

Based mostly on data supplied by CoinMarketCap, the present buying and selling worth of the WLD token stands at $1.28, on the time of writing. This determine signifies a considerable decline of 53% from its preliminary peak worth of $2.71 on the day of the undertaking’s launch.

The day after WLD’s Binance itemizing, on July 25, it traded for $2.456. As of Friday morning, the token’s worth had decreased from that point to $1.317. On condition that a number of altcoins and cryptocurrencies not too long ago had market crashes adopted by recoveries inside a number of weeks, it is a huge lower for a token.

WLDUSDT buying and selling at $1.286 on the weekend chart: TradingView.com

Associated Studying: Tron Reverses August Stoop As TRX Open Curiosity Climbs

In line with information from CoinGecko, the value of WLD has decreased from slightly below $2.50 firstly of August to roughly $1.31 as of August 25. That represents a 44% decline within the earlier 30 days, and if it retains going within the improper path, WLD’s worth will go to single digits within the subsequent 30 days.

Ongoing investigations by authorities in numerous international locations around the globe have dealt a heavy blow to the value of the WLD token. The undertaking’s objective of building decentralized person identities has raised alarm bells due to its eye-ball scanning and biometric information assortment. This course of probably breaches nationwide information safety legal guidelines, resulting in investigations in Germany, France, and the UK.

The Euphoria Shortly Light

Worldcoin reported 2 million sign-ups for World ID and distributed 43 WLD tokens throughout its launch. Altman promoted iris scanning, however the preliminary pleasure waned. Early scanners obtained 25 WLD valued at $60, now decreased to round $30. Early buyers may have misplaced half their funding, whereas brief sellers profited from Worldcoin’s decline.

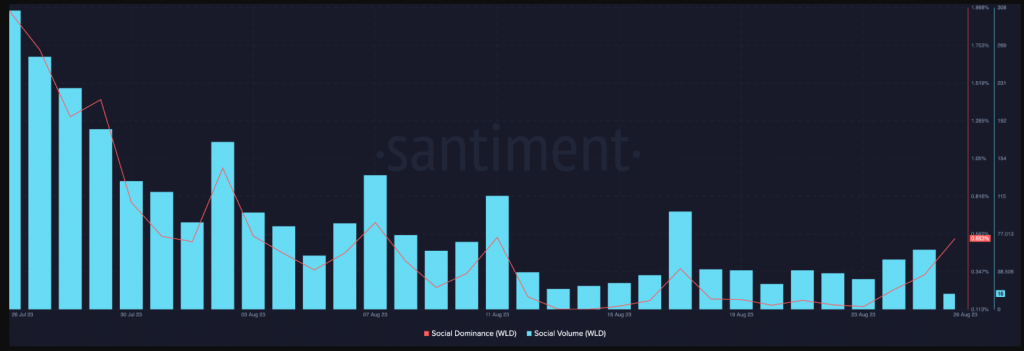

In the meantime, within the final 30 days, WLD’s social quantity and social dominance have decreased by a whopping 95% and 74%, respectively, in response to on-chain information supply Santiment. This denotes a pointy decline within the undertaking’s hype.

Supply: Santiment

Worldcoin’s authentic white paper outlined its aspiration to take part in international competitors, present funds to these with out monetary sources, and supply banking companies to these at the moment with out entry to conventional banking methods.

It seems that ambition will demand greater than mere lip service at this level.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. While you make investments, your capital is topic to threat).

Featured picture from Nation Media Group