Blockchain analytics agency Santiment says that crypto lender Nexo has pulled an enormous portion of Wrapped Bitcoin (WBTC) off of decentralized finance (DeFi) platform MakerDAO following the agency’s authorized troubles with a number of state regulators.

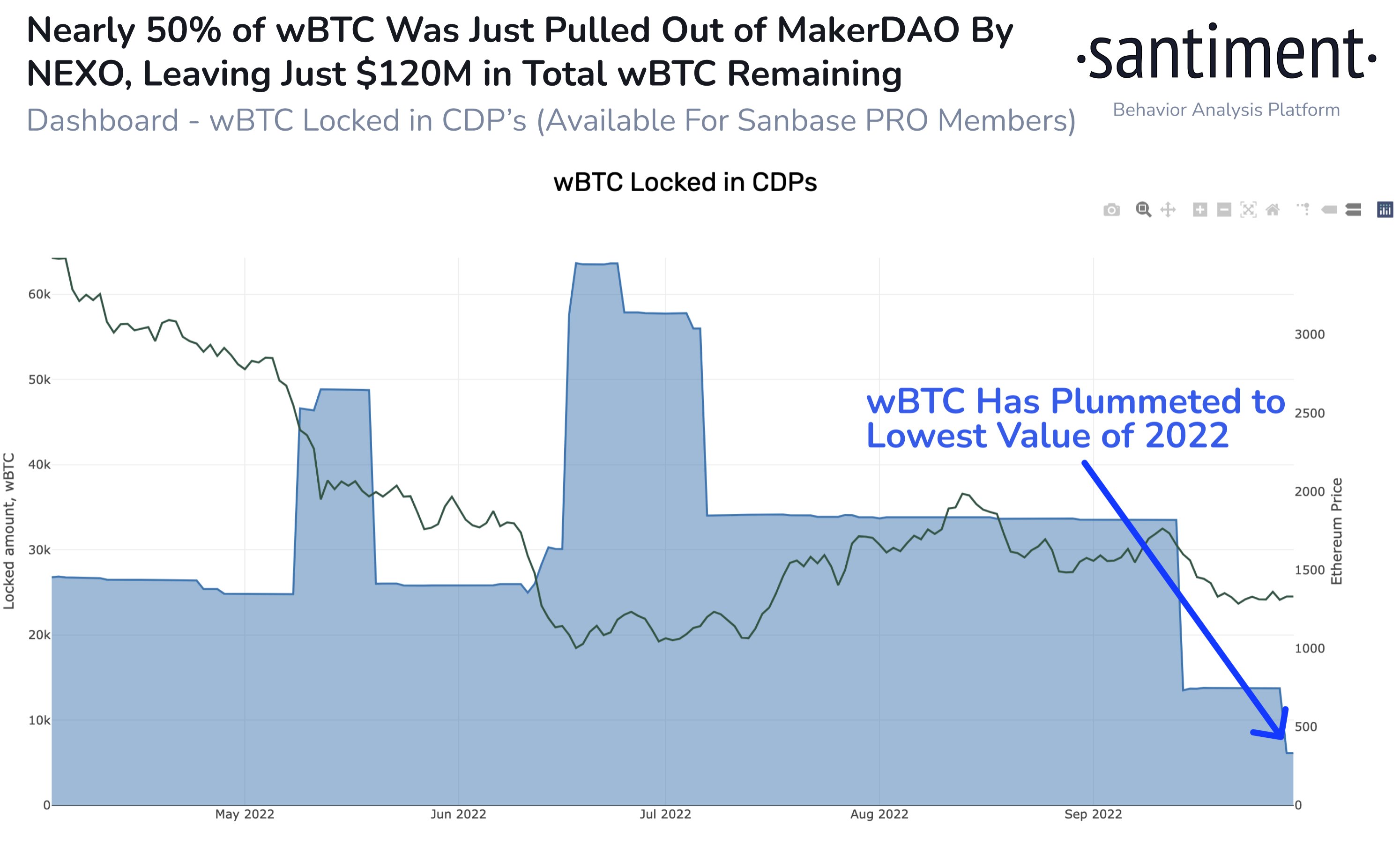

Santiment says that Nexo’s large withdrawal from MakerDAO has taken almost half of all of the WBTC off of the platform and that extra “large strikes” are probably arising.

WBTC is an ERC-20 token pegged to the worth of Bitcoin (BTC) that enables customers to interact in DeFi actions with a Bitcoin-based asset on Ethereum (ETH).

“Nexo has made a giant transfer, and certain plans to make extra after pulling almost 50% of the WBTC held in MakerDao. This has left $120M in WBTC remaining locked in CDPs (collateralized debt place). We shall be monitoring for indicators as to what Nexo plans to do with their free property.”

Final week, state regulators in California, New York, Washington, Kentucky, Vermont, South Carolina, Maryland and Oklahoma made allegations that Nexo was violating securities legal guidelines with its Earn Curiosity Product (EIP).

Nexo stated that it had been working with regulators on the problem and that it now not accommodates US accounts and balances for EIP for the reason that U.S. Securities and Change Fee (SEC) made its stance on crypto lending platforms’ interest-bearing accounts.

“We’ve got been working with US federal and state regulators and perceive their urge, given the present market turmoil and bankruptcies of corporations providing related merchandise, to satisfy their mandates of investor safety by inspecting previous habits of suppliers of earn curiosity merchandise.”

Test Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/artshock