Regardless of Bitcoin’s current restoration to the important thing degree of $26,100, signaling a vital level for its future beneficial properties and stopping additional decline, there are worrisome indicators that might increase issues for Bitcoin bulls within the quick time period.

The mixture of things presents a possible good storm for a market correction.

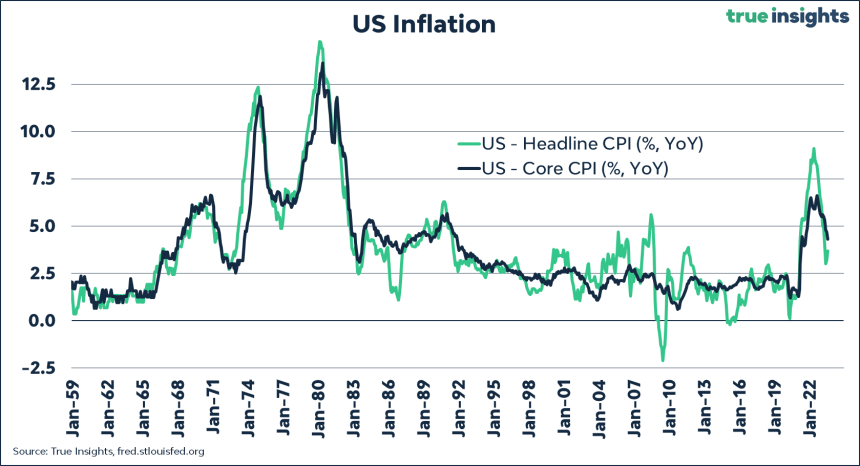

One contributing piece is the higher-than-expected US August headline inflation, coming in at 3.7% up from the earlier month’s 3.2%. Though not a game-changer, it implies that the percentages of one other fee hike are marginally up, now standing at 53%. Jeroen Blokland, a multi-asset investor, highlights this improvement.

Moreover, Bloomberg’s senior macro strategist, Mike McGlone, suggests that Bitcoin could also be main a downward pattern. McGlone emphasizes that Bitcoin is an “exceptionally liquid” asset that has skilled important appreciation with out being tied to particular initiatives or liabilities.

Nonetheless, because it emerged throughout a interval of traditionally low-interest charges, its place as a possible frontrunner for a market reversion is noteworthy.

US Inflation Information And Rising Curiosity Charges Pose Challenges For Bitcoin Bull Run

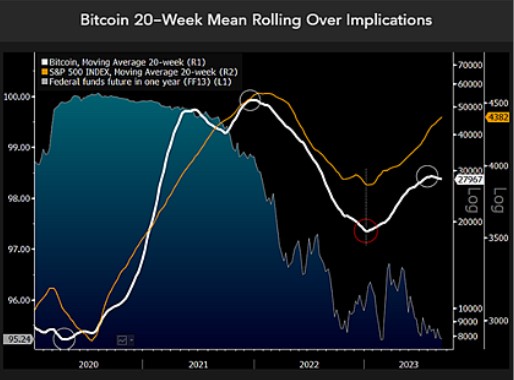

One key indicator highlighted by McGlone is the rollover of Bitcoin’s 20-week shifting common (MA), which has implications for all threat belongings.

Being one of many best-performing belongings in historical past, Bitcoin’s reversion decrease is a major statement. McGlone’s evaluation reveals that federal funds futures for the following yr hover above 5%, indicating restricted expectations for liquidity from the Federal Reserve (Fed).

The same sample was noticed in Bitcoin’s imply reversion in the beginning of 2022 when futures started pricing for the present tightening cycle.

Because the decrease sure of the federal funds fee quickly rises from zero to five.2% and is predicted to proceed rising, important stress on all threat belongings, together with Bitcoin, might ensue.

McGlone additionally highlights the historic relationship between Bitcoin and the broader market. Following the liquidity injection ensuing from the shift to zero rates of interest in early 2020, Bitcoin’s 20-week shifting common reached its backside earlier than the S&P 500 skilled an identical pattern within the third quarter of that yr.

Mike McGlone’s evaluation raises issues about Bitcoin’s future efficiency amid altering rate of interest dynamics and the potential impression on all threat belongings. As Bitcoin’s 20-week shifting common exhibits indicators of rolling over, traders and market individuals will intently monitor its worth trajectory and its skill to face up to the pressures of rising rates of interest.

BTC’s Battle With Resistance, Will It Break Via Or Face A Seven-Month Low?

On the time of writing, the main cryptocurrency available in the market, Bitcoin (BTC), is dealing with a problem in surpassing the resistance wall at $26,400, as highlighted by NewsBTC.

Over the previous 24 hours, BTC has managed to realize a modest 0.3%, whereas essentially the most important beneficial properties within the final 30 days have occurred throughout the seven-day timeframe, with a modest surge of 1.9%.

Ought to BTC achieve surpassing its fast resistance, it can encounter the formidable 200-day and 50-day shifting averages (MA) at ranges of $27,000 and $27,100, respectively. These ranges pose important hurdles for the cryptocurrency’s prospects and potential future beneficial properties.

Conversely, if BTC experiences an prolonged decline and relinquishes its present modest beneficial properties, Bitcoin bulls should intently monitor the essential threshold on the $25,150 degree.

A breach of this degree might probably drive BTC right down to a seven-month low of $22,000, jeopardizing the cryptocurrency’s bull run and the beneficial properties achieved because the starting of the yr.