XRP, the cryptocurrency on the heart of the persevering with authorized battle between cost firm Ripple and the US Securities and Alternate Fee, faces a vital turning level with the unsealing of the highly-anticipated Hinman paperwork on Tuesday.

This growth carries important implications for the way forward for the cryptocurrency market.

Throughout an deal with in 2018, former head of the SEC’s finance division William Hinman primarily declared that Ether (ETH) was not a safety because it had turn into “sufficiently decentralized.” The paperwork in query pertain to this speech.

On Tuesday morning, as quickly as media shops had obtained copies of the Hinman speech supplies, the value of XRP, Ripple’s native cryptocurrency, soared to $0.56, a 2023 excessive.

XRP Soaked In Crimson Amid Hinman Papers Disclosure

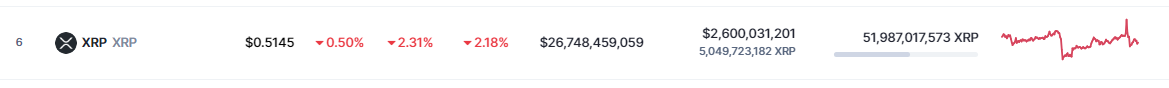

Now, crimson was the dominant shade for XRP on the time this text was written.

CoinMarketCap knowledge reveals that XRP has traded at $0.51, down 2.31% within the earlier 24 hours. Among the many hubbub across the launch of the Hinman paperwork, the token additionally suffered successful within the weekly timeframe, falling by 2.18%.

Supply: CoinMarketCap

In keeping with early reviews, the freshly disclosed Hinman data have far-reaching penalties, suggesting a optimistic end result for Ripple (XRP) of their prolonged authorized battle towards the US regulator.

As said by Hinman in his discuss:

“Primarily based on my understanding of the current state of Ether, the Ethereum community and its decentralized construction, present provides and gross sales of Ether will not be securities transactions.”

Many information organizations have just lately expressed optimism that the data contained contained in the Hinman paperwork could possibly be decisive in Ripple’s ongoing authorized showdown with the SEC.

Nevertheless, for the time being, such optimism doesn’t imply a lot when it comes to XRP’s worth actions, as seen within the graph beneath:

XRP worth trajectory retreating within the crimson zone within the final 24 hours. Supply: CoinMarketCap

Whales Scoop Up Extra Of The Crypto

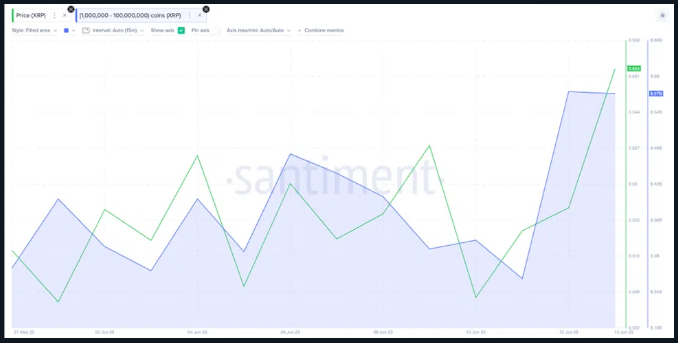

As new particulars unfurl, on-chain knowledge reveals that crypto whales had spent a further $170 million in XRP within the days main as much as the discharge of the Hinman speech papers.

Under is a chart from Santiment exhibiting the 310 million new XRP that crypto whales with 1–100 million of their holdings purchased between June 10–13.

XRP worth climbing as per whales' pockets balances. Supply: Santiment

If the recent funding made by whale traders is valued on the market worth of $0.51, then their complete accumulation is price round $158 million.

As XRP finds itself painted in crimson, the anticipation of a good rally in worth within the midst of the drama portrayed within the SEC versus Ripple authorized tussle grows.

When whales spend a lot on a selected cryptocurrency, and on this case XRP, it normally means they anticipate the value to rise, and this means confidence within the broader crypto market.

However, the query is – will this enormous urge for food by whales sufficient to pump new vigor into the crypto?

XRP market cap at the moment at $26 billion. Chart: TradingView.com

A Climb To $0.60, Or A Drop Under $0.51?

In the meantime, the current market integration of XRP’s newest developments raises questions in regards to the affect of main XRP holders, and their potential efforts to drive the value as much as $0.60.

These influential entities possess substantial quantities of XRP and will make the most of their holdings to exert upward stress on the cryptocurrency’s worth.

Nevertheless, there’s additionally a risk that XRP might expertise a decline, falling beneath its essential help stage of $0.51. Components equivalent to market sentiment, regulatory modifications, and broader financial situations might contribute to a possible lower in XRP’s worth.

In the end, the interaction of varied market forces and the sentiment amongst XRP holders will decide whether or not the cryptocurrency will rally in the direction of $0.60 or retreat beneath the important threshold of $0.51.

Featured picture from Core EM