The cryptocurrency market continues to navigate a sea of uncertainty, and Avalanche (AVAX) isn’t any exception. Whereas AVAX has displayed some resilience in comparison with its altcoin friends, a more in-depth look reveals a market grappling with conflicting indicators – a mixture of cautious optimism and underlying unease.

Associated Studying

Bullish Whispers Or A Mirage?

The way forward for AVAX stays shrouded in uncertainty. Whereas some optimistic indicators exist, like relative outperformance and pockets of bullish sentiment, they’re countered by regarding metrics like dwindling market management and a big drop in buying and selling exercise.

Avalanche: Resistance Ranges Loom Giant

A take a look at AVAX’s six-month chart reveals a rollercoaster experience, characterised by sharp peaks and troughs. This volatility highlights AVAX’s susceptibility to broader market traits and its dependence on particular developments inside its ecosystem.

Over the previous few months, AVAX has exhibited a sample of value spikes adopted by equally sharp corrections. Presently, the altcoin appears to be consolidating across the $38 mark after a latest dip from April’s highs.

If AVAX can preserve assist across the essential $35 degree, there’s a chance for a northward trajectory, particularly if a broader bull run materializes within the cryptocurrency market.

Nevertheless, important resistance awaits at $48 and $53 – value factors that AVAX has repeatedly examined and did not surpass in latest months. A sustained breakout above these ranges would sign a big shift in momentum, doubtlessly propelling AVAX in direction of the $80 and even $100 mark by the third quarter.

A Story Of Two Markets: The place Do Merchants Stand?

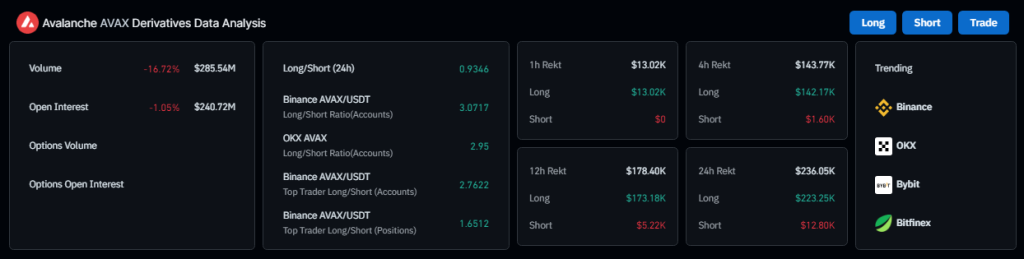

The buying and selling scene surrounding AVAX presents a curious dichotomy. Coinglass information reveals a staggering 60% drop in buying and selling quantity, signifying a big decline in market exercise. That is additional corroborated by a comparatively balanced lengthy/brief ratio throughout numerous platforms, suggesting general indecision amongst merchants concerning AVAX’s future.

Nevertheless, a glimmer of bullish sentiment emerges from Binance, a distinguished cryptocurrency change. Right here, the lengthy/brief ratio skews significantly increased, indicating a doubtlessly extra optimistic outlook amongst particular person merchants on this particular platform.

In the meantime, with a 40% ranking on the Concern and Greed Index, the present standing of the AVAX market is characterised by impartial temper, indicating that traders have balanced opinions.

Associated Studying

Dropping Dominance, Waning Curiosity?

AVAX’s struggles prolong past buying and selling. The altcoin appears to be loosening its grip on market share, with search curiosity additionally declining. This interprets to a scarcity of market management and doubtlessly waning normal curiosity – not precisely the recipe for fulfillment for a token aiming for important positive factors.

Featured picture from Summitpost, chart from TradingView